DFAN14A: Definitive additional proxy soliciting materials filed by non-management including Rule 14(a)(12) material

Published on September 17, 2019

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant ¨

Filed by a Party other than the Registrant þ

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| þ | Soliciting Material Under Rule 14a-12 |

ENZO BIOCHEM, INC.

(Name of Registrant as Specified In Its Charter)

Harbert Discovery Fund GP, LLC

Harbert Discovery Co-Investment Fund I, LP

Harbert Discovery Co-Investment Fund I GP, LLC

Harbert Fund Advisors, Inc.

Harbert Management Corporation

Jack Bryant

Kenan Lucas

Raymond Harbert

Fabian Blank

Peter Clemens

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

| þ | No fee required. |

| o | Fee computed on table below per Exchange Act Rule 14a-6(i)(4) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: | |

| 2) | Aggregate number of securities to which transaction applies: | |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act | |

| Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| 4) | Proposed maximum aggregate value of transaction: | |

| 5) | Total fee paid: | |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the |

| filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| 1) | Amount Previously Paid: | |

| 2) | Form, Schedule or Registration Statement No.: | |

| 3) | Filing Party: | |

| 4) | Date Filed: |

On September 17, 2019, Harbert Discovery Fund, LP and Harbert Discovery Co-Investment Fund I, LP issued a press release (the “Press Release”) to shareholders of ENZO Biochem, Inc. made available on the website www.CureEnzo.com (the “Website”). A copy of each of the Press Release and the Website is attached herewith as Exhibit 1 and Exhibit 2, respectively.

Exhibit 1

Harbert Discovery Fund Nominates Two Highly-Qualified Independent Candidates to Enzo Biochem Board

Sends Letter to Shareholders Highlighting Enzo’s Sustained History of Underperformance and Missteps of Current Entrenched Board and Management Team

Believes Current Leadership Has Operated Enzo as a “Lifestyle Business” With Its Own Interests Placed Ahead of Shareholders’

HDF’s Director Candidates – Fabian Blank and Peter Clemens – Can Help Address Depressed Stock Price and Create Significant Value for All Shareholders

Full letter available at https://cureenzo.com/

Birmingham, AL, September 17, 2019 – Harbert Discovery Fund, LP and Harbert Discovery Co-Investment Fund I, LP (collectively “HDF”), the beneficial owner of more than 11.8% of the outstanding shares of Enzo Biochem, Inc. (NYSE: ENZ) (“Enzo” or the “Company”), announced today in a detailed letter to shareholders that it is nominating two director candidates for election to the Company’s Board of Directors (the “Board”) at its 2019 Annual Meeting of Shareholders.

The full text of the letter follows:

September 17, 2019

Dear Fellow Shareholders,

Harbert Discovery Fund, LP and Harbert Discovery Co-Investment Fund I, LP (collectively “HDF”) currently own approximately 11.8% of the outstanding shares of Enzo Biochem, Inc. (NYSE: ENZ) (“Enzo” or the “Company”), making us the Company’s largest shareholder.

We are writing today because we believe Enzo is deeply undervalued. This depressed valuation is, in our view, a direct result of the Company’s current Board of Directors’ (the “Board”) and management team’s persistent inability to execute Enzo’s stated strategy, deliver on the promises of the Company’s technology and manage the cost structure of the business prudently.

For decades, Enzo has operated as a “lifestyle business,” where management has seemingly placed its own personal and financial interests ahead of its shareholders’ best interests. The Board has repeatedly let this behavior go unchecked and has failed to hold management accountable for its clear inability to deliver profitable growth or acceptable absolute or relative shareholder returns.

Enzo’s underperformance is not a matter of perspective or a story requiring nuance: the Company has drastically underperformed the Russell 2000 by nearly 1,100% over the last 30 years. Clearly, it is time for change. This is why over the last several months we have attempted to engage in substantive, private discussions with the Company regarding the composition of the Board, in an effort to install new independent directors who can help address the Company’s problems. Unfortunately, the Board’s ultimate response to our discussions was unproductive, and we are now forced to pursue other options to ensure that shareholders are properly represented in the Board room.

