PRRN14A: Revised preliminary proxy statement filed by non-management

Published on December 21, 2020

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. 1)

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

| Enzo Biochem, Inc. |

| (Name of Registrant as Specified In Its Charter) |

|

ROUMELL ASSET MANAGEMENT, LLC MATTHEW M. LOAR JAMES C. ROUMELL EDWARD TERINO |

(Name Of Person(s) Filing Proxy Statement, If Other Than The Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| (1) |

Title of each class of securities to which transaction applies:

|

|

| (2) |

Aggregate number of securities to which transaction applies:

|

|

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

| (4) |

Proposed maximum aggregate value of transaction:

|

|

| (5) |

Total fee paid:

|

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) |

Amount Previously Paid:

|

|

| (2) |

Form, Schedule or Registration Statement No.:

|

|

| (3) |

Filing Party:

|

|

| (4) |

Date Filed:

|

PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION

DATED DECEMBER 21, 2020

ROUMELL ASSET MANAGEMENT, LLC

DECEMBER [ ], 2020

Dear Fellow Shareholder:

Roumell Asset Management, LLC (collectively with its affiliates, “Roumell Asset Management”), James. C. Roumell (collectively with Roumell Asset Management, “Roumell” or “we”), together with the other participants in this solicitation, own an aggregate of 2,769,479 shares of common stock, $0.01 par value per share (the “Common Stock”), of Enzo Biochem, Inc., a New York corporation (“Enzo” or the “Company”), representing approximately 5.8% of the Common Stock outstanding of the Company, making us one of the Company’s largest shareholders. For the reasons set forth in the attached proxy statement, we believe changes to the composition of the Board of Directors of the Company (the “Board”) are necessary in order to ensure that the Company is being run in a manner consistent with your best interests.

We believe that immediate changes to the Board are necessary to protect shareholders’ interests. Under the leadership of Elazar Rabbani, Ph.D., who has served as the Company’s Chairman of the Board and Chief Executive Officer for decades, the Company has undergone an enduring period of value destruction. Enzo’s stock has significantly lagged behind its peers and the broader market. According to Institutional Shareholder Services, Inc., a preeminent proxy advisory firm (“ISS”), the Company’s total shareholder return for the five-year period through January 2020 was negative 32.7%, compared with negative 3.2% for its peer group median and 57.8% for the Russell 2000 index. Meanwhile, the Company’s key executives received compensation totaling $34 million on a cumulative basis from 2004 until January 2020. Given the Company’s stock price underperformance under the long-term oversight of Dr. Rabbani, we strongly believe that the Board must be reconstituted to ensure that the interests of the shareholders, the true owners of the Company, are appropriately represented in the boardroom.

Three of the five members of the Board were appointed by Dr. Rabbani and his fellow directors within the past year. As a result, we do not believe that the current Board’s makeup reflects the preference of shareholders. Two directors (the “Replacement Directors”) were recently and hurriedly appointed, after the date which the Company claims to have been the deadline for shareholder nominations for the 2020 annual meeting of shareholders (the “Annual Meeting”). These rushed appointments were made after the sudden, unexplained and almost concurrent resignations of two directors nominated and elected by shareholders following a campaign by Harbert Discovery Fund, LP and Harbert Discovery Co-Investment Fund I, LP, which, collectively with certain of their affiliates, own approximately 11.7% of the Company’s outstanding Common Stock,1 at the 2019 annual meeting of shareholders (such directors, the “Harbert Directors”). Roumell believes that evaluating the Replacement Directors’ performance for the Company would be futile, as each of them has only served a mere two or so months. However, we believe shareholders should be given the opportunity to replace the Harbert Directors, an opportunity which the Company has denied by its refusal to accept our nomination and its retrospective setting of the deadline for nominations for the Annual Meeting, which preceded the appointment of the Replacement Directors.

We are seeking your support to (a) elect our director candidates, Matthew M. Loar and Edward Terino, to the Board, (b) amend the Company’s Amended and Restated Bylaws, as amended (the “Bylaws”) to change the size of the Board to a minimum of three directors with a maximum number of directors to be decided by the Board in its discretion, and (c) repeal any provision of, or amendment to, the Bylaws adopted by the Board without approval of the Company’s shareholders subsequent to February 25, 2020. We believe that the fresh perspectives and deep relevant industry experience of our nominees would, if elected, allow us to revitalize the Company and allow the Company to realize its full potential. We further believe that our proposal to amend the Bylaws will give a refreshed Board flexibility to adjust its own size depending on the Company’s needs. We urge you to carefully consider the information contained in the attached proxy statement and then support our efforts by signing, dating and returning the enclosed GREEN proxy card today.

The attached Proxy Statement and the enclosed GREEN proxy card are first being mailed to shareholders on or about [__], 2020.

If you have any questions or require any assistance with your vote, please contact Saratoga Proxy Consulting LLC, which is assisting us, at its address and toll-free numbers listed below.

| Thank you for your support, | |

| James C. Roumell | |

| President | |

| Roumell Asset Management, LLC |

| 1 | See Amendment No. 9 to Schedule 13D of Harbert Discovery Fund, LP, Harbert Discovery Co-Investment Fund I, LP and certain of their affiliates filed with the Securities and Exchange Commission on December 15, 2020. |

If you have any questions or need assistance in voting your GREEN proxy card, or need additional copies of Roumell’s proxy materials, please contact:

Saratoga Proxy Consulting LLC

520 8th Avenue, 14th Floor

New York, NY 10018

(212) 257-1311

Shareholders Call Toll Free at: (888) 368-0379

Email: info@saratogaproxy.com

PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION

DATED DECEMBER 21, 2020

2020 ANNUAL MEETING OF SHAREHOLDERS

OF

ENZO BIOCHEM, INC.

PROXY STATEMENT

OF

ROUMELL ASSET MANAGEMENT, LLC

PLEASE SIGN, DATE AND MAIL THE ENCLOSED GREEN PROXY CARD TODAY

Roumell Asset Management, LLC (collectively with its affiliates, “Roumell Asset Management”), James C. Roumell (collectively with Roumell Asset Management, “Roumell” or “we”) together with the other participants in this solicitation, own an aggregate of 2,769,479 shares of common stock, $0.01 par value per share (the “Common Stock”), of Enzo Biochem, Inc. (“Enzo” or the “Company”), representing approximately 5.8% of the Common Stock outstanding of the Company. Shareholders who own the Common Stock as of the close of business on November 23, 2020 (the “Record Date”) will be entitled to vote at the 2020 Annual Meeting of Shareholders, scheduled to be held virtually over the internet using the link, www.virtualshareholdermeeting.com/ENZ2020, on January 4, 2021, at 9 a.m., EST (including any other meeting of shareholders held in lieu thereof, and adjournments, postponements, reschedulings or continuations thereof, the “Annual Meeting”). We therefore seek your support at the Annual Meeting for the following:

| 1. | To elect our slate of two director nominees to the Board of Directors of Enzo (the “Board”) at the Annual Meeting, with Matthew M. Loar to serve as a Class II director for a term of two years on the Board, and Edward Terino (each of Mr. Loar and Mr. Terino, a “Nominee” and, together, the “Nominees”), to serve as a Class III director for a term of three years on the Board, or until their respective successors are duly elected and qualified and grant authority to vote for the Company’s nominees; |

| 2. | To vote against the approval, by a nonbinding advisory vote, of the compensation of the Company’s Named Executive Officers; |

| 3. | To ratify the selection of EisnerAmper LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending July 31, 2021; |

| 4. | To vote against the amendment and restatement of the Company’s Amended and Restated 2011 Incentive Plan, including an increase in the number of shares of Common Stock authorized for grant under such plan; |

| 5. | To amend the Company’s Amended and Restated Bylaws (the “Bylaws”) to change the size of the Board to a minimum of three directors with a maximum number of directors to be decided by the Board in its discretion; |

| 6. | To repeal any provision of, or amendment to, the Bylaws adopted by the Board without approval of the Company’s shareholders subsequent to February 25, 2020; and |

| 7. | To transact such other business as may properly come before the Annual Meeting. |

Roumell is soliciting proxies from shareholders to elect Messrs. Loar and Terino to the Board and to approve its Proposals 5 and 6.

We urge you to carefully consider the information contained in this proxy statement and then support our efforts by signing, dating and returning the enclosed GREEN proxy card today. The principal executive offices of the Company are located at 527 Madison Avenue, New York, New York 10022. This proxy statement and the enclosed GREEN proxy card are first being furnished to shareholders on or about December [__], 2020.

