Published on November 27, 2015

Exhibit 99.2

November 2015 www.enzo.com Company Strategy and Overview

1 LEGAL DISCLAIMER Except for historical information, the matters discussed herein may be considered "forward - looking" statements within the meaning of Section 27 A of the Securities Act of 1933 , as amended and Section 21 E of the Securities Exchange Act of 1934 , as amended . Such statements include declarations regarding the intent, belief or current expectations of the Company and its management, including those related to cash flow, gross margins, revenues, and expenses are dependent on a number of factors outside of the control of the company including, inter alia, the markets for the Company’s products and services, costs of goods and services, other expenses, government regulations, litigations, and general business conditions . See Risk Factors in the Company’s Form 10 - K for the fiscal year ended July 31 , 2015 . Investors are cautioned that any such forward - looking statements are not guarantees of future performance and involve a number of risks and uncertainties that could materially affect actual results . The Company disclaims any obligations to update any forward - looking statement as a result of developments occurring after the date of this presentation .

2 TABLE OF CONTENTS Page Summary of Company Strategy 4 Industry Dynamics : Growth and Challenges 7 Enzo’s Solution 17 Financial Overview 37 Appendices 44

November 2015 www.enzo.com Molecular Diagnostics Strategy… From Challenges of Industry to Opportunities for Enzo 3

Summary of Company Strategy 4

5 ENZO BIOCHEM ENZO BIOCHEM, INC . (“ENZO” OR THE “COMPANY”) IS AN INTEGRATED DIAGNOSTICS ENTITY THAT IS UNIQUELY STRUCTURED TO CAPITALIZE UPON ONGOING REIMBURSEMENT PRESSURES IN THE MOLECULAR DIAGNOSTICS MARKET Enzo’s vertically integrated structure positions it to benefit as a disruptor in molecular diagnostics (MDx) : Biotech : Develops technologies and platforms that serve as the engine for innovative product development Molecular Diagnostics : Develops, formats, and manufactures high - performance MDx products on a large scale Clinical Services : Enzo’s state - of - the - art clinical lab provides the Company with meaningful insight and knowledge, allowing it to commercialize high - value diagnostic assays Enzo’s structure is designed to deliver on the development and production of cost - effective, high - performance , easily adaptable products and services that, we believe, provide: 30% - 50 % savings to the current MDx market Superior product performance Seamless fit into customers’ normal workflows Enzo Is P ositioned to Address the Margin D ilemma of the Molecular Diagnostic Market W hich C an C reate S ustained Value for Its Shareholders Our current market position is the culmination of extensive strategic planning and years of work developing core competencies that cannot be easily replicated

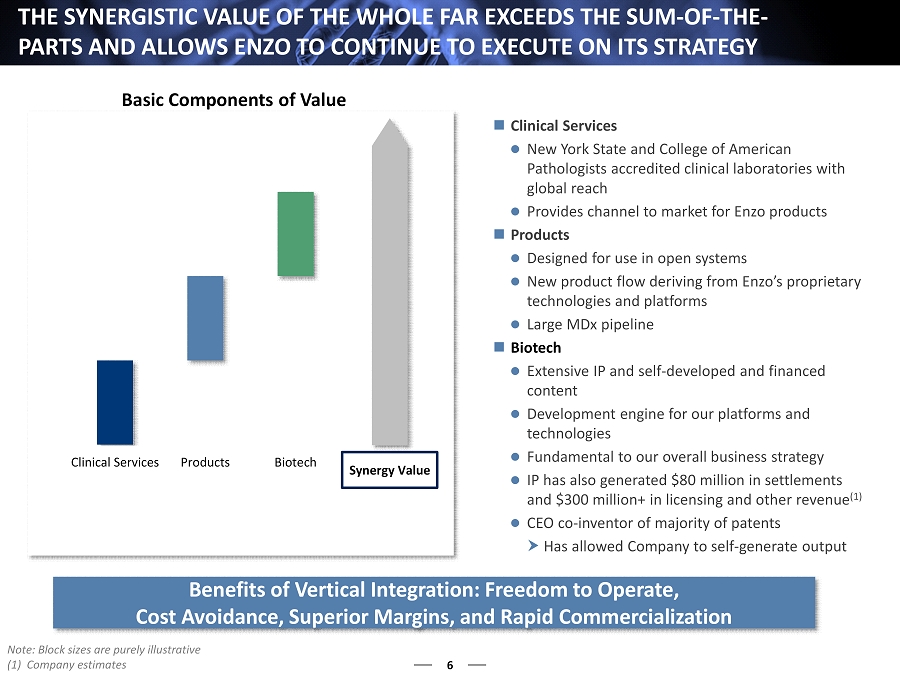

Clinical Services Products Biotech 6 THE SYNERGISTIC VALUE OF THE WHOLE FAR EXCEEDS THE SUM - OF - THE - PARTS AND ALLOWS ENZO TO CONTINUE TO EXECUTE ON ITS STRATEGY Note: Block sizes are purely illustrative (1) Company estimates Benefits of Vertical Integration: Freedom to Operate, Cost Avoidance, Superior Margins, and Rapid Commercialization Clinical Services New York State and College of American Pathologists accredited clinical laboratories with global reach Provides channel to market for Enzo products Products Designed for use in open systems New product flow deriving from Enzo’s proprietary technologies and platforms Large MDx pipeline Biotech Extensive IP and self - developed and financed content Development engine for our platforms and technologies Fundamental to our overall business strategy IP has also generated $80 million in settlements and $ 300 million+ in licensing and other revenue (1 ) CEO co - inventor of majority of patents Has allowed Company to self - generate output Basic Components of Value Synergy Value

Industry Dynamics: Growth and Challenges 7

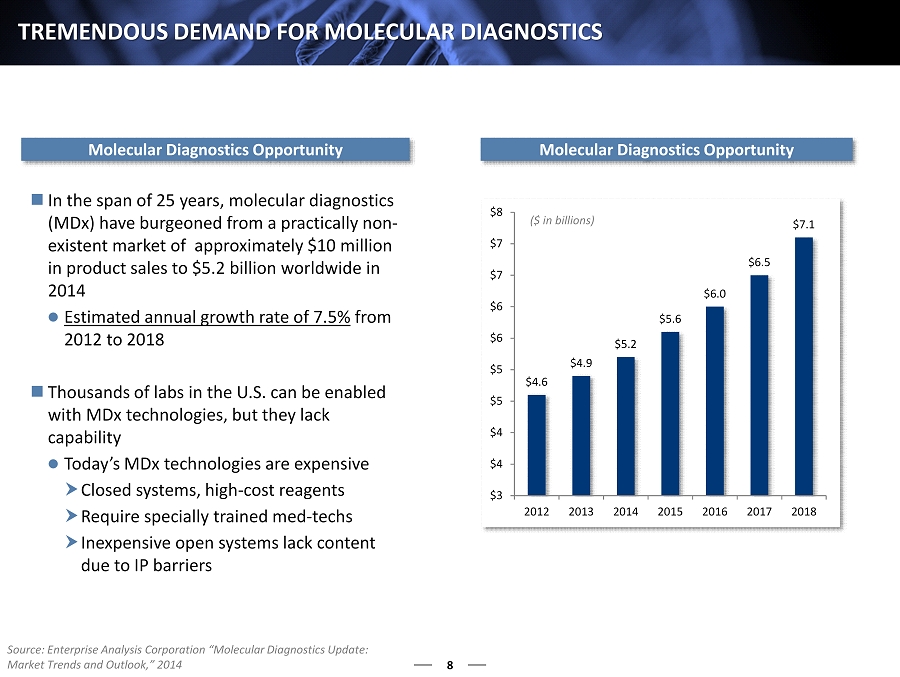

8 TREMENDOUS DEMAND FOR MOLECULAR DIAGNOSTICS $4.6 $4.9 $5.2 $5.6 $6.0 $6.5 $7.1 $3 $4 $4 $5 $5 $6 $6 $7 $7 $8 2012 2013 2014 2015 2016 2017 2018 ($ in billions) Molecular Diagnostics Opportunity In the span of 25 years, molecular diagnostics ( M Dx) have burgeoned from a practically non - existent market of approximately $10 million in product sales to $ 5.2 billion worldwide in 2014 Estimated annual growth rate of 7.5% from 2012 to 2018 Thousands of labs in the U.S. can be enabled with MDx technologies, but they lack capability Today’s MDx technologies are expensive Closed systems, high - cost reagents Require specially trained med - techs Inexpensive open systems lack content due to IP barriers Molecular Diagnostics Opportunity Source: Enterprise Analysis Corporation “Molecular Diagnostics Update: Market Trends and Outlook,” 2014

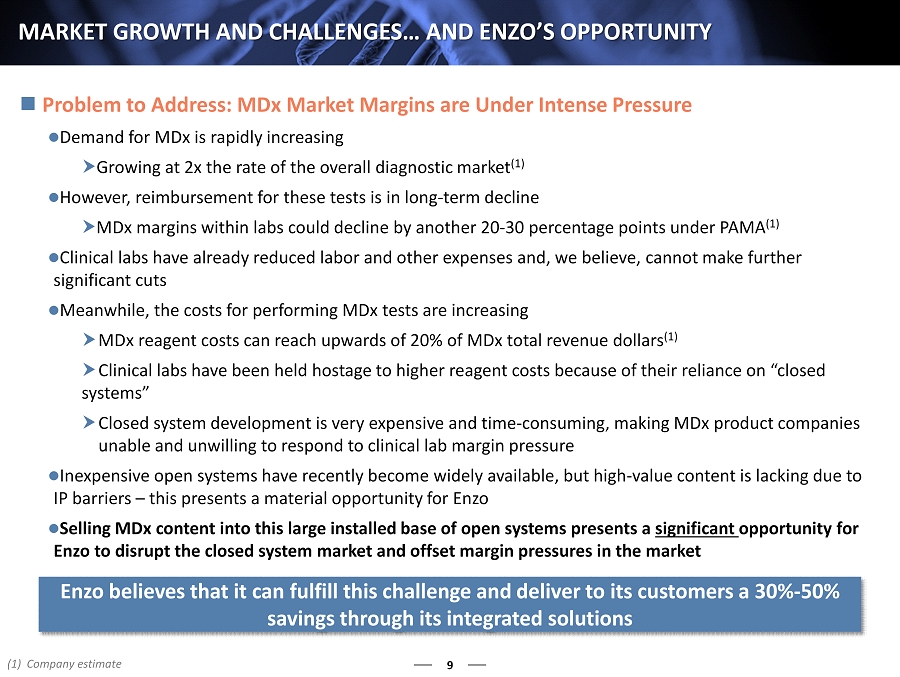

9 MARKET GROWTH AND CHALLENGES… AND ENZO’S OPPORTUNITY Problem to Address: MDx Market Margins are Under Intense Pressure Demand for MDx is rapidly increasing Growing at 2x the rate of the overall diagnostic market (1) However, reimbursement for these tests is in long - term decline MDx margins within labs could decline by another 20 - 30 percentage points under PAMA (1) Clinical labs have already reduced labor and other expenses and, we believe, cannot make further significant cuts Meanwhile, the costs for performing MDx tests are increasing MDx reagent costs can reach upwards of 20% of MDx total revenue dollars (1) Clinical labs have been held hostage to higher reagent costs because of their reliance on “closed systems” Closed system development is very expensive and time - consuming, making MDx product companies unable and unwilling to respond to clinical lab margin pressure I nexpensive open systems have recently become widely available, but high - value content is lacking due to IP barriers – this presents a material opportunity for Enzo Selling MDx content into this large installed base of open systems presents a significant opportunity for Enzo to disrupt the closed system market and offset margin pressures in the market Enzo believes that it can fulfill this challenge and deliver to its customers a 30% - 50% savings through its integrated solutions (1) Company estimate