We are nominating two highly-qualified Board candidates – Fabian Blank and Peter Clemens – for election at the 2019 Annual Meeting of Shareholders (the “Annual Meeting”). These independent candidates have deep operational, financial and strategic experience within the healthcare industry. Having already studied Enzo and the challenges it faces, both candidates are prepared to bring their substantive experience to bear to help steer the Company in the direction of long-term value creation for all shareholders. HDF believes our candidates can immediately help improve the Company’s expense structure and implement a growth strategy that will generate durable long-term shareholder value. Our nominees also are well-positioned to create near-term value through a full exploration of strategic alternatives, with a focus on potential sales of non-core assets and intellectual property.

2

The Case for Change at Enzo

Sustained History of Value Destruction:

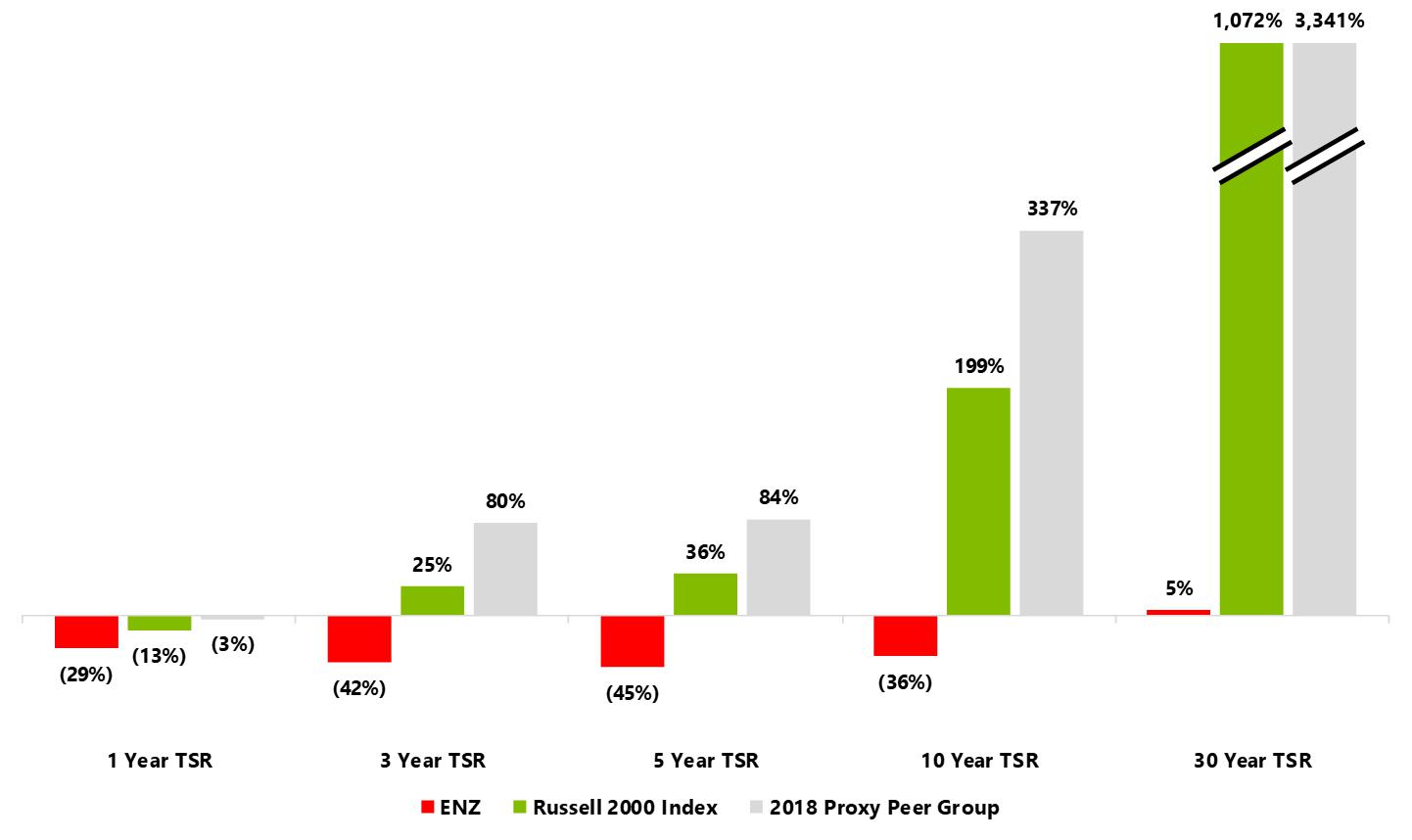

It is our belief that management and the Board’s misguided strategy and failure to execute coupled with an excessive, misaligned and unjustifiable compensation structure has resulted in consistent value destruction for shareholders, as evidenced by Enzo’s stock price which has significantly underperformed any relevant index or peer group comparison across any time period, going back 30 years. See Image 1: Total Shareholder Return.

