DEF 14A: Definitive proxy statements

Published on November 28, 2007

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant [X] | |

| Filed by a Party other than the Registrant [ ] | |

| Check the appropriate box: | |

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Under Rule 14a-12 |

| Enzo Biochem, Inc. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |

| 1) | Title of each class of securities to which transaction applies: |

|

|

||

| 2) | Aggregate number of securities to which transaction applies: |

|

|

||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

||

| 4) | Proposed maximum aggregate value of transaction: |

|

|

||

| 5) | Total fee paid: |

|

| [ ] | Fee previously paid with preliminary materials: | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |

| 1) | Amount Previously Paid: | |

|

||

| 2) | Form, Schedule or Registration Statement No.: | |

|

||

| 3) | Filing Party: |

|

|

||

| 4) | Date Filed: |

|

ENZO BIOCHEM, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JANUARY 24, 2008

To the Shareholders of Enzo Biochem, Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of Enzo Biochem, Inc., a New York corporation (the Company), will be held at The Yale Club, 50 Vanderbilt Avenue, New York, New York 10017, on January 24, 2008, at 9:00 a.m., local time (the Annual Meeting), for the following purposes:

|

|

|

|

1. |

To elect Barry W. Weiner, Melvin F. Lazar and Dr. Bernard Kasten as Class II Directors for a term of three (3) years or until their respective successors are elected and qualified; |

|

|

|

|

2. |

To ratify the appointment of Ernst & Young LLP as the Companys independent registered public accounting firm for the Companys fiscal year ending July 31, 2008; and |

|

|

|

|

3. |

To transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

The close of business on November 26, 2007 has been fixed as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting. The transfer books of the Company will not be closed.

All shareholders are cordially invited to attend the Annual Meeting. Please note that you will be asked to present valid picture identification, such as a drivers license or passport, in order to attend the Annual Meeting. The use of cameras, recording devices and other electronic devices will be prohibited at the Annual Meeting.

Whether or not you expect to attend, you are requested to sign, date and return the enclosed proxy promptly. Shareholders who execute proxies retain the right to revoke them at any time prior to the voting thereof by filing written notice of such revocation with the Secretary of the Company, by submission of a duly executed proxy bearing a later date or by voting in person at the Annual Meeting of Shareholders. Attendance at the Annual Meeting will not in and of itself constitute revocation of a proxy. Any written notice revoking a proxy should be sent to Enzo Biochem, Inc., 527 Madison Avenue, New York, New York 10022, Attention: Shahram K. Rabbani, Secretary. A return envelope which requires no postage if mailed in the United States is enclosed for your convenience.

|

|

By Order of the Board of Directors, |

|

|

|

|

|

Shahram K. Rabbani, Secretary |

New York, New

York

November 28, 2007

ENZO BIOCHEM, INC.

527 Madison Avenue

New York, New York 10022

(212) 583-0100

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JANUARY 24, 2008

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of Enzo Biochem, Inc., a New York corporation (the Company), of proxies in the enclosed form for the Annual Meeting of Shareholders to be held at The Yale Club, 50 Vanderbilt Avenue, New York, New York 10017, on January 24, 2008, at 9:00 a.m., local time (the Annual Meeting), and for any adjournment or adjournments thereof, for the purposes set forth in the preceding Notice of Annual Meeting of Shareholders. The persons named in the enclosed form of proxy will vote the shares for which they are appointed in accordance with the directions of the shareholders appointing them. In the absence of such directions, such shares will be voted FOR Proposals 1 and 2 listed in the preceding Notice of Annual Meeting of Shareholders and, in the best judgment of the persons named as proxies, will be voted on any other matters as may come before the Annual Meeting. Any shareholder giving a proxy has the power to revoke the same at any time before it is voted by timely filing written notice of such revocation with the Secretary of the Company, by timely submission of a duly executed proxy bearing a later date or by voting in person at the Annual Meeting. Attendance at the Annual Meeting will not in and of itself constitute revocation of a proxy. Any written notice revoking a proxy should be sent to Enzo Biochem, Inc., 527 Madison Avenue, New York, New York 10022, Attention: Shahram K. Rabbani, Secretary. A return envelope that requires no postage if mailed in the United States is enclosed for your convenience.

The expense of the solicitation of proxies for the meeting, including the cost of mailing, will be borne by the Company. In addition to mailing copies of the enclosed proxy materials to shareholders, the Company may request persons, and reimburse them for their expenses with respect thereto, who hold stock in their names or custody or in the names of nominees for others, to forward copies of such materials to those persons for whom they hold stock of the Company and to request authority for the execution of the proxies. In addition to the solicitation of proxies by mail, it is expected that some of the officers, directors and regular employees of the Company, without additional compensation, may solicit proxies on behalf of the Board of Directors by telephone, telefax and personal interview.

The principal corporate office of the Company is located at 527 Madison Avenue, New York, New York 10022. The approximate date on which this Proxy Statement and the accompanying form of proxy will first be sent or given to the Companys shareholders is November 28, 2007.

VOTING SECURITIES

Only holders of record of shares of common stock, par value $.01 per share (the Common Stock), of the Company as of the close of business on November 26, 2007 are entitled to vote at the Annual Meeting (the Record Date). On the Record Date there were issued and outstanding 36,719,000 shares of Common Stock. Each outstanding share of Common Stock is entitled to one (1) vote upon all matters to be acted upon at the Annual Meeting. The holders of a majority of the outstanding shares of Common Stock as of the Record Date must be present in person or by proxy at the Annual Meeting to constitute a quorum for the transaction of business at the Annual Meeting.

1

The election of a nominee for director requires a plurality of votes (i.e., an excess of votes over those cast for an opposing candidate) in the event that more than one candidate is running for a vacancy. Shareholders may either vote for or withhold their vote for the director nominees. A properly executed proxy marked withhold with respect to the election of one or more directors will not be voted with respect to the director or directors, although it will be counted for purposes of determining whether there is a quorum. The ratification and approval of Proposal 2 will require the affirmative vote of the majority of the votes cast by holders of shares of Common Stock present in person or represented by proxy at the Annual Meeting and entitled to vote on such proposals. Abstentions and broker non-votes are not counted as votes cast on any matter to which they relate and will have no effect on the outcome of the vote with respect to any matter. A broker non-vote occurs when a broker or other nominee does not have discretionary authority and has not received instructions with respect to a particular proposal. Proxy ballots are received and tabulated by the Companys transfer agent and certified by the inspector of election.

HOUSEHOLDING OF ANNUAL MEETING MATERIALS

Some brokers and other nominee record holders may be participating in the practice of householding proxy statements. This means that only one copy of the proxy statement may have been sent to multiple shareholders in a shareholders household. The Company will promptly deliver a separate copy of the proxy statement to any shareholder who contacts the Companys investor relations department at (212) 583-0100 or at the Companys principal corporate office at 527 Madison Avenue, New York, New York 10022 requesting such copies. If a shareholder is receiving multiple copies of the proxy statement at the shareholders household and would like to receive a single copy of the proxy statement for a shareholders household in the future, shareholders should contact their broker, other nominee record holder, or the Companys investor relations department to request mailing of a single copy of the proxy statement.