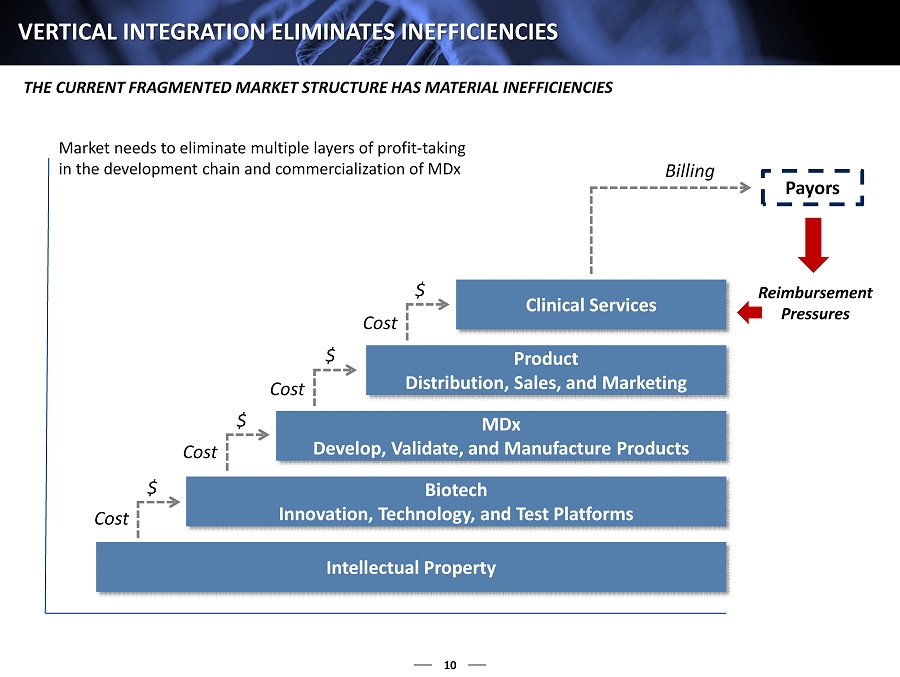

10 VERTICAL INTEGRATION ELIMINATES INEFFICIENCIES THE CURRENT FRAGMENTED MARKET STRUCTURE HAS MATERIAL INEFFICIENCIES Market needs to eliminate multiple layers of profit - taking in the development chain and commercialization of MDx Intellectual Property Biotech Innovation, Technology, and Test Platforms MDx Develop, Validate, and Manufacture Products Product Distribution, Sales, and Marketing Clinical Services $ $ $ $ Billing Payors Cost Cost Cost Cost Reimbursement Pressures

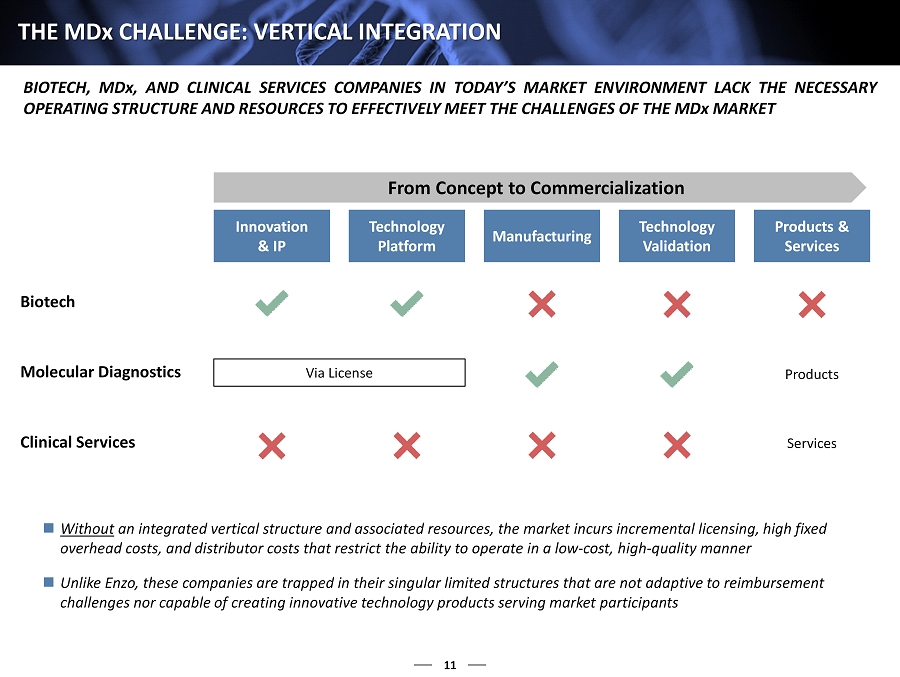

11 THE MD x CHALLENGE : VERTICAL INTEGRATION BIOTECH, MD x, AND CLINICAL SERVICES COMPANIES IN TODAY’S MARKET ENVIRONMENT LACK THE NECESSARY OPERATING STRUCTURE AND RESOURCES TO EFFECTIVELY MEET THE CHALLENGES OF THE MD x MARKET From Concept to Commercialization Innovation & IP Technology Platform Manufacturing Technology Validation Products & Services Biotech Molecular Diagnostics Clinical Services Products Services Via License Without an integrated vertical structure and associated resources, the market incurs incremental licensing, high fixed overhead costs, and distributor costs that restrict the ability to operate in a low - cost, high - quality manner Unlike Enzo, these companies are trapped in their singular limited structures that are not adaptive to reimbursement challenges nor capable of creating innovative technology products serving market participants

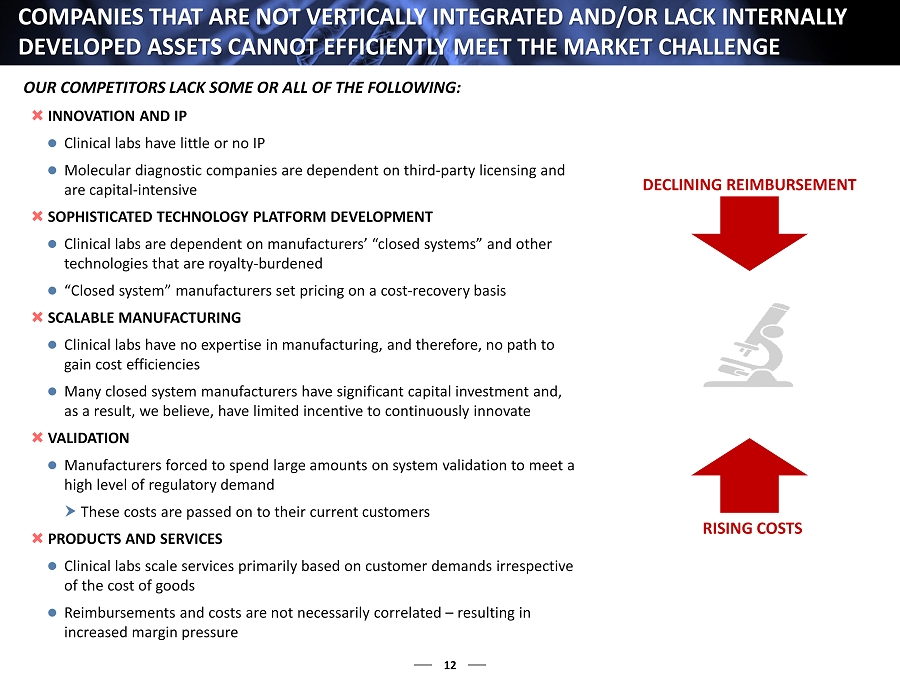

12 INNOVATION AND IP Clinical labs have little or no IP Molecular diagnostic companies are dependent on third - party licensing and are capital - intensive SOPHISTICATED TECHNOLOGY PLATFORM DEVELOPMENT Clinical labs are dependent on manufacturers’ “closed systems” and other technologies that are royalty - burdened “Closed system ” manufacturers set pricing on a cost - recovery basis SCALABLE MANUFACTURING Clinical labs have no expertise in manufacturing, and therefore, no path to gain cost efficiencies Many closed system manufacturers have significant capital investment and, as a result, we believe, have limited incentive to continuously innovate VALIDATION Manufacturers forced to spend large amounts on system validation to meet a high level of regulatory demand These costs are passed on to their current customers PRODUCTS AND SERVICES Clinical labs scale services primarily based on customer demands irrespective of the cost of goods Reimbursements and costs are not necessarily correlated – resulting in increased margin pressure COMPANIES THAT ARE NOT VERTICALLY INTEGRATED AND/OR LACK INTERNA LLY DEVELOPED ASSETS CANNOT EFFICIENTLY MEET THE MARKET CHALLENGE DECLINING REIMBURSEMENT RISING COSTS OUR COMPETITORS LACK SOME OR ALL OF THE FOLLOWING :