Total Shareholder Return

[1]

History of Overpromising and Underdelivering:

Management has a long track record of hyping various platforms and technologies in development, only to fail to deliver the promised results. While this pattern is systemic and has repeated itself for decades, the debacle with AmpiProbe provides a current and salient example of this disappointing phenomenon.

Since 2012, Enzo has briefed investors on its strategy to roll out a new lower cost lab-to-lab business model derived from the development of AmpiProbe:

| · | 2012 – Management first highlighted AmpiProbe and its significant potential in March during its second quarter earnings call. |

1 Source: Bloomberg as of August

31, 2019.

Note: 2018 Proxy Peer Group performance calculated as an equal weight index.

3

| · | 2014 – Two years after the original promise of AmpiProbe, during the fiscal Q4 2014 earnings call in October, management stated in reference to AmpiProbe, “We hope to see the first of these tests available for marketing sometime after the first of the calendar year.” |

| · | 2015 – The Company’s December investor presentation referred to the potential of AmpiProbe to deliver cost savings to the market, stating, “Enzo Is Positioned to Thrive NOW.” |

| · | 2016 – AmpiProbe had still not progressed. On the fiscal Q3 2016 earnings call held in June, management stated, “I think we are in fairly good shape to hopefully see a comprehensive product sometime by year end or soon thereafter. And what I mean by comprehensive product is a panel that can potentially generate revenue growth for us as a company of some size.” |

| · | 2018 – Two and a half years later on the fiscal Q1 2019 earnings call held in December 2018, management stated, “We have been working to now build systems that not only will be approved for a New York State approval, but also for an FDA approval and that is very important in the totality of this process and we are moving forward in that.” This comment is particularly objectionable considering management initially indicated that FDA approval would not be required, claiming New York State approval would suffice. |

Despite its statements over the past seven years that AmpiProbe would drive growth and profitability for Enzo, as of today, AmpiProbe has not generated any material revenue for the Company. In fact, Enzo’s revenues declined from $103 million in fiscal 2012 to $87 million in the LTM period ended April 30, 2019.[2]

Similar to its failed promises about new products generating growth, for years management has repeatedly pointed to strategic partnerships as a source of growth – yet nothing has ever come to fruition.

| · | 2014 – “We continue to look for effective least dilutive ways to monetize many of the transformational technologies we have developed. And as such, we continue to explore joint ventures and other forms of partnerships as a way to help advance technologies and benefit all of us as shareholders” – Barry Weiner Q3 2014 Earnings Call. |

| · | 2016 – “Establishing business relationships on many fronts is a key goal of the many goals that we have set forth for our team here. We are in dialog with multiple parties. We are fortunate that we have many platform technologies that appeal and touch on different segments of this particular marketplace and we are looking to expand those platforms into areas where we may not have the interest or the time or the focus to expand the utility of the platforms. And so we are in dialog. And you could very well see the consummation of relationships with a number of parties out there in the near future.” – Barry Weiner Q4 2016 Earnings Call. |

| · | 2018 – “Finally, we have been developing cost effective approaches on various platforms, not only in molecular, but in the area of anatomical pathology, immunohistochemistry, in flow cytometry these various platforms and business opportunities that are under development, provide from multiple unique opportunities to partner and joint venture to exploit the commercialization capability that they present and dialog is now currently underway to try to move these products in a more expeditious way.” – Barry Weiner Q4 2018 Earnings Call. |

| · | 2019 – “Our commercial efforts towards implementing our marketing plan is twofold, expanding our internal highly trained and technical sales teams and supplementing this effort with a focused business development program to partner, collaborate and/or combine with companies in the diagnostic testing market. In the past quarter alone we’ve held numerous discussions with many strategic partners, many of whom we’ve met with over the last year. Defining the scope of new relationships and building collaborations and partnerships takes time. However, Enzo’s disruptive |

2 Source: Company filings

4

strategic plan is gaining market awareness and acceptance and we are confident new relationships will materialize.” – Barry Weiner Q2 2019 Earnings Call.