Under Article II, Section 15 of the Bylaws, shareholder nominations must be submitted within 90 to 120 days prior to the earlier of the date of the meeting and the anniversary date of the immediately preceding year’s annual meeting. The Company did not definitively announce the date of the Annual Meeting until it filed its “definitive” proxy statement (the “Company Proxy Statement”) on November 27, 2020 with the Securities and Exchange Commission (the “SEC”). Until then, shareholders could only rely on the date of the 2019 annual meeting of shareholders (the “2019 Annual Meeting”) to reach an approximation of the nomination window for the Annual Meeting. Even though the 2019 Annual Meeting was convened and immediately adjourned on January 31, 2020, the formal business of the meeting took place on February 25, 2020 when the meeting was reconvened. Therefore, we believe that we should use “February 25, 2020” for purposes of calculating the nomination window for the Annual Meeting, which, accordingly, should be between October 28, 2020 and November 27, 2020. Under that line of reasoning, a shareholder would not have submitted any nomination notice until October 28, 2020 or later, which would already have missed the deadline retroactively set by the Board, i.e., October 6, 2020. Even if we had used January 31, 2021 as the anniversary date of the 2019 Annual Meeting, the earliest date shareholders could submit nominations would have been October 3, 2020, a Saturday, and three days before the Company’s purported deadline.

The Company may argue that it provided shareholders with some notice regarding the date of the Annual Meeting in its Annual Report on Form 10-K for the fiscal year ended July 31, 2020 (the “10-K”), which referenced “[p]ortions of the definitive Proxy Statement to be delivered to shareholders in connection with the Annual Meeting of Shareholders to be held on or about January 4, 2021.” We believe that shareholders consider that sentence, vaguely worded and not prominently disclosed in the 10-K and, with no clear heading or other indication of importance, inadequate to constitute any kind of notice to shareholders. In addition, a January 4, 2021 meeting date would result in a nomination window of September 6, 2020 to October 6, 2020. Even if shareholders had read the sentence in the 10-K on the day it was filed, it would have been too late for anyone to make nominations. The lack of transparency over the meeting date accompanied with the departure of two shareholder-elected directors and appointment of their replacements within weeks clearly suggest the Board’s attempt to retain control regardless of shareholder rights and democracy.

1

Roumell considers its Nomination Notice (as defined in the section entitled “Background to the Solicitation” below) to be timely because, among other reasons, of the following: (i) as provided in the Bylaws, notice of a business proposal by a shareholder must be delivered to the Company not less than 90 days nor more than 120 days before the first anniversary of the preceding year’s annual meeting, and notice of a nomination by a shareholder must be delivered to the Company not less than 90 days nor more than 120 days prior to the earlier of the date of the meeting and the first anniversary of the preceding year’s annual meeting and (ii) Roumell believes the resignations of Peter J. Clemens, IV and Fabian Blank, both of whom were directors elected to the Board at the 2019 Annual Meeting pursuant to nomination by Harbert Discovery Fund, LP and Harbert Discovery Co-Investment Fund I, LP (collectively, “Harbert”), from, and the subsequent appointments of Mary Tagliaferri, M.D. and Ian B. Walters, M.D. to, the Board after the nomination deadline passed constitute “material” changes in circumstances which, under New York law, require the Company to re-open the shareholder nomination window. Further, the Company’s 2019 Annual Meeting was held on February 25, 2020, as reported in its Current Report on Form 8-K filed on March 2, 2020, and 90 days before the first anniversary of that date is exactly November 27, 2020, which is the same day the Nomination Notice was delivered to the Company.

Under the proxy rules, we may solicit proxies in support of our Nominees and also seek authority to vote for all of the Company’s nominees other than those Company nominees we specify. This allows a shareholder of the Company who desires to vote for up to a full complement of three director nominees, with one Class II director and two Class III directors, to use the GREEN proxy card to vote for our Nominees as well as the Company’s nominees for whom we are seeking authority and will exercise authority to vote. As a result, should a shareholder so authorize us on the GREEN proxy card, we would cast votes for Mr. Loar to serve as a Class II director, Mr. Terino to serve as a Class III director, and up to one of the Company’s nominees to serve as a Class III director. None of the Company’s nominees for whom we seek authority to vote has agreed to serve with any of our Nominees, if elected, and there is no assurance that any of the Company’s nominees will serve as directors if either or both of our Nominees are elected to the Board. You should refer to the Company Proxy Statement and form of proxy for the names, backgrounds, qualifications and other information concerning the Company’s nominees.

If you have already voted for the incumbent management slate, you have every right to change your vote by signing, dating and returning a later dated GREEN proxy card or by voting in person at the Annual Meeting.

If your shares are registered in more than one name, the GREEN proxy card should be signed and dated by all such persons to ensure that all shares are voted for the Nominees.

The Company has set the close of business on November 23, 2020 as the Record Date for determining shareholders entitled to notice of and to vote at the Annual Meeting. The mailing address of the principal executive offices of the Company is 527 Madison Avenue, New York, New York 10022. Shareholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. According to the Company, as of the Record Date, there were 47,895,050 shares of Common Stock outstanding.

Holders of record of shares of Common Stock on the Record Date are urged to submit a proxy, even if such shares have been sold after that date. Each share of Common Stock is entitled to one vote at the Annual Meeting.

If you have any questions or need assistance in voting your GREEN proxy card, or need additional copies of Roumell’s proxy materials, please contact:

Saratoga Proxy Consulting LLC

520 8th Avenue, 14th Floor

New York, NY 10018

(212) 257-1311

Shareholders Call Toll Free at: (888) 368-0379

Email: info@saratogaproxy.com

The solicitation is being made by Matthew M. Loar, Edward Terino, James C. Roumell and Roumell Asset Management LLC, and not on behalf of the Board or management of Enzo. We are not aware of any other matters to be brought before the Annual Meeting other than as set forth in this proxy statement. Should other matters, which we are not made aware of within a reasonable time before this solicitation, be brought before the Annual Meeting, the persons named as proxies in the enclosed GREEN proxy card will vote on such matters in their discretion.

YOU MAY HAVE ALREADY RECEIVED, OR WILL SOON RECEIVE, A PROXY CARD FROM THE COMPANY. PLEASE RETURN ONLY THE ENCLOSED GREEN PROXY CARD AND DO NOT RETURN ANY COMPANY PROXY CARD UNDER ANY CIRCUMSTANCES. ONLY THE LATEST DATED PROXY CARD YOU SUBMIT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting

This proxy statement and GREEN proxy card are available at

www.saratogaproxy.com/Roumell

2

BACKGROUND OF THE SOLICITATION

On August 22, 2018, Roumell Opportunistic Value Fund, of which Roumell Asset Management serves as investment advisor, made its initial investment in the Company.

On September 7, 2018, Roumell Asset Management made its initial investment in the Company.

On January 16, 2019, Mr. Roumell met with Barry Weiner, the President of the Company, at the Company’s headquarters to discuss Roumell’s investment in the Company.

On February 13, 2019, Messrs. Roumell and Weiner met telephonically to discuss general business trends.

On March 26, 2019, Roumell delivered a letter to the Board, requesting the Board to review the Company’s strategic options. The letter was publicly disclosed in a Schedule 13D filed with the SEC on the same date.

On April 25, 2019, Mr. Roumell and Thomas Gandolfo, Senior Analyst at Roumell Asset Management, met, on behalf of Roumell Asset Management, with Mr. Weiner and Elazar Rabbani, Ph.D., Chairman of the Board and Chief Executive Officer and Secretary of the Company, where they discussed the Company’s Ampiprobe platform, business opportunities and Roumell’s interest in recommending an individual to serve as a director on the Board (the “April 25 Meeting”).

On May 21, 2019, Mr. Roumell sent an email to Mr. Weiner and Dr. Rabbani, in which Mr. Roumell thanked Mr. Weiner and Dr. Rabbani for the April 25 Meeting and restated Roumell Asset Management’s interest in working constructively with companies, on behalf of its clients. Mr. Roumell also sent a copy of the resume of Mr. Loar for the Company’s consideration as an addition to the Board and stated Roumell’s belief that the Board should add two directors introduced by shareholders. Mr. Roumell reiterated his interest in speaking further with Mr. Weiner and Dr. Rabbani in order to develop a deeper understanding of the Company, and asked that his email be forwarded to all members of the Board.