2

TABLE OF CONTENTS

|

|

|

|

|

|

|

PAGE |

|

|

|

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

|

4 |

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

6 |

|

|

|

6 |

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

|

16 |

|

|

|

|

|

|

|

17 |

|

|

|

|

|

|

|

17 |

|

|

|

|

|

|

|

17 |

|

|

|

|

|

|

|

18 |

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

27 |

|

|

|

|

|

|

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS |

|

28 |

|

|

|

|

|

|

29 |

|

|

|

|

|

|

|

30 |

|

|

|

|

|

|

|

30 |

|

|

|

31 |

|

|

|

|

|

|

|

32 |

|

|

|

|

|

|

SHAREHOLDER PROPOSALS TO BE PRESENTED AT THE NEXT ANNUAL MEETING |

|

33 |

3

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Set forth below is information concerning stock ownership of all persons known by the Company to own beneficially 5% or more of the shares of Common Stock of the Company, the executive officers named under Compensation of Directors and Executive Officers, all directors, and all directors and executive officers of the Company as a group based upon the number of outstanding shares of Common Stock as of the close of business on the Record Date. Except as otherwise indicated, each of the persons named has sole voting and investment power with respect to the shares shown.

|

|

|

|

|

|

||

|

Name and

Address of |

|

Amount and

Nature of |

|

Percent |

||

|

|

|

|

|

|

||

|

Elazar Rabbani, Ph.D. |

|

|

2,243,377 |

(3) |

|

6.0% |

|

|

|

|

|

|

||

|

Barry W. Weiner |

|

|

1,451,001 |

(4) |

|

3.9% |

|

|

|

|

|

|

||

|

Shahram K. Rabbani |

|

|

2,085,841 |

(5) |

|

5.6% |

|

|

|

|

|

|

||

|

Carl W. Balezentis, Ph.D. |

|

|

5,000 |

|

* |

|

|

|

|

|

|

|

||

|

Andrew R. Crescenzo, CPA |

|

|

6,000 |

|

* |

|

|

|

|

|

|

|

||

|

John J. Delucca |

|

|

92,324 |

(6) |

|

* |

|

|

|

|

|

|

||

|

Irwin C. Gerson |

|

|

63,190 |

(7) |

|

* |

|

|

|

|

|

|

||

|

Melvin F. Lazar, CPA |

|

|

80,393 |

(8) |

|

* |

|

|

|

|

|

|

||

|

John B. Sias |

|

|

173,087 |

(9) |

|

* |

|

|

|

|

|

|

||

|

Stephen B.H. Kent, Ph.D. |

|

|

3,500 |

(10) |

|

* |

|

|

|

|

|

|

||

|

J. Morton Davis |

|

|

3,186,530 |

(11) |

|

8.8% |

|

|

|

|

|

|

||

|

Clearbridge Advisors, LLC and Smith Barney Fund Management LLC |

|

|

4,817,236 |

(12) |

|

14.89% |

|

|

|

|

|

|

||

|

All directors and executive officers as a group (14 persons) (13) |

|

|

6,750,045 |

(14) |

|

17.40% |

* Represents beneficial ownership of less than 1%.

|

|

|

|

(1) |

Except as otherwise noted, all shares of Common Stock are beneficially owned and the sole investment and voting power is held by the persons named, and such persons address is c/o Enzo Biochem, Inc., 527 Madison Avenue, New York, New York 10022. |

|

|

|

|

(2) |

Based upon 36,719,000 shares of Common Stock of the Company outstanding as of the close of business on the Record Date. Common Stock not outstanding but deemed beneficially owned by virtue of the right of an individual to acquire shares within 60 days from the date is treated as outstanding only when determining the amount and percentage of Common Stock owned by such individual. |

4

|

|

|

|

(3) |

Includes (i) 523,342 shares of Common Stock issuable upon the exercise of options which are exercisable within 60 days from the date hereof, (ii) 3,469 shares of Common Stock held in the name of Dr. Rabbani as custodian for certain of his children, (iii) 2,168 shares of Common Stock held in the name of Dr. Rabbanis wife as custodian for certain of their children, (iv) an aggregate of 5,100 shares of Common Stock held in the name of Dr. Rabbanis children and (v) 7,500 shares of restricted Common Stock that vest within 60 days from the date hereof. Includes 4,916 shares of Common Stock held in the Companys 401(k) plan. |

|

|

|

|

(4) |

Includes (i) 523,342 shares of Common Stock issuable upon the exercise of options which are exercisable within 60 days from the date hereof, (ii) 3,642 shares of Common Stock that Mr. Weiner holds as custodian for certain of his children and (iii) 5,000 shares of restricted Common Stock that vest within 60 days from the date hereof. Includes 4,923 shares of Common Stock held in the Companys 401(k) plan. |

|

|

|

|

(5) |

Includes (i) 523,342 shares of Common Stock issuable upon the exercise of options which are exercisable within 60 days from the date hereof, (ii) 1,354 shares of Common Stock held in the name of Mr. Rabbanis son, (iii) 1,671 shares of Common Stock that Mr. Rabbani holds as custodian for certain of his nephews and (iv) 3,500 shares of restricted Common Stock that vest within 60 days from the date hereof. Includes 4,881 shares of Common Stock held in the Companys 401(k) plan. |

|

|

|

|

(6) |

Includes (i) 65,130 shares of Common Stock issuable upon the exercise of options which are exercisable within 60 days from the date hereof and (ii) 9,500 shares of restricted Common Stock vesting 60 days from the date hereof. |

|

|

|

|

(7) |

Includes (i) 54,690 shares of Common Stock issuable upon the exercise of options which are exercisable within 60 days from the date hereof and (ii) 6,000 shares of restricted Common Stock vesting 60 days from the date hereof. |

|

|

|

|

(8) |

Includes (i) 28,644 shares of Common Stock issuable upon the exercise of options which are exercisable within 60 days from the date hereof, (ii) 26,249 shares of Common Stock owned by Mr. Lazars wife, (iii) 10,000 shares of restricted Common Stock vesting 60 days from the date hereof and (iv) 10,500 shares in an Individual Retirement Account. |

|

|

|

|

(9) |

Includes (i) 80,324 shares of Common Stock issuable upon the exercise of options which are exercisable within 60 days from the date hereof and (ii) 6,000 shares of restricted Common Stock vesting 60 days from the date hereof. |

|

|

|

|

(10) |

Includes 3,500 shares of restricted Common Stock vesting 60 days from the date hereof. |

|

|

|

|

(11) |

Mr. Davis address is D.H. Blair Investment Banking Corp., 44 Wall Street, New York, New York 10005. Includes (i) 33,425 shares owned directly by Mr. Davis, (ii) 1,420,345 shares owned directly by Blair Investment, (iii) 663,496 shares owned by Engex, Inc., (iv) 12,733 shares owned by an investment advisor whose principal is Mr. Davis and (v) 1,056,531 shares owned by Rosalind Davidowitz, Mr. Davis wife. This information is based solely on a Schedule 13G filed on February 12, 2007. |

|

|

|

|

(12) |

The address of each entity in the group is 399 Park Avenue, New York, New York 10022. This information is based solely on a Schedule 13G filed on February 8, 2007. |

|

|

|

|

(13) |

The total number of directors and executive officers includes four (4) executive officers who were not named under Security Ownership of Certain Beneficial Owners and Management. |

|

|

|

|

(14) |

Includes 2,084,394 shares of Common Stock issuable upon the exercise of options which are exercisable within 60 days from the date hereof, vesting of restricted stock and non-voting restricted stock units within 60 days from the date hereof. |

5

PROPOSAL 1

ELECTION OF DIRECTORS

The Company has three (3) staggered classes of Directors, each of which serves for a term of three (3) years. At the Annual Meeting, the Companys Class II Directors will be elected to hold office for a term of three (3) years or until their respective successors are elected and qualified. Unless otherwise instructed, the accompanying form of proxy will be voted for the election of the below-listed nominees to serve as Class II Directors. Management has no reason to believe that any of the nominees will not be a candidate or will be unable to serve as a director. However, in the event that the nominees should become unable or unwilling to serve as directors, the form of proxy will be voted for the election of such persons as shall be designated by the Class I and Class III Directors.