We have identified dozens of Company quotes substantively similar to the above. Despite all of these statements, to date the Company has not announced any material strategic partnerships, further illuminating the same pattern of hype and failure that the Board has overseen for years.

This is, in our view, the behavior of a leadership team more concerned with the self-perpetuation of a “lifestyle business” than with delivering results to shareholders, and of a Board that has failed to provide effective oversight for years.

Failed Corporate Governance:

Enzo’s corporate governance is structured to maintain the status quo and benefit insiders at the expense all other stakeholders. The over-tenured Board has approved a misguided strategy and not held management accountable for years of underperformance. It is widely accepted that boards that follow corporate governance best practices make better decisions that result in positive outcomes for all shareholders. They clearly define a company’s strategy and hold the management team accountable for delivering on that strategy. Enzo desperately needs fresh perspective in the boardroom in order to address numerous governance deficiencies, including:

| · | Dual Chairman/CEO as compared to the overwhelming majority of Russell 3000 companies that have separated the two positions;[3] |

| · | Chairman/CEO holds a 44-year tenure; |

| · | CFO is on the Board with a running 43-year tenure; |

| · | Average director tenure is 20+ years as compared to an average of 11-13 years for the Russell 3000;[4] |

| · | Average director age is 65; |

| · | Classified Board as compared to the majority of Russell 3000 companies that elect all their directors annually;[5] and |

| · | Shareholders do not have the right to call a special meeting. |

Excessive Compensation for Underperformance:

Consistent losses of shareholder value, consistent promises of successes just around the corner that never seem to arrive and a consistent lack of oversight at the Board level appear to be the hallmarks of Enzo.

Enzo has reported operating losses every year since 2004, with cumulative negative operating income of -$180 million, excluding legal expenses and settlements. Yet, during this same period, the Board approved paying Chairman / CEO Elazar Rabbani and his brother-in-law CFO Barry Weiner nearly $32 million, including a bonus every single year. This figure does not include the annual related-party payments Mr. Rabbani and Mr. Weiner receive in exchange for leasing the Farmingdale lab facility to the Company. In 2018, Mr. Rabbani and Mr. Weiner each received roughly $600,000 under this arrangement. Additionally, in 2018 while the stock cratered -59% over the course of the year, Mr. Rabbani and Mr. Weiner were paid $2.7 million not including the related party payments.

We believe this unacceptable performance coupled with Enzo’s hallmark of declining profitability is a direct result of management’s defective strategy and lack of execution, making the excessive compensation even more

3https://www.russellreynolds.com/en/Insights/thought-leadership/Documents/TCB-Corporate-Board-Practices-2019.pdf

4 https://corpgov.law.harvard.edu/2019/05/07/corporate-board-practices-in-the-sp-500-and-russell-3000-2019-edition/

5 All of the five largest U.S. mutual funds, the Council of Institutional Investors, the largest public pension funds, and the leading proxy advisory firms (ISS and Glass Lewis) have adopted policies that support the annual election of directors and oppose board classification. See proxy voting guidelines for Fidelity, Vanguard, American Funds, Franklin Mutual Advisers, and T. Rowe Price; Council of Institutional Investors, Policies on Corporate Governance (2016); CalPERS, Global Principles of Accountable Corporate Governance (2010); Institutional Shareholder Services, U.S. Proxy Voting Summary Guidelines (2013), and Glass Lewis & Co., Proxy Paper Guidelines.

5

troubling. A truly independent and competent Board would not reward management for such dramatic long-term fundamental underperformance, and would instead have long ago aligned leadership’s compensation plan with the level of value generated for shareholders.

The Opportunity at Enzo

In spite of the decades of poor oversight and mismanagement, Enzo has a collection of businesses and assets that, with a sound growth strategy, more prudent expense structure, appropriate capital allocation, and effective, independent oversight could be worth significantly more than the value currently ascribed by the market.

