Published on January 8, 2020

Exhibit 99.1

Investor Presentation January 2020

Disclaimer The views expressed in this presentation (this ” Presentation “) represent the opinion of Enzo Biochem, Inc. (the ” Company “). This Presentation is for informational purposes only, and it does not have regard to the specific investment objective, financial situations, suitability or particular need of any specific person who may receive this Presentation and should not be taken a s advice on the merits of any investment decision. This Presentation is not a recommendation or solicitation to buy or sell any securities of the Company. The Company has not sought or obtained consent from any third party to use any statements or information indicated in this Presentation as having been obtained or derived from a third party. Any such statements or information should not be viewed a s indicating the support of such third party for the views expressed in this Presentation. Information contained in this Presen tat ion has not been independently verified by the Company, and the Company disclaims any and all liability as to the completeness or accuracy of the information and for any omissions of material facts. The Company disclaims any obligation to correct, update or revise this Presentation or to otherwise provide any additional materials. The Company, its directors and certain of its executive officers are participants in the solicitation of proxies from shareho lde rs in connection with the Company’s 2019 Annual Meeting of Shareholders. Information regarding the direct and indirect interests, b y security holdings or otherwise of the Company’s participants is set forth in the Company’s definitive proxy statement and pro xy supplement for the 2019 Annual Meeting of Shareholders filed with the SEC on December 5, 2019 and December 31, 2019, respectively. The Company’s definitive proxy statement and proxy supplement can be found on the SEC’s website at www.sec.gov or the Company’s website at http://www.enzo.com/corporate/investor - information. Except for historical information, the matters discussed in this Presentation may be considered “forward - looking” statements wit hin the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements include declarations regarding the intent, belief or current expectations of the Company and its management, including those related to cash flow, gross margins, revenues and expenses, which are dependent on a number of factors outside of the control of the Company including, inter alia, the markets for the Company’s products and services, cos ts of goods and services, other expenses, government regulations, litigation and general business conditions. See Risk Factors in the Company’s Form 10 - K for the fiscal year ended July 31, 2019. Investors are cautioned that any such forward - looking statements are not guarantees of future performance and involve a number of risks and uncertainties that could materially affect actual results. The Company disclaims any obligations to update any forward - looking statement as a result of developments occurring after the date of this Presentation. 2

Situation Overview • Harbert Discovery Fund (“Harbert”) — a short - term oriented activist hedge fund focused on micro - cap companies that we believe has no operational experience or background in our sector — is seeking to replace two highly qualified directors up for election at Enzo’s 2019 Annual Meeting and take control of 40% of Enzo’s Board • Over a period of several months, Enzo made concerted efforts to engage constructively with Harbert and understand their persp ect ives, but our efforts to work constructively with Harbert were not reciprocated – Enzo met with Harbert and provided a “Lab Tour” in January 2019 – In May 2019, Harbert demanded that we immediately replace two incumbent directors (with no preference as to which incumbents it wanted to resign) without disclosing to us the names of their proposed replacement candidates until July 2019 – In an effort to engage constructively with Harbert , Enzo waived its request for the D&O questionnaire to be completed; Harbert never responded to our invitation to interview their candidates – In addition to not following standard, reasonable protocol for director nominations, Harbert has not demonstrated knowledge of our business or sector or advanced a coherent plan to improve Enzo • While Harbert has attacked us, Enzo has a history of proactive change to our business and corporate governance profile , informed by active engagement with our shareholders – Exploration of strategic alternatives for Therapeutics business with the assistance of Lazard – Implemented initiatives to reduce costs in light of industry environment – Recent Board addition, Rebecca Fischer, resulting from thoughtful refreshment process, and adoption of Board Diversity Policy – Governance enhancements such as bylaw proposed for adoption of majority voting and modifications to compensation plan to increase alignment with long - term performance – Appointment of new CFO to free Barry Weiner up to focus on operations and ensure that the CFO is no longer a Board member 3

Situation Overview (cont’d) • Enzo’s strategy is the product of extensive analysis and thoughtful planning and is showing meaningful progress – Our business plan is well - vetted and deliberate; in contrast, we believe Harbert’s ill - conceived arguments demonstrate an utter lack of understanding of our business and of the challenges facing the broader diagnostics market and do not create long - term value for Enzo shareholders – Harbert has not made any suggestions to improve the business that Enzo’s Board has not already thoroughly considered • Enzo’s candidates have deep expertise and knowledge of our business and sector and are the right choice to continue Enzo’s progress on its value - creation strategy – By contrast, Harbert’s nominees do not have relevant experience for Enzo and, moreover, repeatedly refused to share any insights or plan for Enzo – The only public company directorship ever held by either candidate is at a micro - cap company based in Georgia (former Soviet Republic) At this critical juncture, replacing two highly qualified candidates with Harbert’s highly questionable nominees should raise significant concerns for shareholders 4