Effective November 8, 2006, the total cumulative length of time that any Outside Director (a member of the Board who is not an officer or employee of the Company) may serve on the Board shall be limited to a maximum of three three-year terms, whether consecutively or in total, plus any portion of an earlier three-year term that such Outside Director may have been appointed to serve.

CLASS II DIRECTOR NOMINEES TO SERVE UNTIL

THE 2011 ANNUAL MEETING, IF ELECTED:

Class II: Term to Expire In 2011

|

|

|

|

|

|

|

Name |

|

Age |

|

Year First Became a Director |

|

|

|

|

|

|

|

|

||||

|

Barry W. Weiner |

|

57 |

|

1977 |

|

Melvin F. Lazar, CPA |

|

68 |

|

2002 |

|

Dr. Bernard Kasten |

|

61 |

|

|

BERNARD KASTEN, MD (age 61) Dr. Kasten has been a Director of Cleveland Biolabs, Inc. (CBLI: NASDAQ) and has been serving as Chairman of the Board since August 2006. From 1995 to 2004, Dr. Kasten served at Quest Diagnostics Incorporated where he was Chief Laboratory Officer and most recently Vice President of Medical Affairs of its MedPlus Inc. subsidiary. Dr. Kasten served as a director of SIGA Technologies from May 2003 to December 2006, and as SIGAs Chief Executive Officer from July 2004 through April 2006. Dr. Kasten currently serves as a director of GeneLink Inc. (GNLK.OTCBB) and SeraCare Life Sciences Inc. (SCRS Pink Sheets). Dr. Kasten is also a director of several privately held companies. Dr. Kasten is a graduate of the Ohio State University College of Medicine. His residency was served at the University of Miami, Florida and he was awarded fellowships at the National Institutes of Health Clinical Center and NCI, Bethesda, Maryland. He is a diplomat of the Board of Pathology with certification in anatomic and clinical pathology with sub-specialty certification in Medical Microbiology.

THE BOARD OF DIRECTORS OF THE COMPANY RECOMMENDS A VOTE FOR THE ELECTION OF THE ABOVE-NAMED NOMINEES. PROXIES SOLICITED BY THE BOARD OF DIRECTORS WILL BE SO VOTED UNLESS SHAREHOLDERS SPECIFY IN THEIR PROXIES A CONTRARY CHOICE.

6

DIRECTORS WHO ARE CONTINUING IN OFFICE:

Class III: Term to Expire in 2009

|

|

|

|

|

|

|

Name |

|

Age |

|

Year First Became a Director |

|

|

|

|

|

|

|

|

||||

|

Elazar Rabbani, Ph.D. |

|

63 |

|

1976 |

|

John B. Sias |

|

80 |

|

1982 |

Class I: Term to Expire In 2010

|

|

|

|

|

|

|

Name |

|

Age |

|

Year First Became a Director |

|

|

|

|

|

|

|

|

||||

|

Shahram K. Rabbani |

|

55 |

|

1976 |

|

Irwin C. Gerson |

|

77 |

|

2001 |

|

Stephen B. H. Kent, Ph.D |

|

62 |

|

2007 |

DIRECTORS AND EXECUTIVE OFFICERS

The directors and executive officers of the Company are identified in the table below.

|

|

|

|

|

|

|

|

|

Name |

|

Age |

|

Year Became a |

|

Position |

|

|

|

|

|

|

|

|

|

Elazar Rabbani, Ph.D. |

|

63 |

|

1976 |

|

Chairman of the Board of Directors and Chief Executive Officer |

|

|

|

|

|

|

|

|

|

Barry W. Weiner |

|

57 |

|

1977 |

|

President, Chief Financial Officer and Director |

|

|

|

|

|

|

|

|

|

Shahram K. Rabbani |

|

55 |

|

1976 |

|

Treasurer, Secretary and Director, President, Enzo Clinical Labs, Inc. |

|

|

|

|

|

|

|

|

|

Carl W. Balezentis, Ph.D. |

|

50 |

|

2006 |

|

President, Enzo Life Sciences, Inc. |

|

|

|

|

|

|

|

|

|

Norman E. Kelker, Ph.D. |

|

68 |

|

1981 |

|

Senior Vice President |

|

|

|

|

|

|

|

|

|

Andrew R. Crescenzo, CPA |

|

51 |

|

2006 |

|

Senior Vice President of Finance |

|

|

|

|

|

|

|

|

|

Herbert B. Bass |

|

59 |

|

1989 |

|

Vice President of Finance |

|

|

|

|

|

|

|

|

|

Barbara E. Thalenfeld, Ph.D. |

|

67 |

|

1995 |

|

Vice President, Corporate Development |

|

|

|

|

|

|

|

|

|

David C. Goldberg |

|

50 |

|

1995 |

|

Vice President, Business Development |

|

|

|

|

|

|

|

|

|

John J. Delucca |

|

64 |

|

1982 |

|

Director |

|

|

|

|

|

|

|

|

|

Irwin C. Gerson |

|

77 |

|

2001 |

|

Director |

|

|

|

|

|

|

|

|

|

Stephen B. H. Kent, Ph.D. |

|

62 |

|

2007 |

|

Director |

|

|

|

|

|

|

|

|

|

Melvin F. Lazar, CPA |

|

68 |

|

2002 |

|

Director |

|

|

|

|

|

|

|

|

|

John B. Sias |

|

80 |

|

1982 |

|

Director |

|

|

|

|

|

|

|

|

7

Biographical Information Regarding Directors and Executive Officers

DR. ELAZAR RABBANI (age 63) is Enzo Biochems founder and has served as the Companys Chairman of the Board of Directors and Chief Executive Officer since its inception in 1976. Dr. Rabbani has authored numerous scientific publications in the field of molecular biology, in particular, nucleic acid labeling and detection. He is also the lead inventor of many of the Companys pioneering patents covering a wide range of technologies and products. Dr. Rabbani received his Bachelor of Arts degree from New York University in Chemistry and his Ph.D. in Biochemistry from Columbia University. He is a member of the American Society for Microbiology.

BARRY W. WEINER (age 57) President, Chief Financial Officer and Director, is a founder of Enzo Biochem, Inc. He has served as the Companys President since 1996, and previously held the position of Executive Vice President. Before his employment with Enzo, he worked in several managerial and marketing positions at the Colgate Palmolive Company. Mr. Weiner is a Director of the New York Biotechnology Association. He received his Bachelor of Arts degree in Economics from New York University and a Master of Business Administration in Finance from Boston University. Mr. Weiner is a nominee for re-election at the 2008 Annual Meeting.

SHAHRAM K. RABBANI (age 55) Treasurer, Secretary and Director, is a founder and has been with the Company since its inception. He is also President of Enzo Clinical Labs. Mr. Rabbani serves on the New York State Clinical Laboratory Association, a professional board. He received a Bachelor of Arts Degree in Chemistry from Adelphi University.