13 OPERATIONAL EFFICIENCIES HAVE ALREADY VIRTUALLY MAXED OUT Clinical labs have made substantial efforts to reduce costs and have focused their effort on labor expenses Market consolidation is largely complete Due to government mandated staffing levels, clinical labs are no longer able to continue to cut labor costs as aggressively as in the past The cost of referring MDx tests to other clinical labs has not responded to reimbursement pressure either Thus, clinical labs cannot effectively respond to reimbursement limitations MDx COMPANIES HAVE NOT AND CANNOT REDUCE PRICES In many clinical labs, the costs of reagents – utilized to run diagnostic tests – are 20 % of their revenues (1) MDx companies have generally refused to – or have been unable to – reduce the prices they charge to clinical labs due to margin pressure If MDx companies did reduce price as the market needs, their profits would be reduced Therefore, clinical labs cannot receive margin relief from MDx companies Closed systems complete the margin squeeze Diagnostic companies are single - platform - centric, meaning that they sell test kits to the clinical labs that generally only work on the instrumentation with which they were sold This antiquated razor - razorblade model, which has dominated the industry for years, is in desperate need of disruption INDUSTRY’S INABILITY TO RESPOND TO REIMBURSEMENT PRESSURE THE PROTECTING ACCESS TO MEDICARE ACT OF 2014 (OR “PAMA”) IS RESETTING THE ENTIRE LABORATORY FEE SCHEDULE – THIS “ RESETTING” IS RESULTING IN SUBSTANTIAL CUTS TO LABORATORY REIMBURSEMENT RATES (1) Company estimate

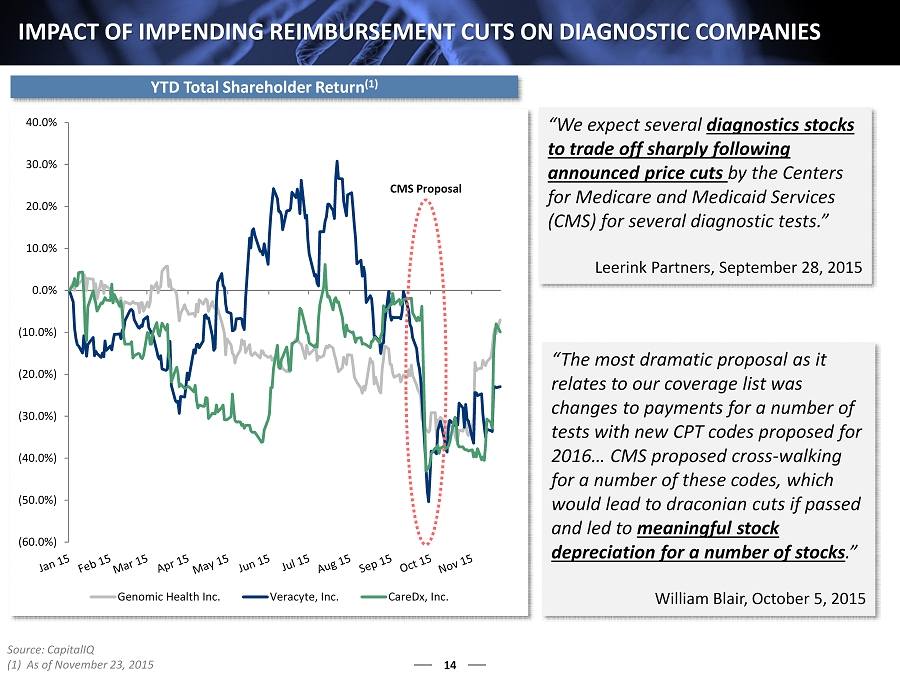

(60.0%) (50.0%) (40.0%) (30.0%) (20.0%) (10.0%) 0.0% 10.0% 20.0% 30.0% 40.0% Genomic Health Inc. Veracyte, Inc. CareDx, Inc. 14 IMPACT OF IMPENDING REIMBURSEMENT CUTS ON DIAGNOSTIC COMPANIES “We expect several diagnostics stocks to trade off sharply following announced price cuts by the Centers for Medicare and Medicaid Services (CMS) for several diagnostic tests.” Leerink Partners, September 28, 2015 “The most dramatic proposal as it relates to our coverage list was changes to payments for a number of tests with new CPT codes proposed for 2016… CMS proposed cross - walking for a number of these codes, which would lead to draconian cuts if passed and led to meaningful stock depreciation for a number of stocks .” William Blair, October 5, 2015 CMS Proposal YTD Total Shareholder Return (1) Source: CapitalIQ (1) As of November 23, 2015

15 UNIQUE CAPABILITIES AND ASSETS ARE REQUIRED TO CAPITALIZE ON THIS DISRUPTIVE OPPORTUNITY Existing IP, technologies, and test platforms Ability to internally generate capital to finance innovation, technology, platforms, IP, product development, marketing, and accessibility Ability to address multitude of test platforms – different technologies fit different applications Knowledge of the market’s needs and lab workflows Test validation and high - quality manufacturing in scale Existing access to patient samples A sales channel with global reach Freedom to operate at every stage in the process Ability to internally and rapidly generate IP, technology, platforms, products, and distribution CAPABILITIES AND ASSETS REQUIRED : LOGICAL SOLUTION: A COMPANY WITH A VERTICALLY INTEGRATED STRUCTU RE, INTERNALLY DEVELOPED AND FINANCED ASSETS THAT HAVE ALREADY BEEN PAID FOR AN D CAN DEVELOP COST - EFFECTIVE, HIGH - PERFORMANCE, AND EASILY ADAPTABLE SOLUTIONS MARKET NEED TO ELIMINATE MULTIPLE LAYERS OF PROFIT - TAKING IN THE DEVELOPMENT CHAIN AND COMMERCIALIZATION OF MD x

16 ENZO PRODUCTS STRUCTURED TO DISRUPT THE MARKET WITHOUT APPEARING DISRUPTIVE Building this Vertically Integrated, Self - Supporting, and Cash - Generating Business Requires a Focused, Diligent Strategy – ENZO HAS SUCH A STRATEGY We avoid the intermediate costs at each step... savings that we pass on to the market and real value for delivery to our shareholders Biotech Leverages Enzo’s extensive IP to develop technologies and platforms which serve as the engine for innovative product development and generates significant capital for the Company The Company has developed and analyzed numerous platforms, and advanced those that can deliver not only in terms of performance and cost, but also be seamlessly compatible with our customers’ regular operations MDx Develops, manufactures, and commercializes high - performance MDx products on a large scale anticipated to be sold at 30% - 50% less than the current market pricing Clinical Services Well - equipped clinical laboratories, which allow Enzo to commercialize high - value MDx content for the global market while generating capital to support its own operation

Enzo’s Solution - Efficient, Self - Generated Development and Commercialization 17

18 THE FUNDAMENTAL BASIS FOR ENZO’S SOLUTION COST - EFFECTIVE HIGH - PERFORMANCE EASILY ADAPTABLE

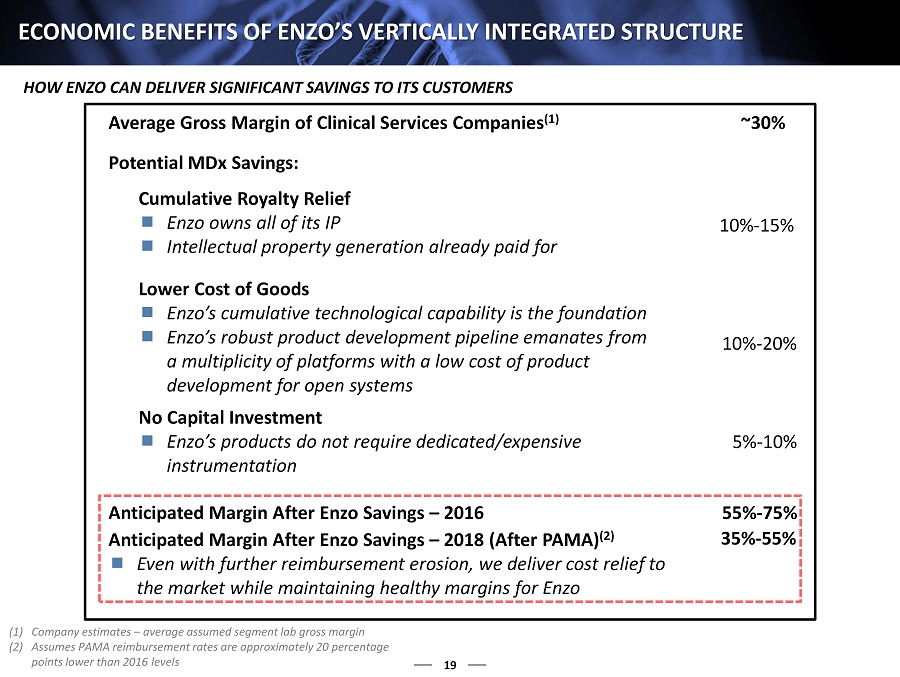

19 ECONOMIC BENEFITS OF ENZO’S VERTICALLY INTEGRATED STRUCTURE Average Gross Margin of Clinical Services Companies (1) ~30% Potential MDx Savings: Cumulative Royalty Relief Enzo owns all of its IP Intellectual property generation already paid for Lower Cost of Goods Enzo’s cumulative technological capability is the foundation Enzo’s robust product development pipeline emanates from a multiplicity of platforms with a low cost of product development for open systems No Capital Investment Enzo’s products do not require dedicated/expensive instrumentation 5% - 10% 10% - 20% 10% - 15% Anticipated Margin After Enzo Savings – 2016 55% - 75% Anticipated Margin After Enzo Savings – 2018 (After PAMA) (2) Even with further reimbursement erosion, we deliver cost relief to the market while maintaining healthy margins for Enzo 35% - 55% (1) Company estimates – average assumed segment lab gross margin (2) Assumes PAMA reimbursement rates are approximately 20 percentage points lower than 2016 levels HOW ENZO CAN DELIVER SIGNIFICANT SAVINGS TO ITS CUSTOMERS 1