On June 17, 2019, Messrs. Roumell and Weiner met telephonically to discuss the previous quarter’s financial results of the Company.

On July 25, 2019, Roumell Asset Management disclosed in a Schedule 13D filed with the SEC that it had sold all of its shares of Common Stock as of that date, including shares owned by Roumell Opportunistic Value Fund.

On June 18, 2020, Roumell Asset Management made an investment in the Company. Together with Roumell Opportunistic Value Fund, it continued to make a series of investments in the Company through October 2020.

On August 31, 2020, Messrs. Roumell and Weiner met telephonically to discuss general business trends, particularly as related to testing for the novel strain of coronavirus.

On September 3, 2020, Mr. Roumell emailed Mr. Weiner to coordinate a visit of the Company’s facility in Ann Arbor, Michigan. On September 9, 2020, Mr. Weiner responded to inform Mr. Roumell that a tour of the Company’s facility in Ann Arbor would not be possible.

On October 6, 2020, unbeknownst to shareholders, the last day under the Bylaws that shareholders could submit director nominations to the Board for the Annual Meeting passed. Under Article II, Section 15 of the Bylaws, shareholder nominations must be submitted within 90 to 120 days prior to the earlier of the (i) date of the annual meeting (the “Upcoming Meeting Based Deadline”) and (ii) anniversary date of the immediately preceding year’s annual meeting (the “Previous Meeting Based Deadline”). The Company used the Upcoming Meeting Based Deadline to set the shareholder nomination period as 90 to 120 days prior to the date of the Annual Meeting by scheduling the Annual Meeting date as January 4, 2021. This resulted in the shareholder nomination period purportedly ending on October 6, 2020, which was seven weeks prior to the date that could have been the shareholder nomination deadline if the Company had chosen to base the shareholder nomination period on the Previous Meeting Based Deadline. However, shareholders would not have known of this purported deadline until the Company disclosed the date of the Annual Meeting in the Company Proxy Statement.

On October 18, 2020, Mr. Roumell emailed Dov Perlysky, a member of the Board and Lead Independent Director, to inform him of Roumell’s investment in the Company and to set up a phone meeting. On October 21, 2020, Mr. Perlysky informed Mr. Roumell that Mr. Perlysky would be available to schedule a phone call with Mr. Roumell, though it was the Company’s policy to direct all shareholder communications to the Company’s President or investor relations contact and that any communications to be directed to independent members of the Board be directed to the lead independent director of the Board.

On October 19, 2020, the Company filed the 10-K with the SEC, which incorporated by reference “[p]ortions of the definitive Proxy Statement to be delivered to shareholders in connection with the Annual Meeting of Shareholders to be held on or about January 4, 2021.” Since the 10-K was filed nearly two weeks after the purported shareholder nomination deadline ended, and prior to the filing of the 10-K the Company had not disclosed any information that shareholders could have used to help them anticipate when the deadline might take place, shareholders could not have known when their nomination period would end until after the nomination period purportedly ended according to the Company=. Further, we believe that, due to the indefinite phrasing of the disclosure, shareholders could not have been reasonably certain as to when the shareholder nomination deadline would occur even if they did review the 10-K.

On October 28, 2020, Messrs. Roumell and Perlysky met telephonically. Mr. Roumell expressed his satisfaction with the Company’s recent initiatives and noted that the Company’s hiring of a new Chief Financial Officer was a positive step, but expressed displeasure with and serious concern regarding Dr. Rabbani’s leadership and lengthy tenure as the Chief Executive Officer of the Company.

3

On October 30, 2020, Mr. Roumell, in an email to Mr. Perlysky, reiterated his concerns regarding Dr. Rabbani’s leadership. In his email, Mr. Roumell requested that his concerns be shared with the full Board.

On November 2, 2020, Mr. Roumell emailed Mr. Perlysky, copying Robert Cohen, an attorney at McDermott Will & Emery LLP, requesting confirmation that the comments included in his October 30, 2020 email had been communicated to the Board. Mr. Perlysky did not provide any such confirmation.

On November 4, 2020, Mr. Roumell emailed Mr. Perlysky, again requesting confirmation that his concerns were expressed to the Board. In addition to Mr. Cohen, Mr. Roumell also copied Messrs. Clemens and Blank on his email to Mr. Perlysky. Later on this date, Mr. Perlysky responded to Mr. Roumell, informing him of a call he had scheduled with the Board and stating that he intended to share Mr. Roumell’s concerns with the Board.

On November 9, 2020, Mr. Clemens resigned as a Class II director from the Board, effective immediately.

On November 10, 2020, Mr. Blank resigned as a Class II director from the Board, effective immediately. The resignations of Messrs. Clemens and Blank were announced in a Form 8-K filed with the SEC on November 16, 2020. However, the Company did not disclose the reason for their resignations.

On November 17, 2020, the Board appointed Dr. Tagliaferri as a Class II director to the Board, effective immediately. The Company announced such appointment in a Form 8-K filed with the SEC on November 23, 2020.

On November 25, 2020, the Company appointed Dr. Walters as a Class III director to the Board, effective immediately. The Company announced such appointment in a Form 8-K filed with the SEC on the same day.

On November 27, 2020, Mr. Roumell sent an email to Mr. Weiner informing him of Roumell Asset Management’s intention to submit the Nominees for election at the Annual Meeting and requesting that Mr. Weiner provide the availability of the Board for a call with Mr. Roumell. As of the date of this proxy statement, the Board has not provided its availability for a discussion with Mr. Roumell regarding Mr. Roumell’s concerns.

Later that day, Roumell Asset Management delivered a letter (the “Nomination Notice”) to Dr. Rabbani, nominating the Nominees for election to the Board at the Annual Meeting, with Mr. Loar nominated to serve as a Class II director for a term of two years on the Board and Mr. Terino nominated to serve as a Class III director for a term of three years on the Board, and submitting shareholder proposals to (i) amend the Bylaws to set the minimum size of the Board at three directors with a maximum number of directors to be decided by the Board in its discretion and (ii) repeal any provision of, or amendment to, the Bylaws adopted by the Board without approval of the Company’s shareholders subsequent to February 25, 2020. Roumell considers the Nomination Notice to be timely because, among other reasons, of the following: (i) as provided in the Bylaws, notice of a business proposal by a shareholder must be delivered to the Company not less than 90 days nor more than 120 days before the first anniversary of the preceding year’s annual meeting, and notice of a nomination by a shareholder must be delivered to the Company not less than 90 days nor more than 120 days prior to the earlier of the date of the meeting and the first anniversary of the preceding year’s annual meeting and (ii) Roumell believes the resignations of Messrs. Clemens and Blank from, and the subsequent appointments of Drs. Tagliaferri and Walters to, the Board after the nomination deadline passed constitute “material” changes in circumstances which, under New York law, require the Company to re-open the shareholder nomination window. Further, the Company’s 2019 Annual Meeting was held on February 25, 2020, as reported in its Current Report on Form 8-K filed on March 2, 2020, and 90 days before the first anniversary of that date is exactly November 27, 2020, which is the same day the Nomination Notice was delivered to the Company.

Also on November 27, 2020, Roumell filed a Schedule 13D with the SEC disclosing (i) its ownership stake in Enzo and (ii) the delivery of the Nomination Notice to the Company.

Also on November 27, 2020, less than an hour before Mr. Roumell emailed Mr. Weiner, the Company filed the Company Proxy Statement, seeking shareholder support for its three director nominees and other proposals to be voted on by shareholders at the Annual Meeting, and disclosing the Annual Meeting date to be January 4, 2021, retrospectively setting the last day that shareholders could submit nominations as October 6, 2020.

Also on November 27, 2020, the Company filed a lawsuit in the United States District Court for the Southern District of New York against Harbert and its affiliates. The lawsuit alleged, among other things, that Harbert violated Section 14(a) of the Exchange Act and Rule 14a-9 thereunder.

On December 1, 2020, Dr. Rabbani sent a brief letter (the “December 1 Letter”) to Roumell Asset Management with a conclusory statement that the Nomination Notice failed to “comport” with the Bylaws. The letter did not point to any specific deficiencies in the Nomination Notice.