DR. CARL W. BALEZENTIS (age 50) President, Enzo Life Sciences, Inc. has held this position since June 2006. Before his employment with Enzo, he was CEO of Lark Technologies, Inc. from 2000 to 2004, prior to its acquisition by Genaissance Pharmaceuticals, Inc. Subsequent to the acquisition he held the positions of President of Lark Technologies, Inc., and Senior Vice President of Genaissance. From 1998 to 2000 he has held numerous executive positions in the life sciences industry at Sigma-Aldrich, Perceptive Scientific Instruments, Inc., Applied Biosystems, Inc. (now Applera) and Promega Corporation. Dr. Balezentis holds a Ph.D. in Genetics from the University of Arizona and completed a Post Doctoral Fellowship at M.D. Anderson Cancer Center in Houston, TX.

DR. NORMAN E. KELKER (age 68) Senior Vice President has held this position since 1989. Before this, he was the Companys Vice President for Scientific Affairs. Dr. Kelker has authored numerous scientific papers and presentations in the biotechnology field. He is a member of American Society of Microbiology and the American Association of the Advancement of Science. Dr. Kelker received his Ph.D. in Microbiology and Public Health from Michigan State University.

ANDREW R. CRESCENZO, CPA (age 51) Senior Vice President of Finance for the Company has held this position since May 2006. Before joining the Company, Mr. Crescenzo was an Executive Director from 2002 to 2006 and a Senior Manager from 1997 to 2002 at Grant Thornton LLP. From 1993 to 1997 he served as Vice President and Chief Financial Officer of J. DAddario & Co, Inc and was employed at Ernst and Young LLP from 1984 to 1993. Mr. Crescenzo is a Certified Public Accountant and received his Bachelors of Business Administration from Adelphi University.

8

HERBERT B. BASS (age 59) Vice President of Finance for the Company and is also Senior Vice President of Enzo Clinical Labs. Before his promotion in 1989 to Vice President of Finance, Mr. Bass served as the Corporate Controller of the Company. Mr. Bass has been with the Company since 1986. From 1977 to 1986, Mr. Bass held various positions at Danziger and Friedman, Certified Public Accountants, the latest of which was audit manager. Mr. Bass received a Bachelor of Business Administration degree in Accounting from Bernard M. Baruch College.

DR. BARBARA E. THALENFELD (age 67) Vice President of Corporate Development for Enzo Biochem and Vice President of Clinical Affairs for Enzo Therapeutics. Dr. Thalenfeld has been employed with the Company since 1982. She has authored numerous scientific papers in the areas of molecular biology and genetics, and is a member of the American Society of Gene Therapy, the Association of Clinical Research Professionals, and the Drug Development Association. Dr. Thalenfeld received her Ph.D. at the Institute of Microbiology at Hebrew University in Jerusalem, Israel and a Master of Science degree in Molecular Biology from Yale University. She also completed a Post Doctoral Fellowship in the Department of Biological Sciences at Columbia University.

DAVID C. GOLDBERG (age 50) Vice President of Business Development for Enzo Biochem and Senior Vice President of Enzo Clinical Labs has been employed with the Company since 1985. He has held several managerial positions within Enzo Biochem. Mr. Goldberg also held management and marketing positions with DuPont-NEN and Gallard Schlesinger Industries before joining the Company. He received a Master of Science degree in Microbiology from Rutgers University and a Master of Business Administration in Finance from New York University.

JOHN J. DELUCCA (age 64) has been a Director of the Company since 1982, and is Chairman of the Governance Committee. From 2003 to 2004, Mr. Delucca was Executive Vice President and Chief Financial Officer of REL Consulting Group. Mr. Delucca was the Chief Financial Officer & Executive Vice President, Finance & Administration of Coty, Inc., from 1999 to 2002. From 1993 until 1999, he was Senior Vice President and Treasurer of RJR Nabisco, Inc. Mr. Delucca is a board member, member of the Compensation Committee of Endo Pharmaceuticals Holdings Inc. (ENDP: NasdaqGS), and Chairman of the Audit Committees of Endo and ITC Deltacom (ITCD.OB). Endo engages in the research, development, sale and marketing of prescription pharmaceuticals. ITC Deltacom is a provider of integrated communication services primarily to business customers in the southeastern United States. Mr. Delucca is also a board member and serves as the Deputy Chairman of the Audit Committee of British Energy (BEYGF.PK) and since January 2007 has been a board member of Tier Technologies (TIER:NasdaqGM). Tier is a provider of information technology services. Mr. Delucca holds a BA in Business Administration from Bloomfield College and an MBA from Fairleigh Dickinson University.

IRWIN C. GERSON (age 77) has been a Director of the Company since May 2001 and is Chairman of the Compensation Committee. From 1995 until December 1998, Mr. Gerson served as Chairman of Lowe McAdams Healthcare and prior thereto had been, since 1986, Chairman and Chief Executive Officer of William Douglas McAdams, Inc., one of the largest advertising agencies in the U.S. specializing in pharmaceutical marketing and communications to healthcare professionals. In February 2000, he was inducted into the Medical Advertising Hall of Fame. He was a director of Andrx Corporation, a NASDAQ listed company which specializes in proprietary drug delivery technologies until November 2006. From 1990-1999, he was Chairman of the Council of Overseers of the Arnold and Marie Schwartz College of Pharmacy and has served as a trustee of The Albany College of Pharmacy and Long Island University. He was elected President of the Advisory Board of Florida Atlantic University Lifelong Learning Society in October 2006. Mr. Gerson has a Bachelor of Science in Pharmacy from Fordham University and an MBA from the NYU Graduate School of Business Administration.

9

DR. STEPHEN B. H. KENT (age 62) has been a Director of the Company since January 2007. Dr. Kent is or has been a Professor of Biochemistry & Molecular Biology (2001-present), Professor of Chemistry (2002-present), and Director of the Institute for Biophysical Dynamics (2003-present) at the University of Chicago. Dr. Kent was the business founder and served as a director of Ciphergen Biosystems (1994-1997) and Gryphon Sciences (1994-2002). At Gryphon Sciences, Kent served as President (1997-2000), CEO (1999-2000), and Chief Scientist (1997-2001). Dr. Kent has served on the Scientific Advisory Board at Amylin Pharmaceuticals from 2005 present, the Board of the Center for Functional Genomics, Victoria University, New Zealand from 2004 present, the Scientific Advisory Board, Institute for Molecular Bioscience, The University of Queensland, Australia, from 2001 present, and the Scientific Advisory Board, New York Blood Center & Kimball Research Institute from 19911997. Dr. Kent received Bachelor of Science and Master of Science degrees in his native New Zealand, and his Ph.D. from the University of California, Berkeley.

MELVIN F. LAZAR, CPA (age 68) has been a Director of the Company since August 2002, the Lead Independent Director since October 2005, and is Chairman of the Audit Committee. Mr. Lazar was a founding partner of the public accounting firm of Lazar, Levine & Felix LLP from 1969 until October 2002. Mr. Lazar is a board member and chairman of the audit committee of Arbor Realty Trust, Inc. (ABR: NYSE). Arbor is a real estate investment trust (REIT) formed to invest in real estate related bridge and mezzanine loans, preferred equity investments and other real estate related assets. Mr. Lazar is a board member and serves as the Chairman of the Audit Committee of Grubb & Ellis Realty Advisors, Inc. (GAV:AMEX). The company is a development stage company formed to acquire commercial real estate properties. Mr. Lazar holds a Bachelor of Business Administration degree from The City College of New York (Baruch College). Mr. Lazar is a nominee for re-election at the 2008 Annual Meeting.