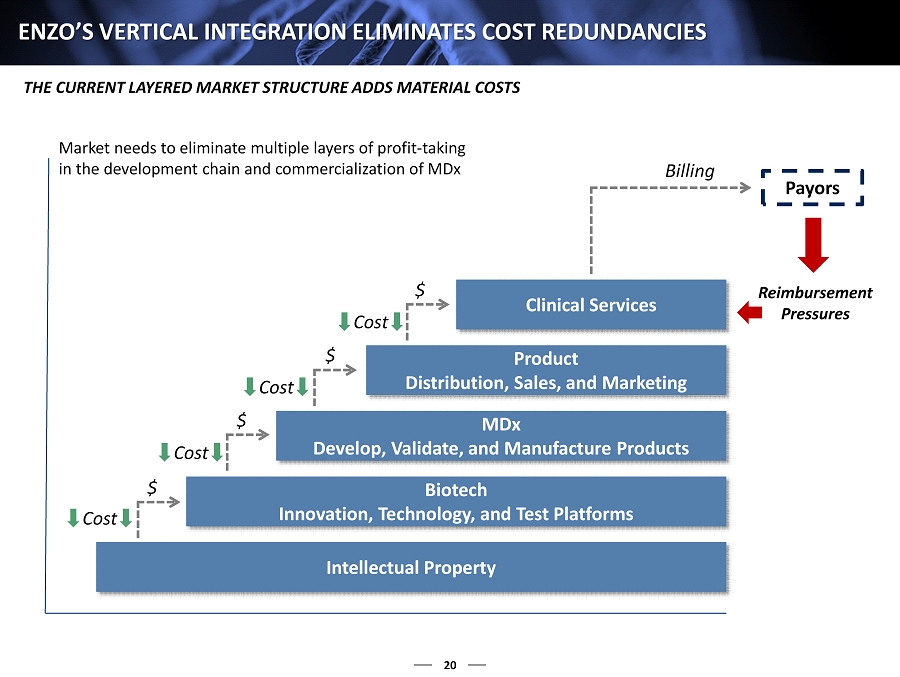

20 ENZO’S VERTICAL INTEGRATION ELIMINATES COST REDUNDANCIES THE CURRENT LAYERED MARKET STRUCTURE ADDS MATERIAL COSTS Intellectual Property Biotech Innovation, Technology, and Test Platforms MDx Develop, Validate, and Manufacture Products Product Distribution, Sales, and Marketing Clinical Services $ $ $ $ Billing Payors Cost Cost Cost Cost Reimbursement Pressures Market needs to eliminate multiple layers of profit - taking in the development chain and commercialization of MDx

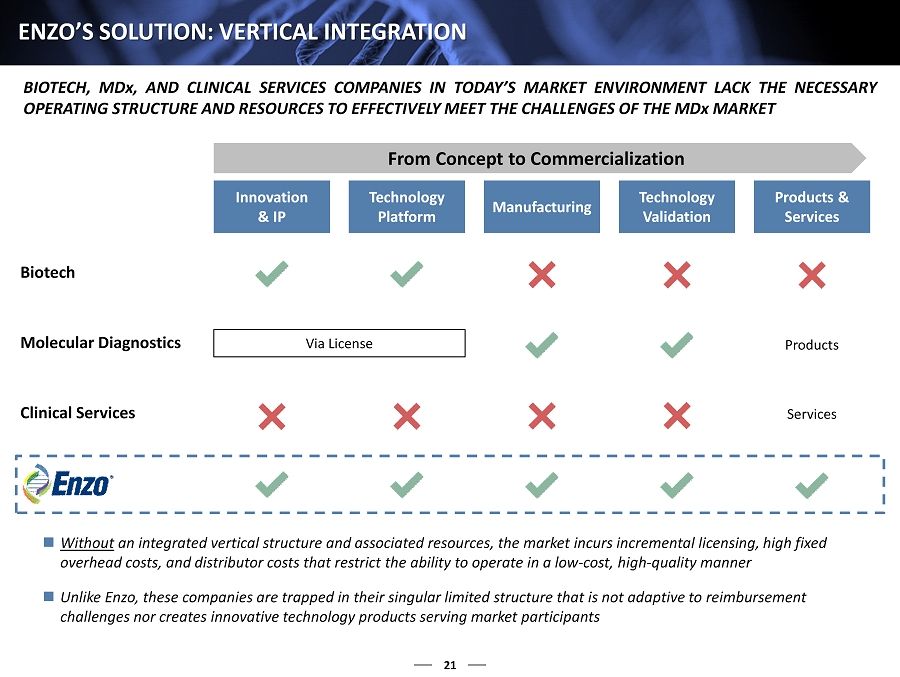

21 ENZO’S SOLUTION: VERTICAL INTEGRATION From Concept to Commercialization Innovation & IP Technology Platform Manufacturing Technology Validation Products & Services Biotech Molecular Diagnostics Clinical Services Products Services Via License BIOTECH, MD x, AND CLINICAL SERVICES COMPANIES IN TODAY’S MARKET ENVIRONMENT LACK THE NECESSARY OPERATING STRUCTURE AND RESOURCES TO EFFECTIVELY MEET THE CHALLENGES OF THE MD x MARKET Without an integrated vertical structure and associated resources, the market incurs incremental licensing, high fixed overhead costs, and distributor costs that restrict the ability to operate in a low - cost, high - quality manner Unlike Enzo, these companies are trapped in their singular limited structure that is not adaptive to reimbursement challenges nor creates innovative technology products serving market participants

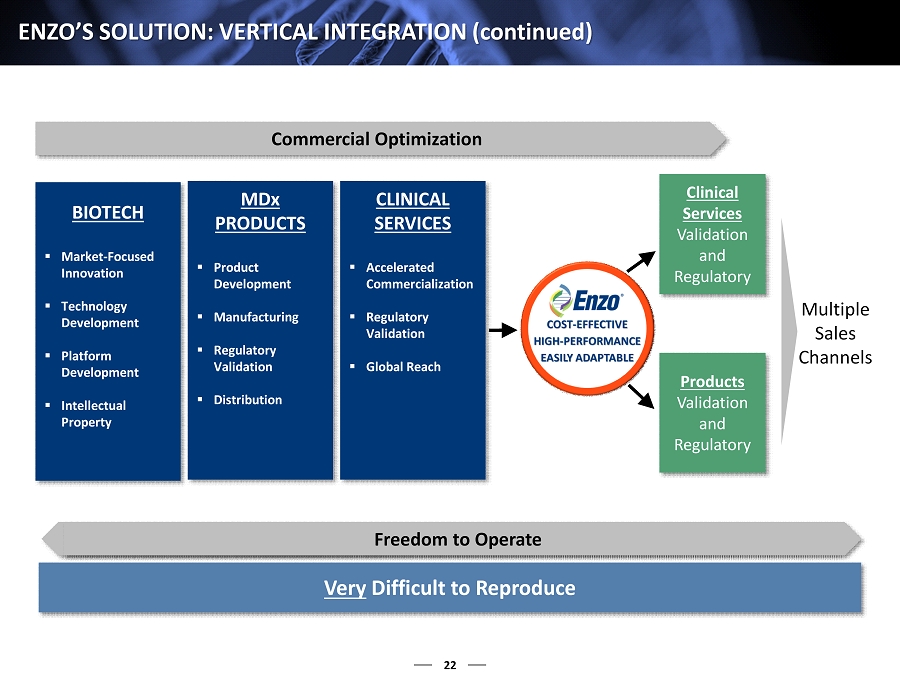

22 ENZO’S SOLUTION: VERTICAL INTEGRATION ( continued ) Commercial Optimization Very Difficult to Reproduce BIOTECH ▪ Market - Focused Innovation ▪ Technology Development ▪ Platform Development ▪ Intellectual Property MD x PRODUCTS ▪ Product Development ▪ Manufacturing ▪ Regulatory Validation ▪ Distribution CLINICAL SERVICES ▪ Accelerated Commercialization ▪ Regulatory Validation ▪ Global Reach Clinical Services Validation and Regulatory Products Validation and Regulatory Multiple Sales Channels Freedom to Operate

23 BIOTECH CONTRIBUTION Enzo’s platforms and technologies are the result of its development engine These lead to products that are: Cost - effective High - performance Easily adaptable Enzo’s Intellectual Property Assets Generate Returns that Serve as the Company’s Foundation

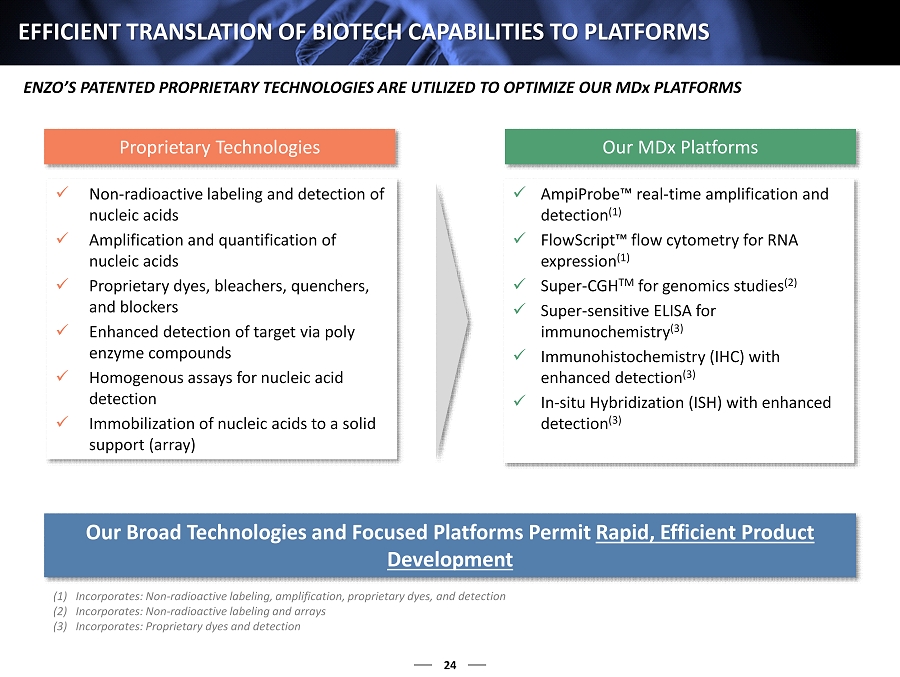

24 EFFICIENT TRANSLATION OF BIOTECH CAPABILITIES TO PLATFORMS x Non - radioactive labeling and detection of nucleic acids x Amplification and quantification of nucleic acids x Proprietary dyes, bleachers, quenchers, and blockers x Enhanced detection of target via poly enzyme compounds x Homogenous assays for nucleic acid detection x Immobilization of nucleic acids to a solid support (array) x AmpiProbe™ real - time amplification and detection (1) x FlowScript™ flow cytometry for RNA expression (1) x Super - CGH TM for genomics studies (2) x Super - sensitive ELISA for immunochemistry (3) x Immunohistochemistry (IHC) with enhanced detection (3) x In - situ Hybridization (ISH) with enhanced detection (3) Proprietary Technologies Our MDx Platforms Our Broad Technologies and Focused Platforms Permit Rapid, Efficient Product Development (1) Incorporates: Non - radioactive labeling, amplification, proprietary dyes, and detection (2) Incorporates: Non - radioactive labeling and arrays (3) Incorporates: Proprietary dyes and detection ENZO’S PATENTED PROPRIETARY TECHNOLOGIES ARE UTILIZED TO OPTIMIZE OUR MD x PLATFORMS