4

On December 3, 2020, Roumell Asset Management delivered a letter (the “December 3 Letter”) to the Company stating the reasons for its belief that the Company should accept the Nomination Notice as timely: (i) shareholders could not have known of the nomination deadline until after the nomination deadline date had passed, and (ii) the resignation of Messrs. Clemens and Black, the two Harbert nominees elected to the Board at the 2019 Annual Meeting, occurred in November and constituted unanticipated material changes after the purported October 6, 2020 deadline and should cause the nomination window to reopen. In light of the foregoing, the letter requested the Company to reconsider its position and accept the Nomination Notice by 5:00 pm, New York time, on December 7, 2020.

On December 4, 2020, Roumell filed Amendment No. 1 to its Schedule 13D with the SEC disclosing the December 1 Letter and stating its position that (i) shareholders had no reasonable notice that October 6, 2020 was the date after which shareholder nominations would not be considered “timely” by the Company, (ii) its nominations and proposals were neither deficient nor untimely submitted as a matter of New York law, and (iii) the Annual Meeting would therefore be “contested”.

Also on December 4, 2020, Roumell Asset Management delivered a letter to the SEC which, among other things, alerted the SEC to Roumell Asset Management’s delivery of the Nomination Notice and the consequential existence of a solicitation in opposition to the Company at the Annual Meeting, and requested that the SEC require the Company to (i) refrain from soliciting proxies in connection with the Annual Meeting, (ii) re-file its “definitive” proxy statement in preliminary form to contain the relevant disclosures regarding the Nomination Notice so that all shareholders possess timely, complete and accurate information that complies with the applicable securities laws, and (iii) disregard any previously submitted proxy cards.

On December 7, 2020, Roumell filed Amendment No. 2 to its Schedule 13D disclosing the contents of the December 3 Letter and restating its view that the Nomination Notice should be treated as timely.

On December 8, 2020, Roumell Asset Management delivered a letter to the Company (the “Demand Letter”), demanding to inspect and make extracts from certain books and records of the Company, pursuant to Section 624 of the New York Business Corporation Law. Also on December 8, 2020, Roumell filed Amendment No. 3 to its Schedule 13D with the SEC disclosing (i) the delivery of the Demand Letter to the Company, and (ii) certain critically important questions Roumell believed the Company should address during its upcoming earnings call on December 9, 2020.

On December 9, 2020, the Company made a brief filing with the SEC, acknowledging its receipt of the Nomination Notice and stating its belief that the Nomination Notice was deficient. The only reason given for the Company’s belief was that “[the Nomination Notice] was not timely and did not meet the requirements prescribed under the [Bylaws].” Again, the Company’s statement was conclusory and lacked specifics as to what requirements under the Bylaws were not met by the Nomination Notice.

Later on December 9, 2020, Roumell made a brief filing with the SEC disclosing certain critically important questions previously disclosed in Amendment No. 3 to its Schedule 13D on December 8, 2020.

Also on December 9, 2020, the Company released its financial results for the first quarter of fiscal year 2021 and held an earnings call with advisors and investors. The Company neglected to address the concerns and questions raised by Roumell both in the Amendment No. 3 to its Schedule 13D filed on December 8, 2020 and in its brief filing made earlier that day.

On December 11, 2020, the Company filed its Quarterly Report on Form 10-Q for the quarterly period ended October 31, 2020 with the SEC.

Also on December 11, 2020, Roumell filed its preliminary proxy statement with the SEC.

On December 14, 2020, Roumell filed Amendment No. 4 to its Schedule 13D announcing the filing of its preliminary proxy statement on December 11, 2020.

Also on December 14, 2020, Anthony Franchi, a shareholder of the Company, commenced an action (the “Franchi Lawsuit”) against the Company and certain of its directors, seeking declaratory and injunctive relief to enjoin the Company from holding the Annual Meeting unless the Company re-opens the nomination window.

On December 15, 2020, the New York County Supreme Court entered an order to show cause setting December 23, 2020 as the hearing date for the Franchi Lawsuit.

On December 15, 2020, the Company filed a Supplement to the Company Proxy Statement (the “Company Proxy Supplement”), restating its position that the Nomination Notice was deficient. The Company Proxy Supplement also included that the Company did not intend to accept Roumell’s nominations of the Nominees or proposals for business brought before the Annual Meeting, and that the Company is of the position that the Annual Meeting will be uncontested. The Company Proxy Supplement also stated that if a proxy granting authority to Mr. Roumell and Craig L. Lukin is submitted by a shareholder, such shareholder’s vote will not be counted for or against the election of either of the Nominees or for or against the proposals brought by Roumell. Roumell believes that the Company’s position limits shareholders’ right to choose the directors of their Board by restricting their options at the Annual Meeting and is a further indication of the Board’s entrenchment.

5

Also on December 15, 2020, McDermott Will & Emery LLP, on behalf of the Company, delivered a letter (the “December 15 Response”) to Roumell Asset Management in response to the Demand Letter, rejecting the Demand Letter as improper because (i) the requested documents, including the list of the non-objecting beneficial owners of Common Stock, were purportedly “not relevant or necessary” for Roumell’s purpose of communicating with shareholders in connection with the Annual Meeting, and (ii) it was overbroad in timeframe. The December 15 Response nevertheless stated that the Company would provide the materials requested by Roumell Asset Management, provided that Roumell Asset Management (i) reimburse the Company in advance for expenses incurred in connection with the production of the applicable materials, and (ii) sign a confidentiality agreement (the “Confidentiality Agreement”) containing certain terms Roumell believes to be considered “off-market” for such agreements.

On December 18, 2020, Roumell Asset Management delivered a response (the “December 18 Letter”) to the December 15 Response to McDermott Will & Emery LLP. The December 18 Letter noted, among other things, Roumell Asset Management’s beliefs that the demand in the Demand Letter serves shareholders’ best interests and is integral to the proper maintenance of shareholder democracy. Though Roumell Asset Management did not believe it was required by New York law to do so, Roumell Asset Management agreed to enter into the Confidentiality Agreement, subject to certain minimal and reasonable changes, and to reimburse the Company in advance for reasonable expenses incurred in connection with the production of the requested materials. In the December 18 Letter, Roumell Asset Management requested the Company return an executed counterpart of the Confidentiality Agreement and a reasonable estimate of expenses no later than December 19, 2020 at 10:00 a.m. Eastern Time, and for the requested materials to be provided to Roumell Asset Management no later than December 22, 2020.

Also on December 18, 2020, Roumell filed Amendment No. 5 to its Schedule 13D disclosing the contents of the December 15 Response and the December 18 Letter.

On December 19, 2020, McDermott Will & Emery LLP, on behalf of the Company, delivered a letter (the “December 19 Response”) to Roumell Asset Management in response to the December 18 Letter. The December 19 Response included the Company’s determination that the request in the December 18 Letter was improper because it requested documents outside the scope of Section 624(b) of the New York Business corporation Law.

On December 21, 2020, Roumell Asset Management delivered a response (the “December 21 Letter”) to the December 19 Response to McDermott Will & Emery LLP, noting, among other things, Roumell Asset Management’s belief that it is entitled to the materials requested nearly two weeks ago in the Demand Letter under clear and unambiguous New York law.

On December 21, 2020, Roumell filed Amendment No. 6 to its Schedule 13D disclosing the contents of the December 19 Response and the December 21 Letter.

On December 21, 2020, Roumell filed an amendment to its preliminary proxy statement with the SEC.

6

REASONS FOR THE SOLICITATION

We own approximately 5.8% of the outstanding equity of Enzo. As such a large shareholder, we are disappointed with the performance of the Company, its Board and management, its strategy and its operations. We believe there is significant potential in the Company. However, the Company, in our view, has simply failed to capitalize on this potential to create value for shareholders, based on its persistent stock price underperformance. We believe change in the Board’s composition is needed to ensure objective and independent oversight of the Company’s operations, strategy and management. While all the directors (save Dr. Rabbani) currently serving on the Board might be “independent” per the rules of the New York Stock Exchange (the “NYSE”), they were hand-picked by the incumbent Board to replace shareholder-nominated directors, and the Board has simultaneously denied shareholders to challenge such appointments, by setting the deadline for director nominations retrospectively. Further, the entire incumbent Board has failed to rectify the Board’s restrictive governance policies to amend its arcane governance documents, which date back approximately thirty years.2 In our view, shareholders cannot expect the Company to perform better in the future than it has in the past without fundamental change, beginning in the boardroom.