JOHN B. SIAS (age 80) has been a Director of the Company since 1982. Mr. Sias had been President and Chief Executive Officer of Chronicle Publishing Company from April 1993 to September 2000. From January 1986 until April 1993, Mr. Sias was President of ABC Network Division, Capital Cities/ABC, Inc. From 1977 until January 1986, he was the Executive Vice President, President of the Publishing Division (which includes Fairchild Publications) of Capital Cities Communications, Inc. Mr. Sias holds a Bachelors degree in Economics from Stanford University.

Dr. Elazar Rabbani and Shahram K. Rabbani are brothers and Barry W. Weiner is their brother-in-law.

John J. Delucca, John B. Sias, Irwin C. Gerson, Melvin F. Lazar and Dr. Stephen Kent qualify as independent directors under the criteria established by the New York Stock Exchange (NYSE).

10

Our Board of Directors and management are committed to responsible corporate governance to ensure that the Company is managed for the long-term benefit of its shareholders. To that end, during the past year, as in prior years, the Board of Directors and management have periodically reviewed and updated, as appropriate, the Companys corporate governance policies and practices. During the past year, the Board has also continued to evaluate and, when appropriate, update the Companys corporate governance policies and practices in accordance with the requirements of the Sarbanes-Oxley Act of 2002 and the rules and listing standards issued by the Securities and Exchange Commission and the NYSE.

Corporate Governance Policies and Practices

The Company has instituted a variety of policies and practices to foster and maintain responsible corporate governance, including the following:

|

|

|

|

|

Corporate Governance Guidelines The Board of Directors adopted Corporate Governance Guidelines, which collect in one document many of the corporate governance practices and procedures that had evolved over the years. These guidelines address the duties of the Board of Directors, director qualifications and selection process, Board operations, Board committee matters and continuing education. The guidelines also provide for annual self-evaluations by the Board and its committees. The Board reviews these guidelines on an annual basis. The guidelines are available on the Companys website at www.enzo.com, and in print to any interested party that requests them. |

|

|

|

|

|

Corporate Code of Ethics The Company has a Code of Ethics that applies to all of the Companys employees, officers and members of the Board. The Code of Ethics is available on the Companys website at www.enzo.com, and in print to any interested party that requests it. |

|

|

|

|

|

Board Committee Charters Each of the Companys Audit, Compensation and Nominating/Governance Committees has a written charter adopted by the Companys Board of Directors that establishes practices and procedures for such committee in accordance with applicable corporate governance rules and regulations. The charters are available on the Companys website at www.enzo.com, and in print to any interested party that requests them. |

|

|

|

|

|

Lead Independent Director Charter The duties of the Lead Independent Director, as set forth in the Lead Independent Director Charter, among other things, are to develop the agendas for and serve as chairman of the executive sessions of the independent directors of the Company; serve as principal liaison between the independent directors of the Company and the Chairman of the Board and between the independent directors and senior management; provide the Chairman of the Board with input as to the preparation of the agendas for Board meetings; advise the Chairman of the Board as to the quality, quantity and timeliness of the information submitted by the Companys management that is necessary or appropriate for the independent directors to effectively and responsibly perform their duties; ensure that independent directors have adequate opportunities to meet and discuss issues in executive sessions without management present; if the Chairman of the Board is unable to attend a Board of Directors meeting, act as chairman of such Board of Directors meeting; and perform such other duties as the Board of Directors shall from time to time delegate. |

|

|

|

|

|

On October 31, 2005, the Board of Directors elected Melvin F. Lazar to serve as Lead Independent Director. The Lead Independent Director Charter is available on the Companys website at www.enzo.com, and in print to any interested party that requests it. |

|

|

|

11

Director Independence

|

|

|

|

|

|

|

Requirements The Board of Directors believes that a substantial majority of its members should be independent, non-employee directors. The Board adopted the following Director Independence Standards, which are consistent with criteria established by the NYSE, to assist the Board in making these independence determinations: |

|

|

|

|

|

|

|

No Director can qualify as independent if he or she has a material relationship with the Company outside of his or her service as a Director of the Company. A Director is not independent if, within the preceding three years: |

|

|

|

|

|

|

|

|

|

The director was an employee of the Company. |

|

|

|

|

|

|

|

|

|

An immediate family member of the director was an executive officer of the Company. |

|

|

|

|

|

|

|

|

|

A director was affiliated with or employed by a present or former internal or external auditor of the Company. |

|

|

|

|

|

|

|

|

|

An immediate family member of a director was affiliated with or employed in a professional capacity by a present or former internal or external auditor of the Company. |

|

|

|

|

|

|

|

|

|

A director, or an immediate family member of the director, received more than $100,000 per year in direct compensation from the Company, other than director and committee fees and pension or other forms of deferred compensation for prior services (provided such compensation is not contingent in any way on continued service). |

|

|

|

|

|

|

|

|

|

The director, or an immediate family member of the director, was employed as an executive officer of another company where any of the Companys executives served on that companys compensation committee of the board of directors. |

|

|

|

|

|

|

|

|

|

The director was an executive officer or employee, or an immediate family member of the director was an executive officer, of another company that made payments to, or received payments from, the Company for property or services in an amount which, in any single fiscal year, exceeded the greater of $1 million or two percent (2%) of such other companys consolidated gross revenues. |

|

|

|

|

|

|

|

|

|

The director, or an immediate family member of the director, was an executive officer of another company that was indebted to the company, or to which the Company was indebted, where the total amount of either companys indebtedness to the other was five percent (5%) or more of the total consolidated assets of the company he or she served as an executive officer. |

|

|

|

|

|

|

|

|

|

The director, or an immediate family member of the director, was an officer, director or trustee of a charitable organization where the Companys annual discretionary charitable contributions to the charitable organization exceeded the greater of $1 million or five percent (5%) of that organizations consolidated gross revenues. |

12

|

|

|

|

|

|

|

|

|

The director was an employee of the Company. |

|

|

|

|

|

|

|

|

|

An immediate family member of the director was an executive officer of the Company. |

|

|

|

|

|

|

|

|

|

A director was affiliated with or employed by a present or former internal or external auditor of the Company. |

|

|

|

|

|

|

|

|

|

An immediate family member of a director was affiliated with or employed in a professional capacity by a present or former internal or external auditor of the Company. |

|

|

|

|

|

|

|

|

|

A director, or an immediate family member of the director, received more than $100,000 per year in direct compensation from the Company, other than director and committee fees and pension or other forms of deferred compensation for prior services (provided such compensation is not contingent in any way on continued service). |

|

|

|

|

|

|

|

|

|

The director, or an immediate family member of the director, was employed as an executive officer of another company where any of the Companys executives served on that companys compensation committee of the board of directors. |

|

|

|

|

|

|

|

|

|

The director was an executive officer or employee, or an immediate family member of the director was an executive officer, of another company that made payments to, or received payments from, the Company for property or services in an amount which, in any single fiscal year, exceeded the greater of $1 million or two percent (2%) of such other companys consolidated gross revenues. |

|

|

|

|

|

|

|

|

|

The director, or an immediate family member of the director, was an executive officer of another company that was indebted to the company, or to which the Company was indebted, where the total amount of either companys indebtedness to the other was five percent (5%) or more of the total consolidated assets of the company he or she served as an executive officer. |

|

|

|

|

|

|

|

|

|

The director, or an immediate family member of the director, was an officer, director or trustee of a charitable organization where the Companys annual discretionary charitable contributions to the charitable organization exceeded the greater of $1 million or five percent (5%) of that organizations consolidated gross revenues. |

|

|

|

|

|

|

|

The Board has reviewed all material transactions and relationships between each director, or any member of his or her immediate family, and the Company, its senior management and its independent auditors. Based on this review and in accordance with its independence standards outlined above, the Board of Directors has affirmatively determined that all of the non-employee directors are independent. |