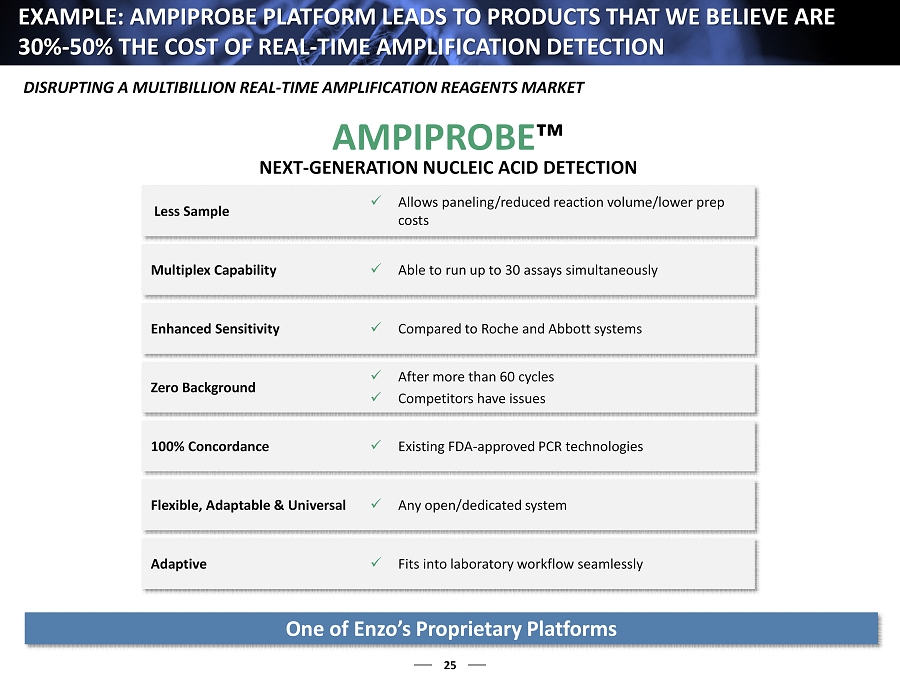

25 EXAMPLE: AMPIPROBE PLATFORM LEADS TO PRODUCTS THAT WE BELIEVE AR E 30% - 50% THE COST OF REAL - TIME AMPLIFICATION DETECTION Less Sample x Allows paneling/reduced reaction volume/lower prep costs Multiplex Capability x Able to run up to 30 assays simultaneously Enhanced Sensitivity x Compared to Roche and Abbott systems Zero Background x After more than 60 cycles x Competitors have issues 100% Concordance x Existing FDA - approved PCR technologies Flexible, Adaptable & Universal x Any open/dedicated system Adaptive x Fits into laboratory workflow seamlessly AMPIPROBE ™ NEXT - GENERATION NUCLEIC ACID DETECTION One of Enzo’s Proprietary Platforms DISRUPTING A MULTIBILLION REAL - TIME AMPLIFICATION REAGENTS MARKET

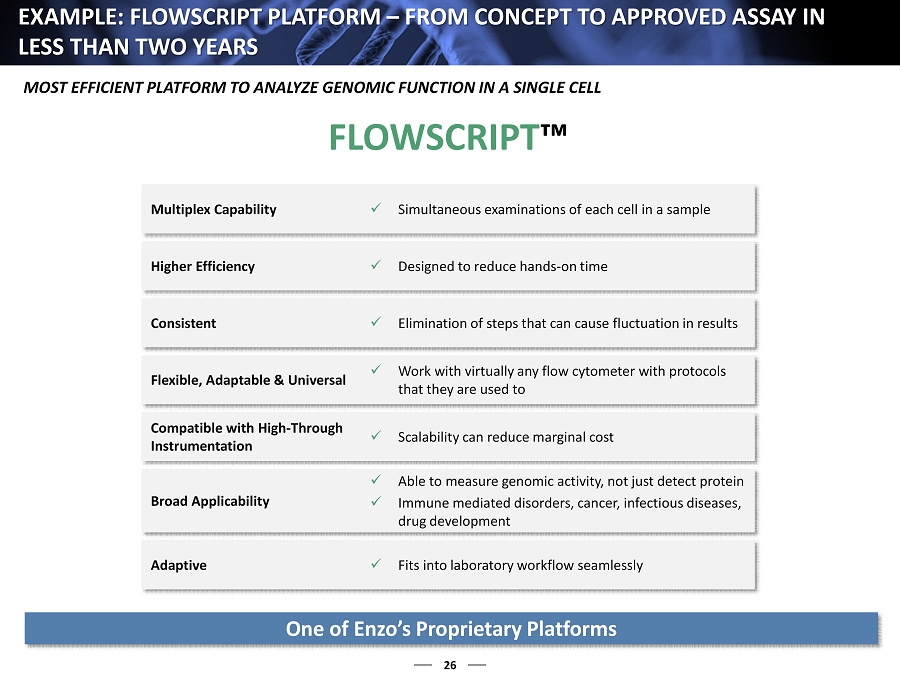

26 EXAMPLE: FLOWSCRIPT PLATFORM – FROM CONCEPT TO APPROVED ASSAY IN LESS THAN TWO YEARS Multiplex Capability x Simultaneous examinations of each cell in a sample Higher Efficiency x Designed to reduce hands - on time Consistent x Elimination of steps that can cause fluctuation in results Flexible, Adaptable & Universal x Work with virtually any flow cytometer with protocols that they are used to Compatible with High - Through Instrumentation x Scalability can reduce marginal cost Broad Applicability x Able to measure genomic activity, not just detect protein x Immune mediated disorders, c ancer, infectious diseases, drug development Adaptive x Fits into laboratory workflow seamlessly FLOWSCRIPT ™ One of Enzo’s Proprietary Platforms MOST EFFICIENT PLATFORM TO ANALYZE GENOMIC FUNCTION IN A SINGLE CELL

27 COMMERCIALLY FOCUSED MD x DEVELOPMENT Large, well - developed markets – no missionary marketing efforts required C ost - effective, high - performing, and adaptable, Enzo’s products poised to penetrate the market Current MDx market pressures help create the need for these products Enzo’s self - developed and financed content allows for substantially less costly products while still providing Enzo improving margins The Company’s operations have provided capital to fuel internal development Game - changing performance and cost; non - disruptive to customers’ operations Enzo IP Provides Durable Barrier to Entry LEVERAGING THE TOTALITY OF ENZO’S ASSETS AND MARKET KNOWLEDGE

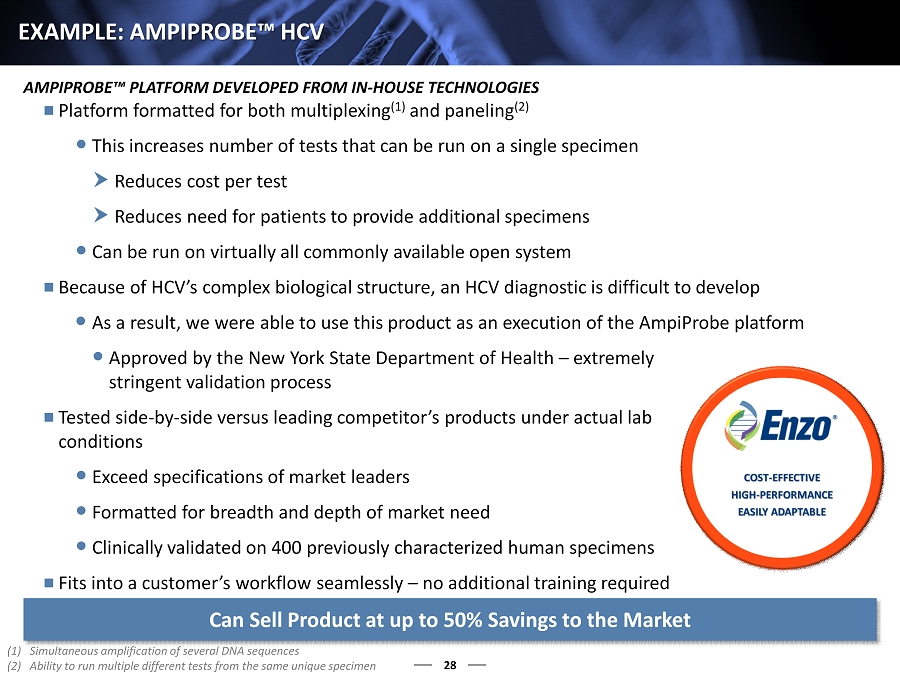

28 EXAMPLE: AMPIPROBE™ HCV Platform formatted for both multiplexing (1) and paneling (2) This increases number of tests that can be run on a single specimen Reduces cost per test Reduces need for patients to provide additional specimens Can be run on virtually all commonly available open system Because of HCV’s complex biological structure, an HCV diagnostic is difficult to develop As a result, we were able to use this product as an execution of the AmpiProbe platform Approved by the New York State Department of Health – extremely stringent validation process Tested side - by - side versus leading competitor’s products under actual lab conditions Exceed specifications of market leaders Formatted for breadth and depth of market need Clinically validated on 400 previously characterized human specimens Fits into a customer’s workflow seamlessly – no additional training required AMPIPROBE™ PLATFORM DEVELOPED FROM IN - HOUSE TECHNOLOGIES Can Sell Product at up to 50% Savings to the Market (1) Simultaneous amplification of several DNA sequences (2) Ability to run multiple different tests from the same unique specimen