Declining Stock Price Performance and Value Destruction

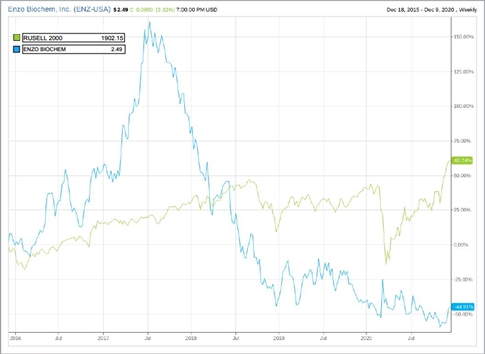

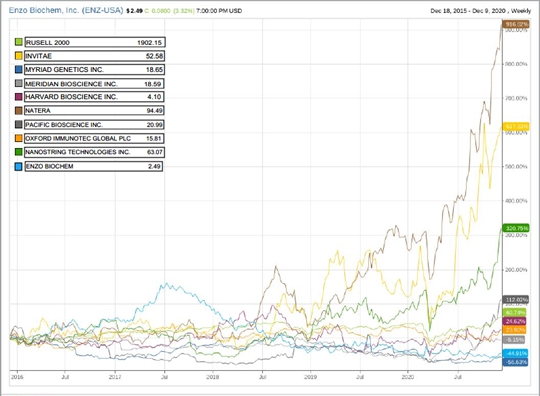

Over the past five years, Enzo’s stock has significantly lagged behind major indices and all of its biosciences-related publicly traded peers (as designated by Institutional Shareholder Services, Inc., a preeminent proxy advisory firm (“ISS”)): Harvard Bioscience Inc., Invitae Corp., Meridian Bioscience Inc., Myriad Genetics Inc., Nanostring Technologies Inc., Natera Inc., Oxford Immunotec Global Plc, and Pacific Biosciences of California Inc. In its most recent report, ISS found that for the five-year period through January 2020, the Company had a total shareholder return (a “TSR”) of negative 51.7%, which was 48.5 percentage points worse than its peer group median, and 109.5 percentage points worse than the broader market index used by ISS (the Russell 2000).3

Based on the same Russell 2000 index used by ISS, the Company’s stock price has also severely underperformed for the past five years, peaking at $11.79 on July 14, 2017, and declining by approximately 80% since then to close at $2.33 on Wednesday, December 18, 2020.4

The Company’s TSR over the one-year, three-year and five-year periods prior to the Nomination Notice further shows its underperformance when measured against its proxy peers and the broader market, as shown in the below table.

TOTAL SHAREHOLDER RETURN THROUGH NOVEMBER 27, 2020

| One Year | Three Year | Five Year | ||||||||||

| Total Shareholder Return | ||||||||||||

| Enzo Biochem | -23.40 | % | -76.61 | % | -58.23 | % | ||||||

| Peer Median | 84.67 | % | 284.64 | % | 175.5 | % | ||||||

| Russell 2000 | 12.54 | % | 25.19 | % | 77.31 | % | ||||||

Source: Factset.com; peers are proxy peers named in the ISS report.

ENZ Stock vs. Russell 2000 for the past five years.

| 2 | To name some of the worst examples of these policies: a classified Board; supermajority (80%) vote requirement for amending certain key provisions of the Certificate of Incorporation, as amended (the “Certificate of Incorporation”); denial of shareholders’ right to call special meetings; unanimity requirement for shareholder actions by written consent. |

| 3 | See ISS Report for Enzo Biochem, Inc., dated February 19, 2020. |

| 4 | Factset.com, as of December 18, 2020. |

7

Contrary to the price of Enzo’s stock, the stock price of Enzo’s peers significantly increased over the past year.

ENZ Stock vs. ISS Peers for the past five years.

By putting forth our Nominees and business proposals at the upcoming Annual Meeting, we aim to provide an alternative to what we have described here. Our Nominees are highly qualified and each have relevant experience in the health care industry and as directors of public companies, and will provide new viewpoints to a Board that has consistently tried to dismiss the valid complaints of its largest shareholders.

8

PROPOSAL 1

ELECTION OF NOMINEES

We are seeking your support at the Annual Meeting to elect our two highly qualified Nominees. Each of the Nominees has consented to being named in this proxy statement and has agreed to serve as a director, if elected. The information below concerning name, age and employment and material occupations, positions or offices of the Nominees for the last five years has been furnished by each of the Nominees. Except as described in this proxy statement, neither of the Nominees beneficially owns any Common Stock.

Each Nominee presently is, and if elected as a director of the Company, each of the Nominees would, in our view, be, an “independent director” within the meaning of (i) NYSE listing standards applicable to Board composition and (ii) Section 301 of the Sarbanes-Oxley Act of 2002. No Nominee is a member of the Company’s Leadership Development and Compensation, Corporate Governance and Nominating Committee or Audit Committee that is not independent under any such committee’s applicable independence standards.

Shareholders will vote to fill three seats on the Board at the Annual Meeting, with one seat in Class II and two seats in Class III. We have nominated fewer nominees than the number of directors that will need to be elected at the Annual Meeting, which enables a shareholder who desires to vote for our Nominees to also vote for one of the Company’s nominees. Under the proxy rules, we may solicit proxies in support of our Nominees and also seek authority to vote for all of the Company’s nominees other than those Company nominees we specify. This allows a shareholder of the Company who desires to vote for up to a full complement of three director nominees, with one Class II director and two Class III directors, to use the GREEN proxy card to vote for our Nominees as well as the Company’s nominees for whom we are seeking authority and will exercise authority to vote. As a result, should a shareholder so authorize us on the GREEN proxy card, we would cast votes for (i) Mr. Loar to serve as a Class II director, (ii) Mr. Terino to serve as a Class III director and (iii) up to one of the Company’s nominees to serve as a Class III director. None of the Company’s nominees for whom we seek authority to vote has consented to being named in our proxy statement or agreed to serve with any of our Nominees, if elected, and there is no assurance that any of the Company’s nominees will serve as directors if either or both of our Nominees are elected to the Board. You should refer to the Company Proxy Statement and form of proxy for the names, backgrounds, qualifications and other information concerning the Company’s nominees.

Proxies cannot be voted for a greater number of persons than the number of nominees, however, we reserve the right to nominate additional person(s), in accordance with the Bylaws and applicable law, if the Company increases the size of the Board above its existing size or increases the number of directors whose terms expire at the Annual Meeting. Roumell does not expect that either of the Nominees will be unable to stand for election or for good cause will not serve as a director, but if any vacancy in the slate of the Nominees occurs for any reason (including if Enzo makes or announces any changes to its Bylaws or takes or announces any other action that has, or if consummated would have, the effect of disqualifying any or all of the Nominees), the shares represented by the GREEN proxy card received by Roumell and not properly revoked will be voted for the substitute nominee(s) properly nominated by Roumell in compliance with the rules of the SEC and any other applicable laws and, if applicable, the Bylaws.

If Roumell lawfully identifies or nominates substitute nominee(s) before the Annual Meeting, Roumell will file an amended proxy statement that identifies these substitute nominee(s), discloses whether such nominees have consented to being named in the revised proxy statement, and include all disclosure requirements required by Schedule 14A with respect to such substitute nominee(s).

There can be no assurance that even if the Nominees are elected, they will be able to successfully work with the remaining members of the Board to maximize shareholder value.

The Company has stated in the Company Proxy Supplement that the election of directors is uncontested which, under the Bylaws, requires the affirmative vote of the majority of the votes cast for a nominee. As such, the Company further states that it does not believe the voting standard for the election of directors at the Annual Meeting is a plurality of votes cast. For reasons described in this proxy statement, it is Roumell’s position that the election of directors at the Annual Meeting will be contested and that directors will be elected by a plurality of votes cast.

Additionally, in the Company Proxy Statement, the Company has stated a position that neither our nominations of the Nominees nor the proposals for business brought before the Annual Meeting will be accepted and that if a proxy that grants authority to Messrs. Roumell and Lukin is submitted, your vote will not be for or against the election of either of the Nominees or for or against the proposals brought by Roumell. Therefore, shareholders who intend to grant Messrs. Roumell and Lukin proxy authority should be advised that the Company may not accept the votes of such shareholders and that, as a result, such shareholders may be disenfranchised with respect to all votes cast in favor of every proposal listed on our proxy card.

We advise shareholders to refer to the Company Proxy Statement for more information.