13

Board Nomination Policies and Procedure

|

|

|

|

|

|

|

Nomination Procedure The Nominating/Governance Committee is responsible for identifying, evaluating, and recommending candidates for election to the Board, with due consideration for recommendations made by other Board members, the CEO, shareholders, and other sources. In addition to the above criteria, the Nominating/Governance Committee also considers the appropriate balance of experience, skills, and characteristics desirable among the members of the board. The independent members of the Board review the Nominating/Governance Committee candidates and nominate candidates for election by the Company shareholders. |

|

|

|

|

|

|

|

Directors must also possess the highest personal and professional ethics, integrity and values and be committed to representing the long-term interests of all shareholders. Board members are expected to diligently prepare for, attend and participate in all Board and applicable Committee meetings. Each Board member is expected to ensure that other existing and future commitments do not materially interfere with the members service as a director. |

|

|

|

|

|

|

|

The Nominating/Governance Committee also reviews whether a potential candidate will meet the Companys independence standards and any other director or committee membership requirements imposed by law, regulation or stock exchange rules. |

|

|

|

|

|

|

|

Director candidates recommended to the Committee are subject to full Board approval and subsequent election by the shareholders. The Board of Directors is also responsible for electing directors to fill vacancies on the Board that occur due to retirement, resignation, expansion of the Board or other reasons between the Shareholders annual meetings. The Nominating/Governance Committee may retain a recruitment firm, from time to time, to assist in identifying and evaluating director candidates. When a firm is used, the Committee provides specified criteria for director candidates, tailored to the needs of the Board at that time, and pays the firm a fee for these services. Suggestions for director candidates are also received from board members and management and may be solicited from professional associations as well. |

Board Committees

|

|

|

|

|

|

|

|

All members of each of the Companys three standing committees the Audit, Compensation, and Nominating/Governance are required to be independent in accordance with NYSE criteria. See below for a description of the responsibilities of the Boards standing committees. |

|

|

|

|

|

|

|

|

Executive Sessions of Non-Management Directors |

||

|

|

|

|

|

|

|

|

The Board and the Audit, Compensation and Nominating/Governance Committees periodically hold meetings of only the independent directors or Committee members without management present. |

|

|

|

|

|

|

|

|

Board Access to Independent Advisors |

||

|

|

|

|

|

|

|

|

The Board as a whole, and each of the Board committees separately, has authority to retain and terminate such independent consultants, counselors or advisors to the Board as each shall deem necessary or appropriate. |

|

14

Communications with Board of Directors

|

|

|

|

|

|

|

|

Direct Communications Any interested party desiring to communicate with the Board of Directors or with any director regarding the Company may write to the Board or the director, c/o Shahram K. Rabbani, Office of the Secretary, Enzo Biochem, Inc., 527 Madison Avenue, New York New York 10022. The Office of the Secretary will forward all such communications to the director(s). Interested parties may also submit an email by filling out the email form on the Companys website at www.enzo.com. Moreover, any interested party may contact the non-management directors of the Board and/or the presiding (or lead) director. |

|

|

|

|

|

|

|

|

|

Annual Meeting The Company encourages its outside directors to attend the annual meeting of shareholders each year. Messrs. Delucca, Gerson, Kent, Lazar and Sias attended the Annual Meeting of Shareholders held in January 2007. |

|

Meetings of the Board of Directors and its Committees

During the fiscal year ended July 31, 2007, there were seven formal meetings of the Board of Directors, several actions by unanimous consent and several informal meetings. Currently, the Board of Directors has a Nominating/Governance Committee, an Audit Committee and a Compensation Committee. The Nominating/Governance Committee had three formal meetings, the Audit Committee had four formal meetings and the Compensation Committee had three formal meetings.

The Audit Committee was established by and among the Board of Directors for the purpose of overseeing the accounting and financial reporting processes of the Company and audits of the financial statements of the Company in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended, The Audit Committee is authorized to review proposals of the Companys auditors regarding annual audits, recommend the engagement or discharge of the auditors, review recommendations of such auditors concerning accounting principles and the adequacy of internal controls and accounting procedures and practices, review the scope of the annual audit, approve or disapprove each professional service or type of service other than standard auditing services to be provided by the auditors, and review and discuss the audited financial statements with the auditors. The current members of the Audit Committee are Messrs. Lazar, Delucca and Gerson, and Mr. Lazar is the Chairman. The Board of Directors has determined that each of the Audit Committee members are independent, as defined in the NYSEs listing standards and as defined in Item 7(d)(3)(iv) of Schedule 14A under the Securities and Exchange Act of 1934 The Board of Directors has further determined that Messrs. Delucca and Lazar are each audit committee financial experts as such term is defined under Item 401(h)(2) of Regulation S-K, and that Mr. Deluccas service on more than three audit committees does not impair his ability to serve on the Companys audit committee.

The Compensation Committee has the power and authority to (i) establish a general compensation policy for the officers and employees of the Corporation, including to establish and at least annually review officers salaries and levels of officers participation in the benefit plans of the Corporation, (ii) prepare any reports that may be required by the regulations of the Securities and Exchange Commission or otherwise relating to officer compensation, (iii) approve any increases in directors fees, (iv) grant stock options and/or other equity instruments (v) exercise all other powers of the Board of Directors with respect to matters involving the compensation of employees and the employee benefits of the Corporation as shall be delegated by the Board of Directors to the Compensation Committee. The current members of the Compensation Committee are Messrs. Gerson, Sias and Lazar and Mr. Gerson is the Chairman.

15

The Nominating/Governance Committee has the power to recommend to the Board of Directors prior to each annual meeting of the shareholders of the Corporation: (i) the appropriate size and composition of the Board of Directors; and (ii) nominees: (1) for election to the Board of Directors for whom the Corporation should solicit proxies; (2) to serve as proxies in connection with the annual shareholders meeting; and (3) for election to all committees of the Board of Directors other than the Nominating/Governance Committee. The Nominating/Governance Committee will consider nominations from the shareholders, provided that they are made in accordance with the Companys By-laws. The current members of the Nominating/Governance Committee are Messrs. Delucca, Kent, Lazar and Sias and Mr. Delucca is the Chairman.