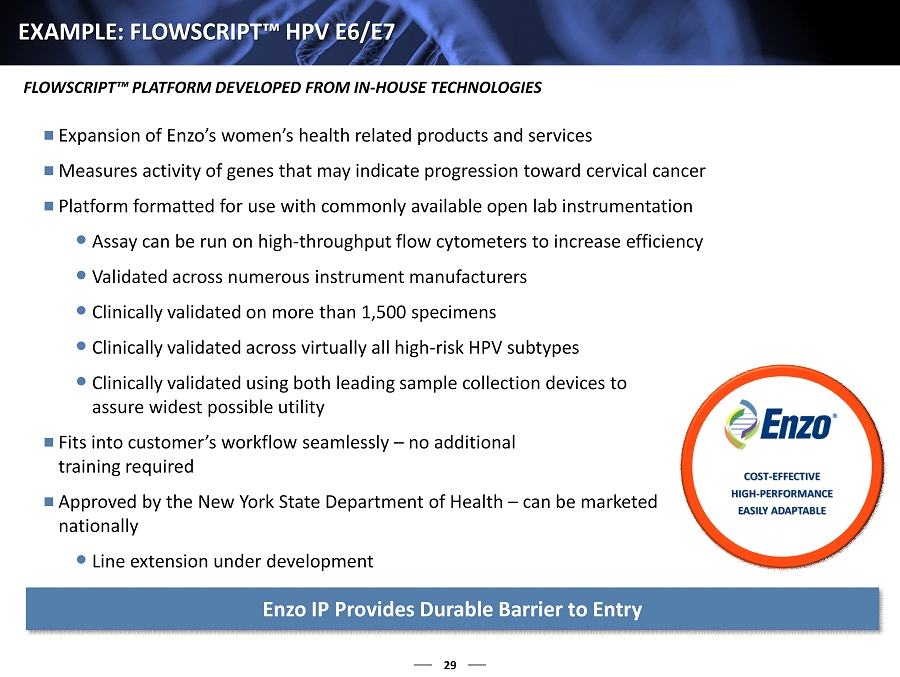

29 EXAMPLE: FLOWSCRIPT™ HPV E6/E7 FLOWSCRIPT™ PLATFORM DEVELOPED FROM IN - HOUSE TECHNOLOGIES Expansion of Enzo’s women’s health related products and services Measures activity of genes that may indicate progression toward cervical cancer Platform formatted for use with commonly available open lab instrumentation Assay can be run on high - throughput flow cytometers to increase efficiency Validated across numerous instrument manufacturers Clinically validated on more than 1,500 specimens Clinically validated across virtually all high - risk HPV subtypes Clinically validated using both leading sample collection devices to assure widest possible utility Fits into customer’s workflow seamlessly – no additional training required Approved by the New York State Department of Health – can be marketed nationally Line extension under development Enzo IP Provides Durable Barrier to Entry

30 ENZO HAS A ROBUST MD x PIPELINE Product / Test Description Expected Availability Platform Opportunity (1) HPV E6/E7 Detection Available FLOWSCRIPT™ GENE EXPRESSION $200mm+ product $500mm service HCV Viral Load Available AMPIPROBE™ REAL - TIME AMPLIFICATION AND DETECTION $300mm product $450mm service Fertility Assay Q1 2016 ENHANCED I MMUNOASSAY $15mm product $40mm service Cardiac Marker Q2 2016 ENHANCED IMMUNOASSAY $20mm product $30mm service Women’s Health Panel Q3 2016 AMPIPROBE™ REAL - TIME AMPLIFICATION AND DETECTION $500mm product $1bn service HBV Viral Load 2017 AMPIPROBE™REAL - TIME AMPLIFICATION AND DETECTION $250mm product $375mm service HIV Viral Load 2017 AMPIPROBE™ REAL - TIME AMPLIFICATION AND DETECTION $600mm product $900mm service IHC Detection 2017 ENHANCED DETECTION $50mm+ (clinical) TH1/TH2 In development FLOWSCRIPT™ GENE EXPRESSION - Cancer AB Panel In development AMPIFLOW™ ENHANCED DETECTION LABEL - Cancer Marker Panel In development FLOWSCRIPT™ GENE EXPRESSION - Rapid Roll - Out (1) Company estimates

31 Translational Capability x Bridge between product development from MDx platforms and service and product validation x Enzo rapidly adapts its development efforts to the clinical services market through constant feedback Rapid Clinical Assay Validation (Clinical Trials) x New York State regulation is extremely rigorous, and it allows the tests to be offered on a national basis x Enzo validates all of its assays under actual clinical conditions using real clinical specimens, not just control samples – as a result, our products are evaluated under the same conditions experienced by our customers x The access to thousands of previously characterized specimens allows us to perform validations at a fraction of the cost of others that need to obtain such specimens from outside sources x Our integrated premarketing insights and efforts provide for material efficiencies in development and commercialization of our assays Accelerated Commercialization x Technical support and service x Market to clinical labs and payors x Enzo’s integrated structure provides unparalleled market knowledge and expertise as Enzo’s clinical laboratory is one of its own customers CLINICAL SERVICES COMPONENT

32 CLINICAL SERVICES x Technical Expertise x Accreditation x Logistics x IT – Lab x IT – Clients - Integrated into customers’ operations x Financial Services x Payor Relations – In - network with most major payors x Reputation for Excellence x Marketing and Sales Enzo H as Built a C linical Service Lab Based on Many Y ears of Experience and Substantial C apital Investment

33 NATIONAL AND GLOBAL REACH NEW YORK STATE LICENSURE ALLOWS FOR A NATIONAL REACH , WHILE ENZO ACCREDITATIONS AND GLOBAL FOOTPRINT ALLOW FOR WORLDWIDE REACH Hawaii Alaska Continued expansion of national and worldwide sales and marketing presence Enzo’s strategy provides optionality to the market Products with 30% - 50% savings Comprehensive service for less than price of competitors’ product alone

34 CLOSE ALIGNMENT WITH PAYORS Private payors (insurance companies) increasingly control the practice of medicine and influence the specimen flow to service providers Enzo is currently in - network with most major payors We are well positioned to become the “ first - choice ” service provider to payors for MDx as the low - cost, high - quality provider The Company can offer significant savings in return for substantial increases in MDx sample volume nationwide Sample Volume

35 SUMMARY The Company evaluated multiple internally generated technologies and platforms and selected those to further advance based on the development of: Products that could be sold at 30% - 50% less than the current market Products that could perform at or superior to market leaders’ products Medically relevant information Products that could fit into existing operations Products that result in greater margins for Enzo We have demonstrated that Enzo has the assets and capabilities to engineer a system that can generate products based on these features We have been able to design proprietary products and protocols that are in lock step with current market operations WITHOUT the need to utilize third - party intellectual property ENZO’S SYNERGISTIC STRATEGY AND INTEGRATED STRUCTURE ADDRESSES THE CHALLENGES IN MD x MARKET Company Strategically Positioned for Substantial Growth

36 SUMMARY ( continued ) To build the infrastructure we have developed would take hundreds of millions of dollars and many years – and there would be no guarantee that such an entity could amass the innovation, intellectual property, and structural efficiencies that would allow it to address the market challenge Enzo has Addressed the Market C hallenge by Creating P roducts and Platforms as a Result of Its C ulture and Infrastructure

Financial Overview 37

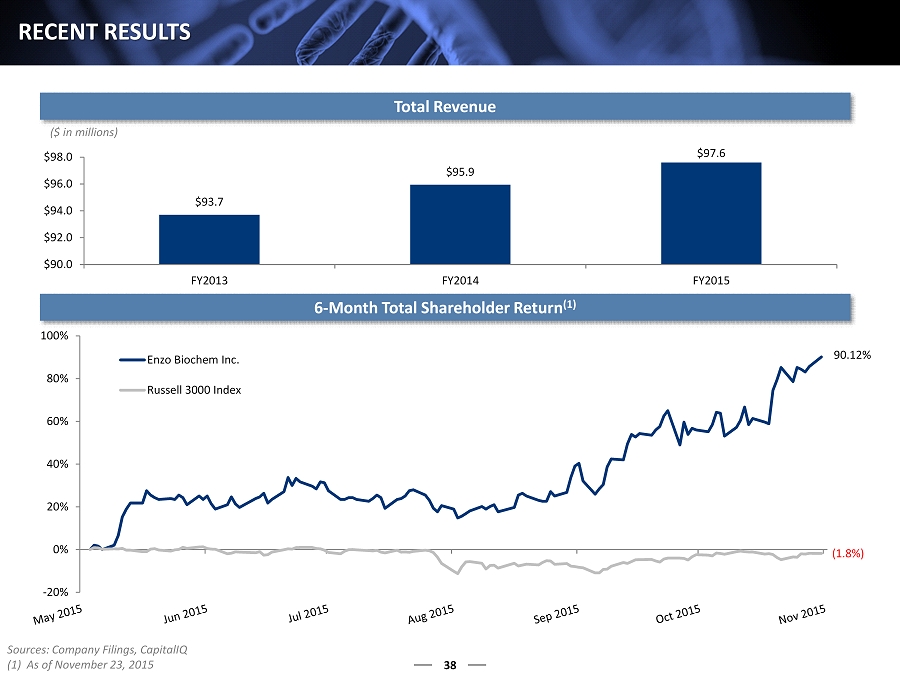

38 RECENT RESULTS $93.7 $95.9 $97.6 $90.0 $92.0 $94.0 $96.0 $98.0 FY2013 FY2014 FY2015 Total Revenue ($ in millions) 6 - Month Total Shareholder Return (1) Sources: Company Filings, CapitalIQ (1) As of November 23, 2015 90.12% (1.8%) -20% 0% 20% 40% 60% 80% 100% Enzo Biochem Inc. Russell 3000 Index