9

INFORMATION ABOUT THE NOMINEES

| Name | Age | Principal Occupation | ||

| Matthew M. Loar | 57 | Independent Financial Consultant | ||

| Edward Terino | 67 | President of GET Advisory Services |

We believe the Nominees have the experience and qualifications to address the Company’s strategic, operational and governance deficiencies and possess the skill sets required to address the Company’s current needs:

Matthew M. Loar

Matthew M. Loar, age 57, is an independent financial consultant to public and private companies in the health care industry, and has been performing services in this capacity since July 2019. He previously served as the Chief Financial Officer of Mateon Therapeutics, Inc., a public biopharmaceutical company, from July 2015 until his resignation in June 2019. Earlier in his career, Mr. Loar served as Chief Financial Officer of KineMed, Inc., a privately held biotechnology company, from January 2014 to July 2015. Mr. Loar has also previously served as acting Chief Executive Officer and Chief Financial Officer of Neurobiological Technologies, Inc. (“NTI”), a publicly traded pharmaceutical company, from 2010 through 2019 and as Chief Financial Officer of Virolab, Inc., a biotechnology company, from 2011 to 2012. Previously, he was Chief Financial Officer of NTI from 2008 to 2009. Earlier in his career, Mr. Loar was Chief Financial Officer of Osteologix, Inc., a publicly traded pharmaceutical company, from 2006 to 2008, and of Genelabs Technologies, Inc., a publicly traded biopharmaceutical and diagnostics company, from 1995 to 2006. Prior to moving into the biopharmaceutical industry in 1995, he served as Manager, Corporate Accounting at the North American Corporate Headquarters of CBR Cement Corporation from 1991 to 1995, and as an Audit Manager from Coopers & Lybrand from 1986 to 1991. Mr. Loar has served on the board of NTI from 2010 to 2019. Mr. Loar also has previously served on the board of Transcept Pharmaceuticals, Inc. from 2013 to 2014 and Silicon Valley Chapter of Financial Executives International (“SVFEI”) from 1999 to 2004. He also served as Treasurer of SVFEI from 2001 to 2003. Mr. Loar received a B.A. in Legal Studies from the University of California, Berkeley and is a Certified Public Accountant (inactive) in California. We believe Mr. Loar’s extensive background in the biotechnology and pharmaceutical industries and specific knowledge of financial, accounting and legal issues within the industries qualify him to serve on the Board.

Edward Terino

Edward Terino, age 67, currently serves as the President of GET Advisory Services, a New Hampshire-based consulting business providing strategy planning and financial management consulting services focused on the Media, Technology, Education and Maritime Transportation industries that he started in 2009. From April 2016 to February 2019, he served as the Chief Executive Officer of SeaChange International Inc. (“SeaChange”), a global leader in video technology solutions to content owners, telecommunications providers and cable operators. He also served as Chief Operational Officer of SeaChange from June 2015 to April 2016. Mr. Terino was previously the Chief Executive Officer and President of Arlington Tankers Ltd. from July 2005 until its merger with General Maritime in December 2008. He previously served as Senior Vice President and Chief Financial Officer of Art Technology Group, Inc. from September 2001 to June 2005; Senior Vice President, Chief Financial Officer and Treasurer of Applix, Inc. from April 1999 to September 2001; and Chief Financial Officer, Treasurer and Secretary of Celerity Solutions, Inc. from 1996 to 1999. Mr. Terino served in various positions at Houghton Mifflin, including Vice President of Finance, Planning and Operations, from 1985 to 1996. He began his career in 1976 at Deloitte & Touche and spent nine years in their consulting services organization, where, among other roles, Mr. Terino served as lead consultant on a number of engagements within the healthcare industry, including the evaluation of internal controls for several healthcare organizations and of information systems for several hospitals, all in the greater Boston area. Mr. Terino currently serves on the board of Zagg Inc., a global mobile lifestyle company. Mr. Terino previously served on the boards of SeaChange from July 2010 to February 2019; Baltic Trading Limited from March 2010 until its merger with Genco Shipping and Trading Ltd. in July 2015; Extreme Networks from October 2012 to November 2013; S1 Corporation from April 2007 until its sale to ACI Worldwide, Inc. in February 2012; and Phoenix Technologies Ltd. from November 2009 until its sale to Marlin Equity Partners in November 2010. Mr. Terino has served as Chairman of the Audit Committee and a member of the Compensation Committee on most of these boards. Mr. Terino earned a M.B.A. from Suffolk University–Sawyer School of Management and a B.S. in Management from Northeastern University. We believe Mr. Terino’s executive management and strategy-planning experience and background in consulting in the technology and healthcare industries qualify him to serve on the Board.

If elected, the Nominees will be entitled to such compensation from the Company as is consistent with the Company’s practices for services of non-employee directors. On November 27, 2020, each Nominee entered into an indemnification agreement (together, the “Indemnification Agreements”) with Roumell Asset Management in connection with his nomination to the Board. Pursuant to the Indemnification Agreements, Roumell Asset Management has agreed to indemnify each of the Nominees against any and all claims of any nature arising from the solicitation of proxies in connection with a potential proxy contest. Also on November 27, 2020, Roumell Asset Management, Mr. Roumell and each of the Nominees entered into a Joint Filing and Solicitation Agreement pursuant to which, among other things, each of Roumell Asset Management, Mr. Roumell and the Nominees agreed to the joint filing on behalf of each of them to allow for solicitation in connection with a potential proxy contest. Other than as described in this proxy statement, there are no arrangements or understandings between or among either Nominee and any other person pursuant to which either Nominee was or is to be selected as a director or nominee.

10

SHARE OWNERSHIP OF NOMINEES

The following table contains a summary of the total number of shares of Common Stock beneficially owned by the Nominees as of the Record Date of the Annual Meeting.

The address for each Nominee is listed below. The information in the following table has been furnished to us by the respective Nominees. Percentage of beneficial ownership is based on 47,895,050 shares of Common Stock outstanding as of November 23, 2020, which was disclosed in the Company Proxy Statement:

| Name and Address | Number of Shares Beneficially Owned | Percentage of Shares Beneficially Owned | |||

| Matthew M. Loar c/o Roumell Asset Management, LLC 2 Wisconsin Circle, Suite 640 Chevy Chase, Maryland 20815 |

0 | N/A | |||

| Edward Terino 17 Canterbury Road Windham, New Hampshire 03087 |

0 | N/A | |||

| All Nominees as a group (two persons) | 0 | N/A |

WE URGE YOU TO VOTE “FOR” THE ELECTION OF OUR NOMINEES ON THE ENCLOSED GREEN PROXY CARD AND INTEND TO VOTE OUR SHARES FOR OUR NOMINEES.

11

PROPOSAL 2

ADVISORY VOTE ON THE COMPANY’S NAMED EXECUTIVE OFFICER COMPENSATION

As discussed in further detail in the Company Proxy Statement, Section 14A of the Exchange Act requires that the Company provide shareholders with the opportunity to vote to approve, on a nonbinding advisory basis, the compensation of the Company’s Named Executive Officers (as such term is defined in the Company Proxy Statement) as disclosed in the Company Proxy Statement in accordance with the SEC’s rules (commonly referred to as “Say-on-Pay”).

According to the Company Proxy Statement, the Company will request that shareholders vote to approve, on a non-binding advisory basis, the following resolution:

“RESOLVED, that the Company’s shareholders approve, on a nonbinding advisory basis, the compensation paid to the Company’s Named Executive Officers, as disclosed in the Company’s Proxy Statement for the 2020 Annual Meeting of Shareholders pursuant to the compensation disclosure rules of the SEC, including the Summary Compensation Table and the other related compensation tables and narrative discussion.”

As further disclosed by the Company, the vote on this resolution is advisory, which means that it is not binding on the Company, the Board or the Compensation Committee. If shareholders fail to approve the compensation of the Company’s Named Executive Officers, the Company has indicated that it will review the voting results and will take into account the outcome of the vote when considering future compensation decisions for the Named Executive Officers. We encourage all shareholders to review the Company’s disclosures related to this proposal in the Company Proxy Statement in detail.

We recommend a vote “Against” this proposal and intend to vote against this proposal to express our disappointment with the Company’s recent performance.

WE RECOMMEND YOU VOTE “AGAINST” PROPOSAL 2 AND INTEND TO VOTE OUR SHARES AGAINST THIS PROPOSAL.