The bulk of the value at Enzo could be unlocked through three factors:

| 1. | A new corporate strategy that acknowledges Enzo’s strengths and weaknesses as well as the broader market realities; |

| 2. | A sale of non-core assets; and |

| 3. | Once Enzo is generating cash, return of excess cash to shareholders. |

Enzo’s attempts to launch a new model for the diagnostic marketplace has overburdened the business with unnecessary expenses. Enzo has neither the scale nor the expertise to execute on this strategy and attempting to do so puts the whole enterprise at risk. Enzo is too small today and building out a sales force would be too costly for Enzo to successfully market the “labs to labs” business whereby Enzo will serve as the “central capability” for smaller labs.[6] Investor’s recognition of this fact is a significant factor of the share price underperformance over the years.

Instead, Enzo should focus on the inherent strengths of its lab’s location in a high-density population market and strong relationships with existing customers. Building on those two strengths coupled with prudent cost cuts could return that segment to profitability.

With respect to the life sciences division, Enzo is correct to look to strategic partnerships to accelerate growth. The failure to consummate any meaningful partnerships over the years is, we believe, a result of management failures and weak Board oversight as well as Enzo’s highly litigious reputation in the industry. Without change, shareholders will continue to see the pattern of promises without follow-through. However, we believe the vast expertise and extensive networks of our candidates will put Enzo in a position to execute strategic partnerships that can quickly accelerate growth in the life sciences division.

Enzo has a very valuable patent portfolio of 343 patents and 157 patents pending as evidenced by $117 million of settlements since 2001. Unfortunately, Enzo’s legal expenses over that period were $99 million.[7] Not only has decades of patent litigation at Enzo harmed the Company’s reputation, impairing its ability to form partnerships for growth, but the litigation has not produced an attractive return for shareholders. Instead of continuing to litigate, Enzo should look to monetize non-core patents. This would provide an immediate, substantial cash inflow to the business, while also signaling to potential strategic partners that Enzo is looking to work together in good faith in the future.

The therapeutics division has value to a strategic buyer, but at Enzo it has proved to be a distraction to management and the Company as a whole. Instead of periodically promoting one potential therapy or another, only to see it fail to progress beyond a Phase I or Phase II trial, Enzo should sell the division to a buyer with a proven track record of successful therapeutic development. Divesting therapeutics would provide the best risk adjusted value for Enzo shareholders.

Following the right sizing of the clinical services cost structure, accelerated growth in the life sciences division, the sale of non-core IP, and the sale of the therapeutics division, Enzo could have a cash balance that matches or exceeds the current market capitalization of the business today. Under those assumptions, shareholders are

6 Enzo third quarter and nine months operating results press release dated June 10, 2019.

7SEC filings.

6

getting $87 million of revenue for free today when peers for the clinical services division and life sciences division trade for roughly 2.2x revenue and 6.5x revenue, respectively. Applying those multiples to each segment implies nearly 3x upside from the current share price.

Clearly, there is substantial opportunity at Enzo for all shareholders. However, the current, misguided strategy is resulting in increasing expenses and a declining cash balance. The current Board cannot, in our view, achieve Enzo’s full potential. Immediate change is needed.

Our Solution for Enzo

It is our view that Enzo’s Board is entrenched, detached and more focused on self-perpetuation than the concerns of other shareholders. Its seeming acceptance of negative returns, insider dealings, and constant misallocation of capital is simply unacceptable. Each day the current Board remains in place the status quo continues – and shareholders suffer.

HDF believes two new independent directors will be able to refocus Enzo’s Board and swiftly deliver value for shareholders. After an extensive search, HDF has identified two extremely qualified Board candidates who we believe, upon election and subject to their fiduciary duties, will:

| · | Bring new and necessary perspectives to the Board; |

| · | Develop a better strategic plan for the business; |

| · | Be immediately impactful in addressing the Company’s bloated cost structure; |

| · | Hold management accountable for its performance; |

| · | Deliver on the potential of strategic partnerships to grow the business; |

| · | Restructure executive compensation in a manner that is aligned with shareholder interests; and |

| · | Evaluate the full range of strategic alternatives available to create shareholder value. |

HDF’s highly-qualified director candidates, who will truly represent and act in the best interests of all shareholders, will realign the Company’s operating and growth strategy and create significant value at Enzo, are:

Fabian Blank: Healthcare Advisor and Investor

Operational Expertise – Substantial operational and growth experience in healthcare space

| · | Mr. Blank is a senior healthcare executive with a broad and diversified operational background across multiple areas of the healthcare industry and substantial experience advising companies like Enzo on healthcare strategy, digitalization, disruption, and growth. |

| · | Mr. Blank is an Independent Non-Executive Director of Georgia Healthcare Group PLC, an integrated healthcare group that is prime listed on the London Stock Exchange. His primary focus is on guiding the group through its digitalization and growth ambitions across its services-, pharma-, laboratory- and insurance assets. |

| · | Mr. Blank serves as an Advisory Board Member of GYANT.com, a US-based health tech company providing artificial intelligence enabled patient engagement services to HMOs and other healthcare players. He is particularly focused on establishing the company’s business in Europe. |

| · | Mr. Blank is the Non-Executive Chairman of Recover Health Ltd., an Israeli digital health startup focused on developing a digital platform to increase the quality of life of both stroke survivors and caregivers. |

| · | From 2013 to 2016, Mr. Blank was the CEO and Co-owner of the Meduna Klinik Group, a privately held clinic group specialized on post-acute services. He successfully grew revenues and EBITDA in a highly competitive market before consummating a successful sale to a private equity buyer. |

| · | From 2000 to 2013, he was at McKinsey & Company, Inc., where he also served as a Partner of the firm. He served technology and healthcare clients from various settings of acute, rehab, labs or polyclinics on growth topics, with operational presence in over 20 countries. |

7

| · | He holds a graduate business management degree (Diplom Kaufmann) from the HHL Leipzig Graduate School of Management and completed additional studies at University of Trier, Boston University’s Questrom School of Business and ESADE in Barcelona, Spain. |

Peter (Pete) Clemens: Director of Vituro Health

Financial Expertise – Public healthcare company CFO

| · | Mr. Clemens has a distinguished career in healthcare serving in multiple senior finance roles and is a two-time public company healthcare CFO with significant turnaround, growth, operational, and M&A experience. During his tenures, shareholders of his past companies saw annualized returns of 33.7% and 38.0%, respectively. |

| · | He is currently the Director of Vituro Health and Chairman of the Samford University Board of Overseers. |

| · | From 2011 to 2015, Mr. Clemens served as the CFO of Surgical Care Affiliates, providing valuable guidance through an IPO process, transitioning from private equity ownership, and several years of robust growth for the company. |

| · | From 1995 to 2010, he worked at Caremark where he held multiple senior finance roles for over 15 years and was CFO of the company as they successfully completed a $21B merger of equals with CVS Corporation after over a decade of tremendous growth and outsized returns to shareholders. |

| · | Mr. Clemens previously served on the board of DSI Renal, a privately-owned dialysis company that was sold to Fresenius in September of 2011. |

| · | Mr. Clemens began his career in credit and lending roles at both AmSouth Bank and Wachovia Bank. |

| · | He holds a Bachelor’s degree from Samford University and an MBA in Finance from Vanderbilt University. |

The status quo is not what Enzo needs. We believe the current Board lacks the leadership, objectivity and perspective to hold management accountable and make decisions that are in the best interests of all shareholders. For months, HDF has attempted to engage in productive dialogue with the Company to reconstruct the Board. Our strong preference was to work privately in a constructive manner with the goal of greatly improving corporate governance while attempting to avoid the difficulties and distractions of a proxy battle. The Company’s response has been unproductive and discouraging, while highlighting the deep-seated issues resulting from the Company’s lack of leadership and oversight.

Without shareholder involvement, we believe management will continue to benefit as shareholders continue to suffer. Therefore, we are nominating our candidates for election to the Board at the 2019 Annual Meeting of Shareholders.

Sincerely,

Harbert Discovery Fund, LP

Harbert Discovery Co-Investment Fund I, LP

Kenan Lucas, Managing Director and Portfolio Manager of Harbert Discovery Fund GP, LLC and Harbert Discovery Co-Investment Fund I GP, LLC