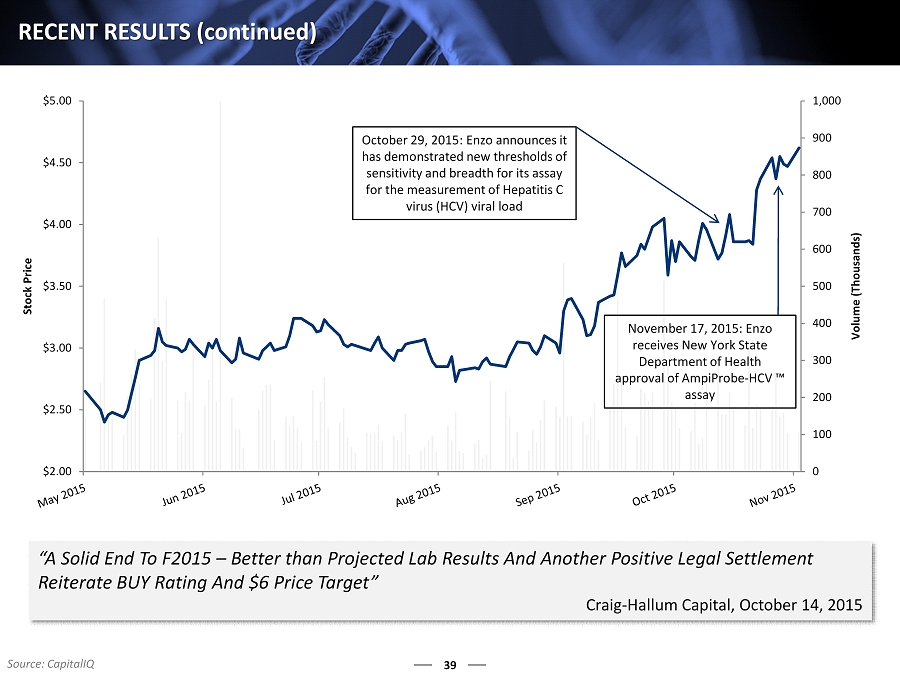

0 100 200 300 400 500 600 700 800 900 1,000 $2.00 $2.50 $3.00 $3.50 $4.00 $4.50 $5.00 Volume (Thousands) Stock Price October 29, 2015: Enzo announces it has demonstrated new thresholds of sensitivity and breadth for its assay for the measurement of Hepatitis C virus (HCV) viral load November 17, 2015: Enzo receives New York State Department of Health approval of AmpiProbe - HCV ™ assay 39 RECENT RESULTS ( continued ) Source: CapitalIQ “A Solid End To F2015 – B etter than Projected Lab Results And Another Positive Legal Settlement Reiterate BUY Rating And $6 Price Target” Craig - Hallum Capital, October 14, 2015

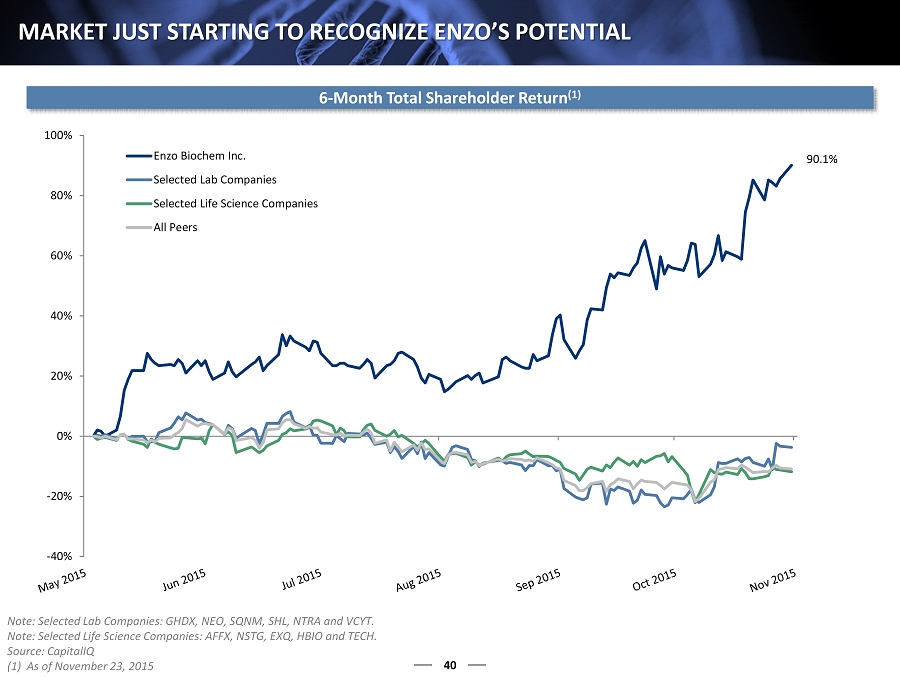

-40% -20% 0% 20% 40% 60% 80% 100% Enzo Biochem Inc. Selected Lab Companies Selected Life Science Companies All Peers 40 MARKET JUST STARTING TO RECOGNIZE ENZO’S POTENTIAL 6 - Month Total Shareholder Return (1) Note: Selected Lab Companies: GHDX, NEO, SQNM, SHL, NTRA and VCYT. Note: Selected Life Science Companies: AFFX, NSTG, EXQ, HBIO and TECH. Source: CapitalIQ (1) As of November 23, 2015 90.1%

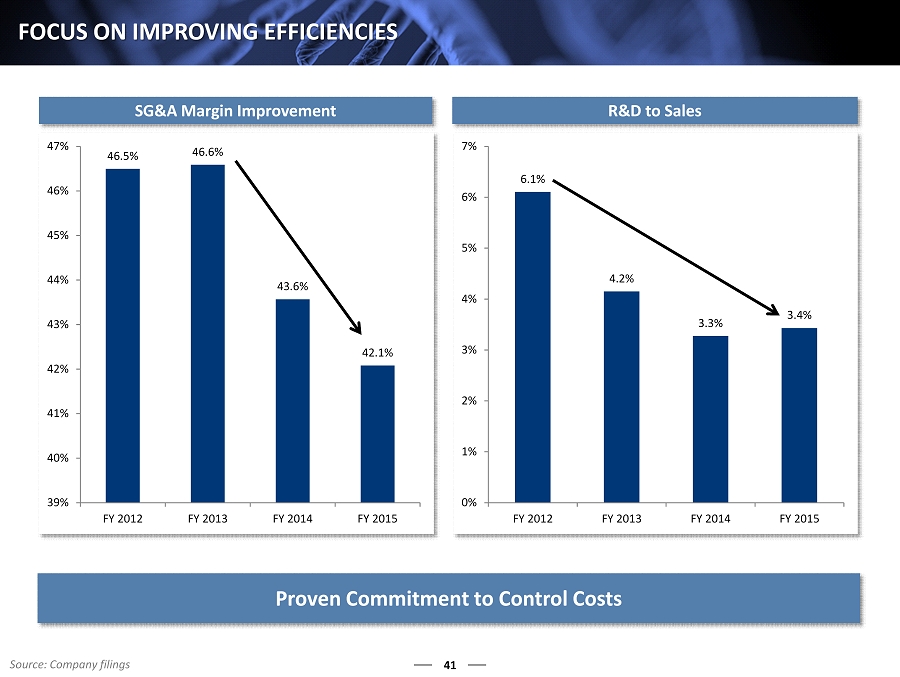

6.1% 4.2% 3.3% 3.4% 0% 1% 2% 3% 4% 5% 6% 7% FY 2012 FY 2013 FY 2014 FY 2015 46.5% 46.6% 43.6% 42.1% 39% 40% 41% 42% 43% 44% 45% 46% 47% FY 2012 FY 2013 FY 2014 FY 2015 41 FOCUS ON IMPROVING EFFICIENCIES SG&A Margin Improvement R&D to Sales Proven C ommitment to Control Costs Source: Company filings

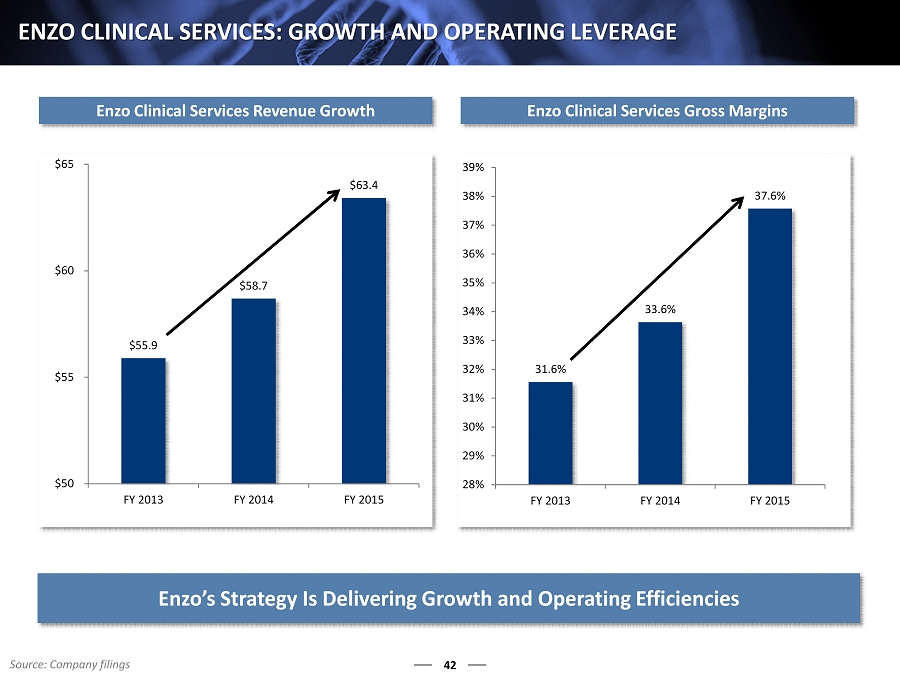

42 ENZO CLINICAL SERVICES: GROWTH AND OPERATING LEVERAGE Enzo Clinical Services Revenue Growth Enzo Clinical Services Gross Margins 31.6% 33.6% 37.6% 28% 29% 30% 31% 32% 33% 34% 35% 36% 37% 38% 39% FY 2013 FY 2014 FY 2015 $55.9 $58.7 $63.4 $50 $55 $60 $65 FY 2013 FY 2014 FY 2015 Enzo’s Strategy Is Delivering G rowth and Operating E fficiencies Source: Company filings