In connection with the preparation and filing of the Companys Annual Report on Form 10-K for the year ended July 31, 2007:

|

|

|

|

|

|

|

(1) The Audit Committee reviewed and discussed the audited financial statements with management; |

|

|

|

|

|

|

|

(2) The Audit Committee discussed with the independent registered public accountants matters required to be discussed under Statement on Auditing Standards No. 61, as may be modified or supplemented; |

|

|

|

|

|

|

|

(3) The Audit Committee reviewed the written disclosures and the letter from the independent registered public accountants required by the Independence Standards Board Standard No. 1, as may be modified or supplemented, and discussed with the independent auditors any relationships that may impact their objectivity and independence and satisfied itself as to the independent registered public accountants' independence; |

|

|

|

|

|

|

|

(4) The Audit Committee discussed with the Companys independent registered public accountants the overall scope and plans for its audit. The Audit Committee met with the independent registered public accountants, with and without management present, to discuss the results of their examinations, their evaluations of the Companys internal controls, and the overall quality of the Companys financial reporting. The Audit Committee held four formal meetings during the fiscal year ended July 31, 2007; and |

|

|

|

|

|

|

|

(5) Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements of the Company be included in the 2007 Annual Report on Form 10-K. |

|

|

|

|

|

|

Submitted by the members of the Audit Committee |

|

|

|

|

|

|

|

|

Melvin F. Lazar, CPA |

|

|

|

John J. Delucca |

|

|

|

Irwin C. Gerson |

16

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Companys executive officers, directors and persons who beneficially own more than 10% of a registered class of the Companys equity securities (collectively, Reporting Persons) to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. Such executive officers, directors and greater than 10% beneficial owners are required by Securities and Exchange Commission regulation to furnish the Company with copies of all Section 16(a) forms filed by such reporting persons.

Based solely on the Companys review of such forms furnished to the Company and written representations from certain reporting persons, the Company believes that the Reporting Persons have complied with all applicable filing requirements, except that Messrs. Delucca and Goldberg each filed one report late and Dr. Thalenfeld filed two reports late.

Certain Relationships and Related Transactions

Enzo Clinical Labs, Inc. (Enzo Lab), a subsidiary of the Company, leases a facility located in Farmingdale, New York from Pari Management Corporation (Pari). Pari is owned equally by Elazar Rabbani, Ph.D., Shahram Rabbani and Barry Weiner and his wife, who are the officers and directors of Pari. The lease originally commenced on December 20, 1989, but was amended and extended in March 2005 and now terminates on March 31, 2017. During fiscal 2007, Enzo Lab paid approximately $1,376,000 (including $182,000 in real estate taxes) to Pari with respect to such facility and future payments are subject to cost of living adjustments. The non-interested members of the Board of Directors have reviewed and approved this transaction in accordance with the Companys procedures for reviewed related party transactions. The Company, which has guaranteed Enzo Labs obligations to Pari under the lease, believes that the existing lease terms are as favorable to the Company as would be available from an unaffiliated party.

The Company has adopted a Code of Ethics (as such term is defined in Item 406 of Regulation S-K). The Code of Ethics is available on the Companys website at www.enzo.com, and in print to any shareholder that requests it. The Code of Ethics applies to the Companys employees, officers and members of the board. The Code of Ethics has been designed to deter wrongdoing and to promote:

|

|

|

|

(1) |

Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

|

|

|

|

(2) |

Full, fair, accurate, timely, and understandable disclosure in reports and documents that the Company files with, or submits to, the Securities and Exchange Commission and in other public communications made by the Company; |

|

|

|

|

(3) |

Compliance with applicable governmental laws, rules and regulations; |

|

|

|

|

(4) |

The prompt internal reporting or violations of the Code of Ethics to an appropriate person or persons identified in the Code of Ethics; and |

|

|

|

|

(5) |

Accountability for adherence to the Code of Ethics. |

17

As of November 1, 2005, the Lead Independent Director receives an annual directors fee of $50,000 and each other person who serves as a director and who is not otherwise an officer or an employee (such director being classified as an Outside Director) of the Company, receives an annual directors fee of $20,000. For each meeting of the Board of Directors attended in person or by telephone, the Lead Independent Director and all other Outside Directors receive a fee of $2,000. Additionally, each Outside Director who serves on a committee of the Board of Directors receives a fee of $1,000 for each meeting of the committee attended in person or by telephone. In addition to the $1,000 per committee meeting fee, the Chairman of the Audit Committee receives an additional fee of $1,000 for each meeting of the Audit Committee attended in person or by telephone, the Lead Independent Director receives an additional fee of $500 for each meeting of any Board committee attended in person or by telephone, and the Chairman of the Compensation Committee and the Chairman of the Nominating/Governance Committee each receives an additional fee of $500 for each meeting of the committee attended in person or by telephone. The Lead Independent Director will receive restricted stock units immediately following the Annual Meeting, provided such person is a director of the Company at such time. Each of the other Outside Directors will receive restricted stock units immediately following the Annual Meeting, provided such person is a director of the Company at such time. The number of restricted stock units that the Lead Independent Director and each of the Outside Directors receive will be determined on an annual basis by the Compensation Committee. Each of the restricted stock units referred to above shall be subject to a two-year vesting period; provided that at the time any non-employee director ceases to be a director of the Company (other than due to such directors resignation), such non-employee directors restricted stock units shall become fully vested at such time. The Company reimburses directors for their travel and related expenses in connection with attending meetings of the Board of Directors and Board-related activities.

The Board of Directors of the Company have approved changes to non-executive director compensation effective January 1, 2008. The major changes are as follows:

|

|

|

|

|

|

(1) |

Annual Board membership retainer will increase to $30,000 per year. |

|

|

|

|

|

|

(2) |

A set dollar value of annual restricted stock unit grants equal to $125,000 per year. |

|

|

|

|

|

|

(3) |

The elimination of Board meeting fees. |

|

|

|

|

|

|

(4) |

Fixed committee retainer fee of $7,500 per year. |

|

|

|

|

|

|

(5) |

Fixed Nominating/Governance and Compensation Committee Chair retainer of $10,000 per year each. |

|

|

|

|

|

|

(6) |

Fixed Audit Committee Chair retainer of $20,000 per year. |

|

|

|

|

|

|

(7) |

Lead Director additional annual cash retainer of $25,000 per year. |

|

|

|

|

|

The Board determined that the changes set forth above provide non-executive director compensation more in line with those received by non-executive directors in its peer group. |

||

18

The following table sets forth the information concerning compensation earned during our 2007 fiscal year by all non-employee directors:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

Fees Earned or |

|

Stock Awards |

|

Option Awards |

|

Change in Pension Value |

|

All Other |

|

Total |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

John J. Delucca |

|

$ |

58,000 |

|

$ |

95,591 |

|

|

$ |

153,591 |

|

|||||

|

Director |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Irwin C. Gerson |

|

$ |

53,000 |

|

$ |

64,945 |

|

|

$ |

117,945 |

|

|||||

|

Director |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Stephen P. H. Kent (1) |

|

$ |

18,000 |

|

$ |

30,645 |

|

|

$ |

48,645 |

|

|||||

|

Director |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Melvin F.Lazar, CPA |

|

$ |

133,500 |

|

$ |

112,379 |

|

|

$ |

245,879 |

|

|||||

|

Director |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

John B. Sias |

|

$ |

41,000 |

|

$ |

64,945 |

|

|

$ |

105,945 |

|

|||||

|

Director |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

Represents partial year as director. |

|

|

|

|

(2) |

Each independent director was awarded 7,000 restricted stock units in fiscal 2007, except the lead independent director who was awarded 10,000 restricted stock units. The amounts reflect the dollar amount recognized for financial statement reporting purposes for the fiscal year ended July 31, 2007, in accordance with FAS 123(R) for awards pursuant to the Companys 2005 Plan and include awards granted in and prior to 2007. |

COMPENSATION OF EXECUTIVE OFFICERS

Compensation Discussion and Analysis

The Compensation Committee of our Board of Directors oversees our executive compensation program. In this role, the Compensation Committee reviews and approves all compensation decisions relating to our named executive officers. The Compensation Committee also reviews and approves all equity awards for all employees.