8

SECURITY HOLDERS ARE ADVISED TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES FROM THE STOCKHOLDERS OF ENZO BIOCHEM, INC. BY Harbert Discovery Fund, LP, Harbert Discovery Fund GP, LLC, Harbert discovery co-investment fund i, lp, harbert discovery co-investment fund i gp, llc, Harbert Fund Advisors, Inc., Harbert Management Corporation, Jack Bryant, Kenan Lucas, and Raymond Harbert WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION. WHEN COMPLETED, A DEFINITIVE PROXY STATEMENT AND A FORM OF PROXY WILL BE MAILED TO STOCKHOLDERS OF ENZO BIOCHEM, INC. AND WILL ALSO BE AVAILABLE AT NO CHARGE AT THE SECURITIES AND EXCHANGE COMMISSION’S WEBSITE AT HTTP://WWW.SEC.GOV. INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION IS CONTAINED IN THE SCHEDULE 13D, AS ORIGINALLY FILED ON APRIL 8, 2019 AND AS MOST RECENTLY AMENDED ON SEPTEMBER 17, 2019. EXCEPT AS OTHERWISE DISCLOSED IN SUCH SCHEDULE 13D, THE PARTICIPANTS HAVE NO INTEREST IN ENZO BIOCHEM, INC.

Important Disclosure

THIS STATEMENT CONTAINS OUR CURRENT VIEWS ON THE VALUE OF SECURITIES OF ENZO BIOCHEM, INC. (“ENZO”). OUR VIEWS ARE BASED ON OUR ANALYSIS OF PUBLICLY AVAILABLE INFORMATION AND ASSUMPTIONS WE BELIEVE TO BE REASONABLE. THERE CAN BE NO ASSURANCE THAT THE INFORMATION WE CONSIDERED IS ACCURATE OR COMPLETE, NOR CAN THERE BE ANY ASSURANCE THAT OUR ASSUMPTIONS ARE CORRECT. WE DO NOT RECOMMEND OR ADVISE, NOR DO WE INTEND TO RECOMMEND OR ADVISE, ANY PERSON TO PURCHASE OR SELL SECURITIES AND NO ONE SHOULD RELY ON THIS STATEMENT OR ANY ASPECT OF THIS STATEMENT TO PURCHASE OR SELL SECURITIES OR CONSIDER PURCHASING OR SELLING SECURITIES. THIS STATEMENT DOES NOT PURPORT TO BE, NOR SHOULD IT BE READ, AS AN EXPRESSION OF ANY OPINION OR PREDICTION AS TO THE PRICE AT WHICH ENZO’S SECURITIES MAY TRADE AT ANY TIME. AS NOTED, THIS STATEMENT EXPRESSES OUR CURRENT VIEWS ON ENZO. OUR VIEWS AND OUR HOLDINGS COULD CHANGE AT ANY TIME WITHOUT NOTICE AND WE MAKE NO COMMITMENT TO UPDATE THIS STATEMENT IN THE EVENT OUR VIEWS OR HOLDINGS CHANGE. INVESTORS SHOULD MAKE THEIR OWN DECISIONS REGARDING ENZO AND ITS PROSPECTS WITHOUT RELYING ON, OR EVEN CONSIDERING, ANY OF THE INFORMATION CONTAINED IN THIS STATEMENT.

About Harbert Discovery Fund (HDF)

HDF invests in a concentrated portfolio of publicly traded small capitalization companies in the US and Canada. We perform significant due diligence on each portfolio company prior to investing. In addition to researching all publicly available information and meeting with management, our diligence includes substantial primary research with industry experts, consultants, bankers, customers and competitors. We often spend months or years researching ideas before making an investment decision and we only invest in companies that we believe are significantly undervalued, and where there is the potential for change to enhance or accelerate value creation. In an effort to unlock this potential value, we seek to work directly with the boards and management teams of our portfolio companies privately and collaboratively, engaging with them on a range of factors including governance, board composition, corporate strategy, capital allocation, strategic alternatives and operations. We have effected positive, fundamental changes at our current and past investments through this behind-the-scenes, constructive approach. HDF currently has board representation at three of our portfolio companies. In each case, changes to the board were agreed upon privately and it is our strong preference in every investment to avoid the unnecessary distractions and costs of a public proxy campaign.

About Harbert Management Corporation (HMC)

HMC is an alternative asset management firm with approximately $6.6 billion in regulatory assets under management as of September 1, 2019. HMC currently sponsors nine distinct investment strategies with dedicated investment teams. Additional information about HMC can be found at www.harbert.net.

9

Investor Contact

Okapi Partners LLC

Bruce Goldfarb / Chuck Garske / Jason Alexander, 212-297-0720

info@okapipartners.com

Media Contact

Sloane & Company

Dan Zacchei / Sarah Braunstein, 212-486-9500

dzacchei@sloanepr.com / sbraunstein@sloanepr.com

.

10

Exhibit 2