12

PROPOSAL 3

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

As discussed in further detail in the Company Proxy Statement, the Audit Committee (the “Audit Committee”) of the Board has selected and the Board has appointed EisnerAmper LLP (“EisnerAmper”), an independent registered public accounting firm, to audit the Company’s financial statements for the fiscal year ending July 31, 2021. EisnerAmper has audited the financial statements of the Company since 2013. The Company is submitting its selection of EisnerAmper for ratification by the shareholders at the Annual Meeting.

As disclosed in the Company Proxy Statement, shareholder approval is not required to appoint EisnerAmper as the Company’s independent registered public accounting firm, but the Company is submitting the selection of EisnerAmper to shareholders for ratification as a matter of sound corporate governance. If the shareholders fail to ratify the selection, the Company has indicated that the adverse vote will be considered as an indication to the Audit Committee that it should consider selecting another independent registered public accounting firm for the following fiscal year, but the Audit Committee is not required to do so. The Company has further disclosed that even if the appointment is ratified by shareholders, the Audit Committee, in its discretion, may select a new independent registered public accounting firm at any time during the year if it believes that such a change would be in the Company’s best interest.

We encourage all shareholders to review the Company’s disclosures related to this proposal in the Company Proxy Statement in detail.

WE RECOMMEND YOU VOTE “FOR” PROPOSAL 3 AND INTEND TO VOTE OUR SHARES FOR THIS PROPOSAL.

13

PROPOSAL 4

APPROVAL OF THE AMENDMENT AND RESTATEMENT

OF

THE COMPANY’S AMENDED AND RESTATED 2011 INCENTIVE PLAN

As discussed in further detail in the Company Proxy Statement, the Company is requesting that shareholders approve the amendment and restatement of the Company’s Amended and Restated 2011 Incentive Plan (the “2011 Plan”), which was approved by the Board on October 7, 2020, subject to shareholder approval at the Annual Meeting. If this proposal is approved:

| ● | an additional 4,000,000 shares of Common Stock will be available for grant under the 2011 Plan; and |

| ● | the maximum length of the term of the 2011 Plan will extend until October 7, 2030; and |

| ● | certain provisions regarding the “performance-based compensation” exemption repealed by the Tax Cuts and Jobs Act of 2017 will no longer apply. |

No other changes are being made to the 2011 Plan at this time. A copy of the 2011 Plan highlighting the changes under this amendment and restatement is set forth in Exhibit A to the Company Proxy Statement.

As disclosed in the Company Proxy Statement, shareholder approval is required to approve the amendment and restatement of the 2011 Plan. If the shareholders fail to approve the 2011 Plan, the Company will be unable to grant any additional equity awards with the remaining share reserve under the 2011 Plan.

We encourage all shareholders to review the Company’s disclosures related to this proposal in the Company Proxy Statement in detail.

We intend to vote against this proposal because, as described elsewhere in this proxy statement, we believe that the Company has been mismanaged by the Board and executive officers of the Company and do not believe that they should be further rewarded, which will be the effect of the approval of this proposal.

WE MAKE NO RECOMMENDATION WITH RESPECT TO PROPOSAL 4 AND INTEND TO VOTE OUR SHARES AGAINST THIS PROPOSAL.

14

PROPOSAL 5

APPROVAL OF THE AMENDMENT TO THE BYLAWS TO CHANGE THE SIZE OF THE BOARD TO A MINIMUM OF THREE DIRECTORS WITH A MAXIMUM NUMBER OF DIRECTORS TO BE DECIDED BY THE BOARD IN ITS DISCRETION

We submit, for a shareholder vote at the Annual Meeting, the following Proposal:

“RESOLVED, that Article II, Section 2 of the Amended and Restated By-Laws of Enzo Biochem, Inc., as amended, is amended and restated as follows:

Section 2. Number, Election and Terms. The number of directors constituting the Board shall be not less than three, and the Board shall have discretion to adjust the size of the Board from time to time subject to that minimum. The directors, other than those who may be elected by the holders of any class or series of stock having a preference over another class or series of stock as to dividends or upon liquidation, shall be classified, with respect to the time for which they severally hold office, into three classes, as nearly equal in number as possible, as determined by the Board, one class to be originally elected for a term expiring at the annual meeting of shareholders to be held in 1989, another class to be originally elected for a term expiring at the annual meeting of shareholders to be held in 1990, and another class to be originally elected for a term expiring at the annual meeting of shareholders to be held in 1991, with each class to hold office until its successor is elected and qualified. At each annual meeting of the shareholders of the Corporation, the successors of the class of directors whose term expires at the meeting shall be elected to hold office for a term expiring at the annual meeting of shareholders held in the third year following the year of their election. Directors need not be residents of the State of New York, shareholders of the Corporation or citizens of the United States. Unless provided otherwise by law, any director may be removed at any time, with or without cause, at a special meeting of the shareholders called for that purpose.”

Currently, the size of the Board is fixed at five directors under Article II, Section 2 of the Bylaws. Under the Company’s Certificate of Incorporation, amending Article II, Section 2 of the Bylaws requires shareholder approval. The reason that we intend to submit this proposal for consideration at the Annual Meeting is because we do not believe that fixing the size of the Board is clearly in the best interests of shareholders. Instead, we believe that this proposal, once adopted by shareholders, will give the Board the flexibility to adjust its size to ensure that it has the proper composition to maximize shareholder value. Specifically, by providing discretion to the Board to increase its size with a minimum number of directors set at three, Roumell believes that, at times of need, the Board will be able to accommodate more perspectives and a greater diversity, ultimately benefitting its shareholders.

Other than as described elsewhere in this proxy statement, none of the Proposing Persons has any material interest in this proposal, individually or in the aggregate, including any anticipated benefit to us.

WE URGE YOU VOTE “FOR” PROPOSAL 5 AND INTEND TO VOTE OUR SHARES FOR THIS PROPOSAL.

15

PROPOSAL 6

REPEAL ANY PROVISION OF, OR AMENDMENT TO, THE BYLAWS OF THE COMPANY ADOPTED BY THE BOARD WITHOUT APPROVAL OF THE COMPANY’S SHAREHOLDERS SUBSEQUENT TO FEBRUARY 25, 2020.

We submit, for a shareholder vote at the Annual Meeting, the following proposal:

“RESOLVED, that any provision of, or amendment to, the Amended and Restated By-Laws of Enzo Biochem, Inc., as amended, adopted by the Board without the approval of the Company’s shareholders subsequent to February 25, 2020 be and are hereby repealed.”

The reason for conducting this business at the Annual Meeting is to ensure that the will of the Company’s shareholders, with respect to the Nominees and proposals, at the Annual Meeting is upheld and not thwarted by any unilateral Bylaw provision or amendment adopted by the Board. We chose February 25, 2020 as the cut-off date because, according to the Company’s public filings, that is the date the most recent amendment to the Company’s Bylaws was adopted. While we are not aware of any such provisions or amendments to the Bylaws, we urge shareholders to adopt this proposal to prevent any possible interference with the shareholder franchise and our right as shareholders of the Company to present business at the Annual Meeting for shareholders to consider and vote upon. This proposal, if approved, may have the effect of repealing Bylaw amendments which one or more shareholders of the Company may consider to be beneficial to them or the Company. However, this proposal will not preclude the Board from reconsidering any repealed Bylaw following the Annual Meeting. We believe the approval of this proposal is necessary to safeguard the integrity of the contested Annual Meeting so that shareholders will not be deprived of considering and voting on our Nominees and proposals.

Other than as described elsewhere in this proxy statement, none of us has any material interest in this proposal, individually or in the aggregate, including any anticipated benefit to us.

WE URGE YOU VOTE “FOR” PROPOSAL 6 AND INTEND TO VOTE OUR SHARES FOR THIS PROPOSAL.

16

WHO CAN VOTE AT THE ANNUAL MEETING

The Record Date for determining shareholders entitled to notice of and, to vote at, the Annual Meeting is November 23, 2020. Shareholders of Enzo as of the Record Date are entitled to one vote at the Annual Meeting for each share of Common Stock held on the Record Date. Based on publicly available information, we believe that the only outstanding class of securities of Enzo entitled to vote at the Annual Meeting is the Common Stock. The number of shares of Common Stock outstanding as of the Record Date, according to the Company Proxy Statement, is 47,895,050.