The Company strives to apply a uniform philosophy to compensation for all of its employees. This philosophy is based on the premise that the achievements of the Company result from the combined and coordinated efforts of all employees working toward common objectives.

Objectives and Philosophy of Our Executive Compensation Program

The primary objectives of the Compensation Committee with respect to executive compensation are to:

|

|

|

|

|

|

|

align executive compensation with comparable companies in our industry sectors to attract, retain and motivate the best possible executive talent; |

|

|

|

|

|

|

|

ensure that executive compensation is aligned with our corporate business objectives and performance; |

|

|

|

|

|

|

|

promote the achievement of key strategic and financial performance objectives by linking cash and equity incentives; and |

|

|

|

|

|

|

|

align executives incentives with the creation of long-term stockholder value. |

19

To achieve these objectives, the Compensation Committee evaluates senior management with input from our CEO, with the goal of setting compensation at levels the Compensation Committee believes are competitive with those of other companies in our industry that compete with us for executive talent. The Compensation Committee also conducts an annual evaluation of the CEO in addition to senior management evaluations. As part of these evaluations, our Compensation Committee considers key strategic, financial and operational objectives, including but not limited to: award of new patents, intellectual property protection, advancement of strategic alliances, collaborations, licensing, clinical trial progress, new product introductions, provider contracts, investor relations, corporate governance, and our financial and operational performance, as measured by the respective value drivers in each of the operating segments.

We may also award long term incentive compensation in the form of restricted stock awards that vest over time. We believe this practice helps to retain our executives and aligns their interests with those of our stockholders by allowing them to participate in the longer term success of our Company as reflected in stock price appreciation.

In making compensation decisions, the Compensation Committee compares our executive compensation against a peer group of publicly traded companies which they believe have business life cycles, revenues, market capitalizations, products, research and development investment levels and/or number/capabilities of employees that are roughly comparable to ours and against which the Compensation Committee believes we compete for executive talent. In 2005, the Compensation Committee retained James F. Reda & Associates LLC, (Consultant) an independent compensation consultant. The Companys senior management, with the assistance of the Consultant, compiled a list of peer companies. The Consultant then analyzed the executive compensation programs of these companies and issued a report to the Compensation Committee.

The companies included in the peer group surveyed by the Consultants in 2005 were:

|

|

|

|

|

|

|

|

|

Alkermes, Inc. |

|

|

|

|

|

|

|

|

|

Amylin Pharmaceuticals, Inc. |

|

|

|

|

|

|

|

|

|

Bio-Reference Laboratories, Inc. |

|

|

|

|

|

|

|

|

|

Cell Genesys, Inc. |

|

|

|

|

|

|

|

|

|

Cell Therapuetics, Inc. |

|

|

|

|

|

|

|

|

|

Digene Corp.1 |

|

|

|

|

|

|

|

|

|

Incyte, Corp. |

|

|

|

|

|

|

|

|

|

Intermune, Inc. |

|

|

|

|

|

|

|

|

|

Isis Pharmaceuticals, Inc. |

|

|

|

|

|

|

|

|

|

The Medicines Company |

|

|

|

|

|

|

|

|

|

Orchid Cellmark, Inc. |

|

|

|

|

|

|

|

|

|

PDL Bio Pharma, Inc. |

|

|

|

|

|

|

|

|

|

Supergen, Inc. |

|

|

|

|

|

|

|

|

|

Trimeris, Inc. |

|

|

|

|

|

|

|

|

|

United Therapeutics Corp. |

|

|

|

|

|

|

|

|

|

Vertex Pharmaceuticals, Inc. |

20

We compete with many other companies for executive personnel. The Compensation Committee generally targets total compensation for executives at the 50th percentile of total compensation paid to similarly situated executives of the companies in the peer group.

The Compensation Committee may adjust compensation levels, upon consideration of the relevant drivers relating to the life sciences, clinical diagnostics or therapeutics industries we operate in, with respect to an executives individual experience and performance level, and our overall Company performance.

The Compensation Committee met three times in fiscal 2007 in order to review and approve our compensation for named executives and non-employee directors, review candidates presented by senior management for key positions, approve equity awards for all employees and review with our Consultant the peer group information. The results of the Compensation Committee activities were reported to the Board of Directors.

Components of our Executive Compensation Program

The primary elements of our executive compensation program are:

|

|

|

|

|

base salary; |

|

|

|

|

|

cash bonus; |

|

|

|

|

|

equity awards; |

|

|

|

|

|

benefits and other compensation; and |

|

|

|

|

|

severance and change-of-control benefits. |

Base Salary

Base salary levels recognize the experience, skills, knowledge and responsibilities of each executives position within the Company.

Exclusive of the base salaries that are contractual, base salaries are reviewed annually by the Compensation Committee, and may be adjusted from time to time to realign salaries with market levels after taking into account individual responsibilities, performance and experience. Base salaries also may be increased for merit reasons, based on the executives success in meeting or exceeding individual performance objectives, promoting our core values and demonstrating leadership abilities.

The base salaries of the three founders: our Chairman of the Board, Chief Executive Officer and Director; our President, Chief Financial Officer and Director; and our Treasurer, Secretary, President of Enzo Clinical Labs and Director, are contractual and in accordance with executed employment agreements. The base salaries for the other two named executives, Dr. Carl W. Balezentis and Andrew R. Crescenzo are also contractual and were made in accordance with their initial employment agreements.

Annual Cash Bonus

The Compensation Committee approves discretionary cash bonuses for certain employees, including our named executive officers.

Based on performance evaluations conducted in December 2006, the Compensation Committee awarded Dr. Rabbani a $350,000 cash bonus, which represented 76% of his base salary at such date. The Compensation Committee recognized Dr. Rabbanis broad contributions in the areas of his role as Chairman of the Board, oversight of our technology platform and scientific product development, recruitment of new members of the executive management, and strategy for business development, including negotiating licensing and collaboration arrangements.

21

Based on performance evaluations conducted in December 2006, the Compensation Committee awarded Mr. Weiner a $225,000 cash bonus, which represented 54% of his base salary at such date. The Compensation Committee recognized Mr. Weiners contributions in the strategic planning area, communications with the Board, financial management, corporate governance, communication efforts with our stockholders and investors, role in recruitment of new members of the corporate finance group and divisional management and leadership role among the divisional executives.

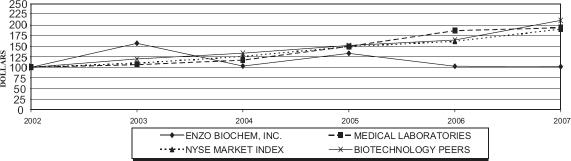

Based on performance evaluations conducted in December 2006, the Compensation Committee awarded Mr. Rabbani a $200,000 cash bonus, which represented 48% of his base salary at such date. The Compensation Committee recognized Mr. Rabbanis contributions relating to financial improvements at the Clinical Lab, expansion of the managed care contracts, on-going identification and evaluation of acquisition targets, representation of Clinical Lab at industry organizations, communications with the Board and role in leadership among the divisions management.