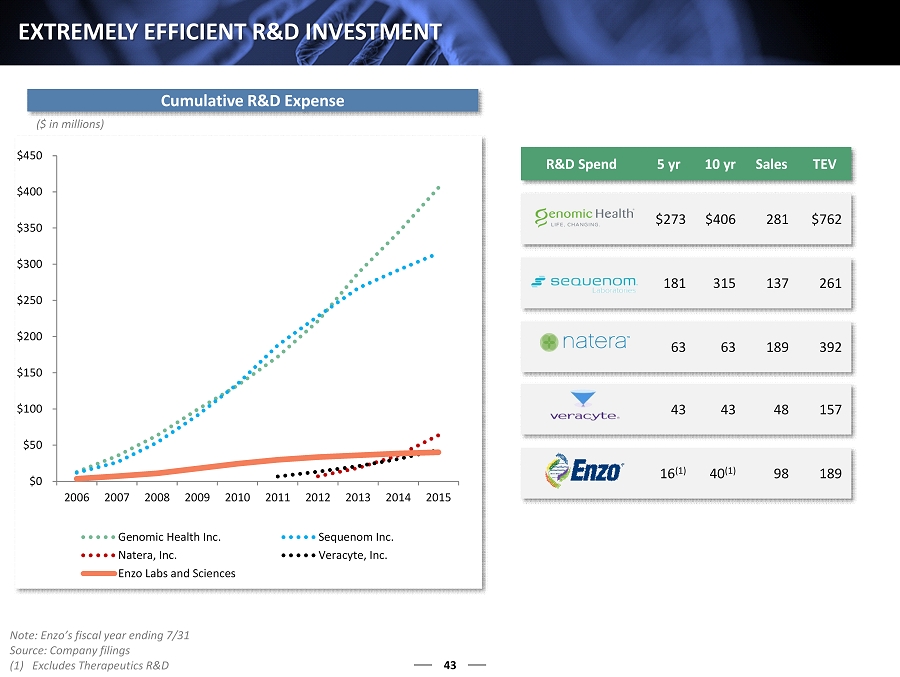

$0 $50 $100 $150 $200 $250 $300 $350 $400 $450 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Genomic Health Inc. Sequenom Inc. Natera, Inc. Veracyte, Inc. Enzo Labs and Sciences R&D Spend 5 yr 10 yr Sales TEV $273 $406 281 $762 181 315 137 261 63 63 189 392 43 43 48 157 16 (1) 40 (1) 98 189 43 EXTREMELY EFFICIENT R&D INVESTMENT ($ in millions) Cumulative R&D Expense Note: Enzo’s fiscal year ending 7/31 Source: Company filings (1) Excludes Therapeutics R&D

Appendices 44

Appendix: IP Assets 45

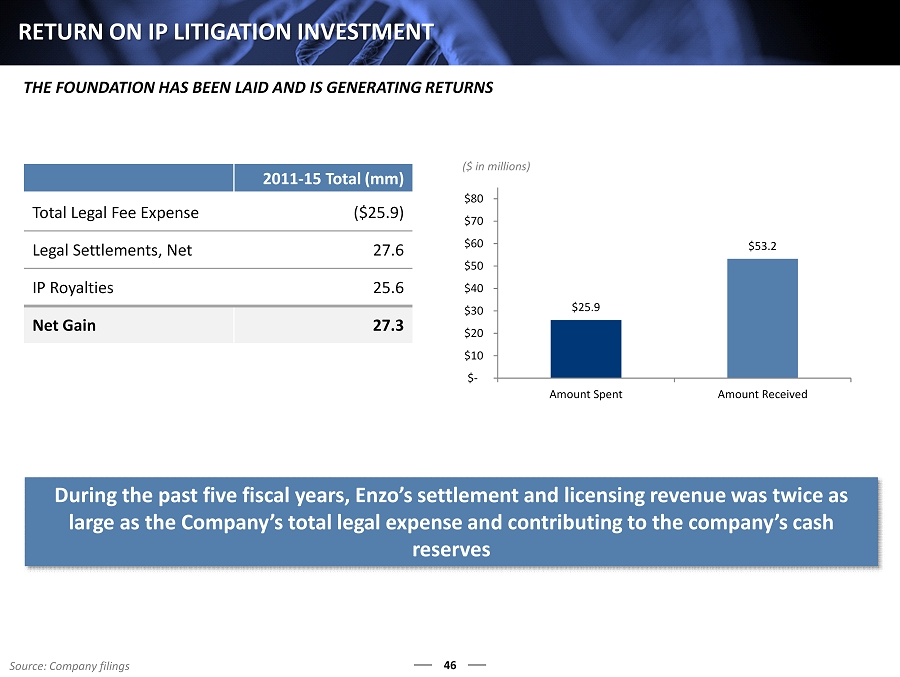

46 RETURN ON IP LITIGATION INVESTMENT 2011 - 15 Total (mm) Total Legal Fee Expense ($25.9) Legal Settlements, Net 27.6 IP Royalties 25.6 Net Gain 27.3 ($ in millions) THE FOUNDATION HAS BEEN LAID AND IS GENERATING RETURNS $25.9 $53.2 $- $10 $20 $30 $40 $50 $60 $70 $80 Amount Spent Amount Received Source: Company filings During the past five fiscal years, Enzo’s settlement and licensing revenue was twice as large as the Company’s total legal expense and contributing to the company’s cash reserves

Appendix: Therapeutics 47

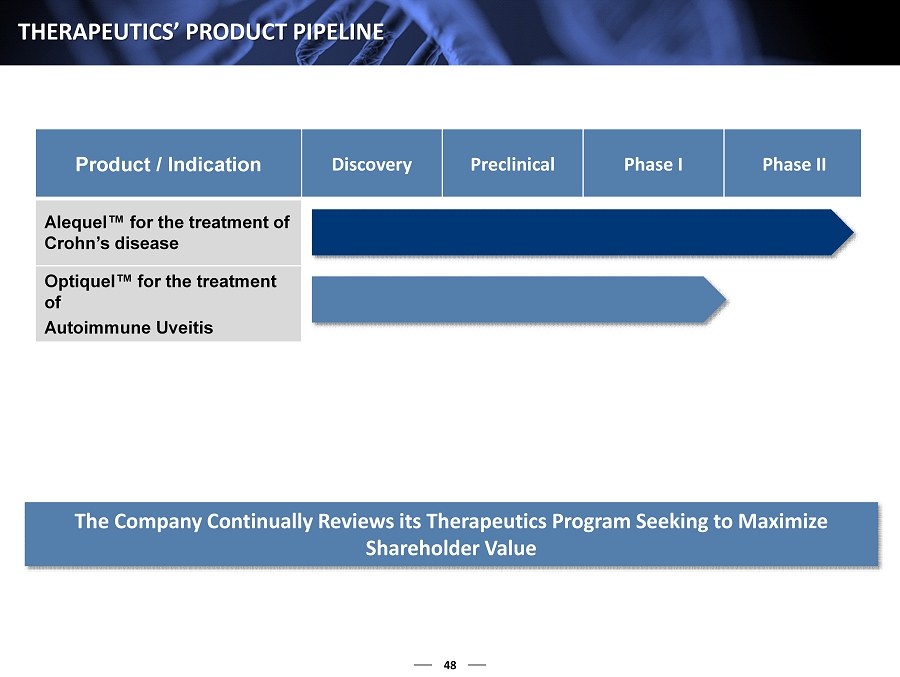

48 THERAPEUTICS’ PRODUCT PIPELINE Product / Indication Discovery Preclinical Phase I Phase II Alequel™ for the treatment of Crohn’s disease Optiquel™ for the treatment of Autoimmune Uveitis The Company Continually R eviews its Therapeutics Program Seeking to Maximize S hareholder V alue

Appendix: Definitions 49

50 DEFINITIONS Molecular Diagnostics (MDx): The application of molecular techniques to detect, diagnose, and monitor diseases, it can include the use of nucleic acid (DNA/RNA) technologies, as well as monoclonal antibodies and ELISA - based assays for the study of immunology (1) Immunohistochemistry: The fundamental concept is the demonstration of antigens (proteins) within tissue sections by means of specific antibodies (2) In situ hybridization: T he use of a DNA or RNA probe to detect complementary genetic material in cells or tissue (3) In situ hybridization involves hybridizing a labeled nucleic acid to suitably prepared cells or tissues on microscope slides to allow visualization in situ (in the normal location) Biotech: An entity that is engaged in biological innovation, leading to enablement of that idea (technology) which could lead to intellectual property Closed System/Open System: Closed systems are instruments that are usually formatted to be used with a dedicated reagent system, and no other, and therefore not adaptable for use with alternate reagents. Such instruments and reagents are usually sold together Open systems are instruments that allow for numerous different reagents and allow flexibility to the user. However, such reagents may face IP barriers Flow cytometry: A technology that simultaneously measures and then analyzes multiple physical characteristics of single particles, usually cells, as they flow in a fluid stream through a beam of light (4) (1) Molecular Diagnostics, 2006, Jain PharmaBiotech Report (2) J. A. Ramos - Vara, Animal Disease Diagnostic Laboratory and Department of Comparative Pathobiology, Purdue University (3) Medicine.net, October 2012 (4) BD Biosciences, 2000

Appendix: Management Biographies 51

52 ELAZAR RABBANI, Ph . D . is an Enzo Biochem founder and has served as the Company’s Chairman of the Board and Chief Executive Officer since its inception in 1976 and Secretary since November 25 , 2009 . Dr . Rabbani has authored numerous scientific publications in the field of molecular biology, in particular, nucleic acid labeling and detection . He is also the lead inventor of most of the Company’s pioneering patents covering a wide range of technologies and products . Dr . Rabbani received his Bachelor of Arts degree from New York University in Chemistry and his Ph . D . in Biochemistry from Columbia University . BARRY W . WEINER , President, Chief Financial Officer, Principal Accounting Officer and Director and a founder of Enzo Biochem . He has served as the Company’s President since 1996 , and previously held the position of Executive Vice President . Before his employment with Enzo Biochem, he worked in managerial and marketing positions at the Colgate Palmolive Company . Mr . Weiner is a member of the New York Biotechnology Association . He received his Bachelor of Arts degree in Economics from New York University and his Master of Business Administration in Finance from Boston University . JAMES M . O’BRIEN , Executive Vice President, Finance joined Enzo Biochem in February 2014 . Mr . O’Brien has held leadership positions for Corporate and Business Unit budgeting and forecasting, SEC Reporting, Internal Controls and Accounting Operations for large and small multi - national public companies in pharmaceutical, consumer products and manufacturing industries . From 2010 to 2013 Mr . O’Brien was Vice President and Corporate Controller for Actavis, plc . ,( now Allergan plc . ) a global specialty pharmaceutical company . From 1998 to 2010 , Mr . O’Brien held senior level Finance leadership roles at Nycomed US, Aptuit, Inc . , Purdue Pharma LLP and Bristol Myers Squibb Company . From 1988 to 1998 Mr . O’Brien was with PricewaterhouseCoopers LLP . He received his Bachelor of Arts degree from George Washington University and his Master of Business Administration from Fordham University . Mr . O’Brien is a Certified Public Accountant . DAVID C . GOLDBERG , Vice President of Corporate Development, has been employed with the Company since 1985 . He also held several other executive positions within Enzo Biochem . Mr . Goldberg held management and marketing positions with DuPont - NEN and Gallard Schlesinger Industries before joining the Company . He received his Master of Science degree in Microbiology from Rutgers University and his Master of Business Administration in Finance from New York University . EXPERIENCED MANAGEMENT TEAM