Only holders of record as of the close of business on the Record Date will be entitled to vote at the Annual Meeting. If you were a shareholder of record on the Record Date, you will retain your voting rights for the Annual Meeting even if you sold your shares after the Record Date. Accordingly, it is important that you vote the shares held by you on the Record Date, or grant a proxy to vote such shares, even if you sold such shares after the Record Date.

HOW TO VOTE BY PROXY

To elect the Nominees to the Board, promptly complete, sign, date and mail the enclosed GREEN proxy card in the enclosed postage-paid envelope. Whether you plan to attend the Annual Meeting or not, we urge you to complete and return the enclosed GREEN proxy card. Please contact our proxy solicitor, Saratoga Proxy Consulting LLC, toll free at (888) 368-0379 if you require assistance in voting your shares or need additional copies of our proxy materials.

Properly executed proxies will be voted in accordance with the directions indicated thereon. If you sign the GREEN proxy card but do not make any specific choices, your proxy will vote your shares as follows:

| ● | “FOR” the election of our two Nominees to the Board: Matthew M. Loar and Edward Terino. |

| ● | “AGAINST” the approval, by a nonbinding advisory vote, of the compensation of the Company’s Named Executive Officers. |

| ● | “FOR” the ratification of the appointment of EisnerAmper as the Company’s independent registered public accounting firm for the fiscal year ending July 31, 2021. |

| ● | “AGAINST” the amendment and restatement of the Company’s Amended and Restated 2011 Incentive Plan. |

| ● | “FOR” the proposal to amend the Bylaws to change the size of the Board to a minimum of three directors with a maximum number of directors to be decided by the Board in its discretion. |

| ● | “FOR” the proposal to repeal any provision of, or amendment to, the Bylaws of the Company adopted by the Board without approval of the Company’s shareholders subsequent to February 25, 2020. |

Rule 14a-4(c)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), governs our use of our discretionary proxy voting authority with respect to a matter that is not known by us a reasonable time before our solicitation of proxies. It provides that if we do not know, a reasonable time before making our solicitation, that a matter is to be presented at the meeting, then we are allowed to use our discretionary voting authority when the proposal is raised at the meeting, without any discussion of the matter in this proxy statement. If any other matters are presented at the Annual Meeting for which we may exercise discretionary voting, your proxy will be voted in accordance with the best judgment of the persons named as proxies on the attached GREEN proxy card. At the time this proxy statement was mailed, we knew of no matters which needed to be acted on at the Annual Meeting, other than those discussed in this proxy statement.

If any of your shares are held in the name of a brokerage firm, bank, bank nominee or other institution on the Record Date, only that entity can vote your shares and only upon its receipt of your specific instructions. Accordingly, please contact the person responsible for your account at such entity and instruct that person to execute and return the GREEN proxy card on your behalf. You should also sign, date and mail the voting instruction that your broker or banker sends you (or, if applicable, vote by following the instructions supplied to you by your brokerage firm or bank, including voting by telephone or via the internet). Please do this for each account you maintain to ensure that all of your shares are voted.

A large number of brokerage firms and banks are participating in a program that allows eligible shareholders to vote by telephone or via the internet. If a shareholder’s brokerage firm or bank is participating in the telephone voting program or internet voting program, then such brokerage firm or bank will provide the shareholder with instructions for voting by telephone or the internet on the voting form. Telephone and internet voting procedures, if available through a shareholder’s brokerage firm or bank, are designed to authenticate shareholders’ identities to allow shareholders to give their voting instructions and to confirm that their instructions have been properly recorded. Shareholders voting via the internet should understand that there might be costs that they must bear associated with electronic access, such as usage charges from internet access providers and telephone companies. If a shareholder’s brokerage firm or bank does not provide the shareholder with a voting form, but the shareholder instead receives our GREEN proxy card, then such shareholder should mark our GREEN proxy card, date and sign it, and return it in the enclosed postage-paid envelope.

17

VOTING AND PROXY PROCEDURES

The Board currently consists of five individuals divided into three classes. Under the current structure, if elected, Matthew M. Loar would serve as a Class II director for a period of two years and Edward Terino would serve as a Class III director for a period of three years. Shareholders of Enzo are not permitted to cumulate their votes for the election of directors.

A majority of the outstanding shares of Common Stock, represented in person or by proxy, constitutes a quorum. Rights of appraisal or similar rights of dissenters are not available to shareholders of the Company with respect to any matter to be acted upon at the Annual Meeting. A shareholder who abstains from voting on any or all proposals will be included in the number of shareholders present at the Annual Meeting for the purpose of determining the presence of a quorum. A “broker non-vote” will also be counted for the purpose of determining the presence of a quorum. A “broker non-vote” occurs when a beneficial owner whose shares are held of record by a broker does not instruct the broker how to vote those shares and the broker does not otherwise have discretionary authority to vote on a particular matter. Brokers are not permitted to vote shares without instructions on proposals that are not considered “routine.” The NYSE rules determine whether proposals are routine or not routine. If a proposal is routine, a broker holding shares for an owner in street name may vote on the proposal without voting instructions. Because there is a contested election, the NYSE rules governing brokers’ discretionary authority do not permit brokers to exercise discretionary voting power regarding any of the proposals to be voted on at the Annual Meeting, whether routine or not.

Election of Directors – Because the election of directors at the Annual Meeting will be contested, the Bylaws require that directors be elected by a plurality of the votes cast, meaning the nominees who receive the highest number of shares voted “FOR” their election, in each Class, will be elected to the Board. Shareholders may vote “FOR”, “AGAINST”, or “WITHHOLD” for each nominee. With respect to the election of directors, only votes cast “FOR” a nominee will be counted. Under the Bylaws, neither an abstention nor a broker non-vote will count as “votes cast” on this proposal, nor will either have any effect on the outcome of the vote with respect to the election of directors. As stated elsewhere in this proxy statement, the Company has taken the position that the election of directors is uncontested which, under the Bylaws, requires the affirmative vote of the majority of the votes cast for a nominee. As such, the Company further states that it does not believe the voting standard for the election of directors at the Annual Meeting is a plurality of votes cast. Shareholders should refer to the Company Proxy Supplement for more information on the Company’s position.

Non-Binding Advisory Vote to Approve the Compensation of the Company’s Named Executive Officers – According to the Company Proxy Statement, the approval of this proposal will require, assuming that a quorum is present, the affirmative vote of the holders of a majority of the votes cast by holders of shares of Common Stock present, in person or represented by proxy at the Annual Meeting and entitled to vote on such proposal. Shareholders may vote “FOR”, “AGAINST”, or “ABSTAIN” with respect to this proposal. According to the Company Proxy Statement, while the Board intends to carefully consider the shareholder vote resulting from this proposal, the vote is not binding and is advisory in nature. Under the rules of the NYSE, abstentions will be counted as “votes cast” and will have the same effect as a vote “AGAINST” for the purpose of determining whether a majority of the votes cast have been voted “FOR” this proposal. Broker non-votes will not be counted as “votes cast” on this proposal and will have no effect on the outcome of the vote with respect to this proposal.

Ratification of the Selection of Accounting Firm – According to the Company Proxy Statement, the ratification and approval of this proposal will require the affirmative vote of a majority of the votes cast by holders of shares of Common Stock present, in person or by proxy, at the Annual Meeting and entitled to vote on such proposal. Shareholders may vote “FOR”, “AGAINST”, or “ABSTAIN” with respect to this proposal. Under the rules of the NYSE, abstentions will be counted as “votes cast” and will have the same effect as a vote “AGAINST” for the purpose of determining whether a majority of the votes cast have been voted “FOR” this proposal. Broker non-votes will not be counted as “votes cast” on this proposal and will have no effect on the outcome of the vote with respect to this proposal.

Approval of the Amendment and Restatement of the Company’s Amended and Restated 2011 Incentive Plan – According to the Company Proxy Statement, the approval of this proposal will require the affirmative vote of a majority of the votes cast by holders of shares of Common Stock present, in person or by proxy, at the Annual Meeting and entitled to vote on such proposal. Shareholders may vote “FOR”, “AGAINST”, or “ABSTAIN” with respect to this proposal. Under the rules of the NYSE, abstentions will be counted as “votes cast” and will have the same effect as a vote “AGAINST” for the purpose of determining whether a majority of the votes cast have been voted “FOR” this proposal. Broker non-votes will not be counted as “votes cast” on this proposal and will have no effect on the outcome of the vote with respect to this proposal.