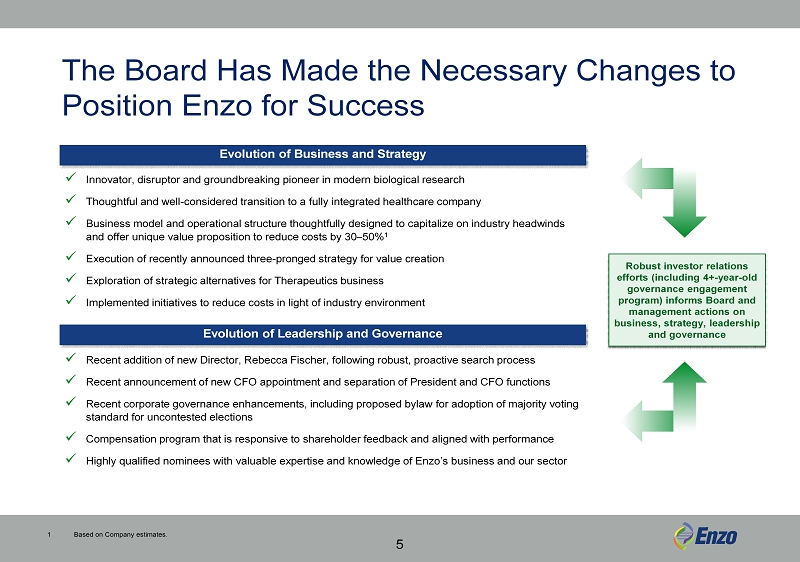

x Innovator, disruptor and groundbreaking pioneer in modern biological research x Thoughtful and well - considered transition to a fully integrated healthcare company x Business model and operational structure thoughtfully designed to capitalize on industry headwinds and offer unique value proposition to reduce costs by 30 – 50% 1 x Execution of recently announced three - pronged strategy for value creation x Exploration of strategic alternatives for Therapeutics business x Implemented initiatives to reduce costs in light of industry environment 5 x Recent addition of new Director, Rebecca Fischer, following robust, proactive search process x Recent announcement of new CFO appointment and separation of President and CFO functions x Recent corporate governance enhancements, including proposed bylaw for adoption of majority voting standard for uncontested elections x Compensation program that is responsive to shareholder feedback and aligned with performance x Highly qualified nominees with valuable expertise and knowledge of Enzo’s business and our sector Evolution of Business and Strategy Evolution of Leadership and Governance 1 Based on Company estimates. Robust investor relations efforts (including 4+ - year - old governance engagement program) informs Board and management actions on business, strategy, leadership and governance The Board Has Made the Necessary Changes to Position Enzo for Success

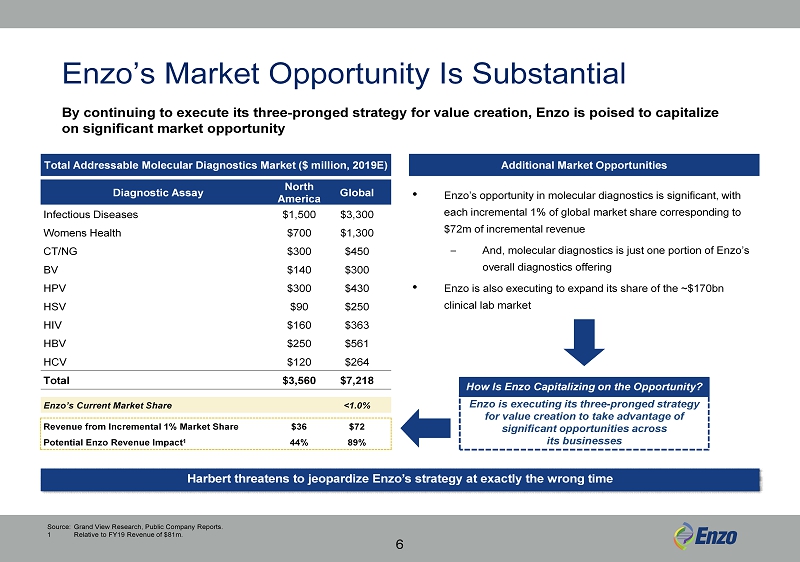

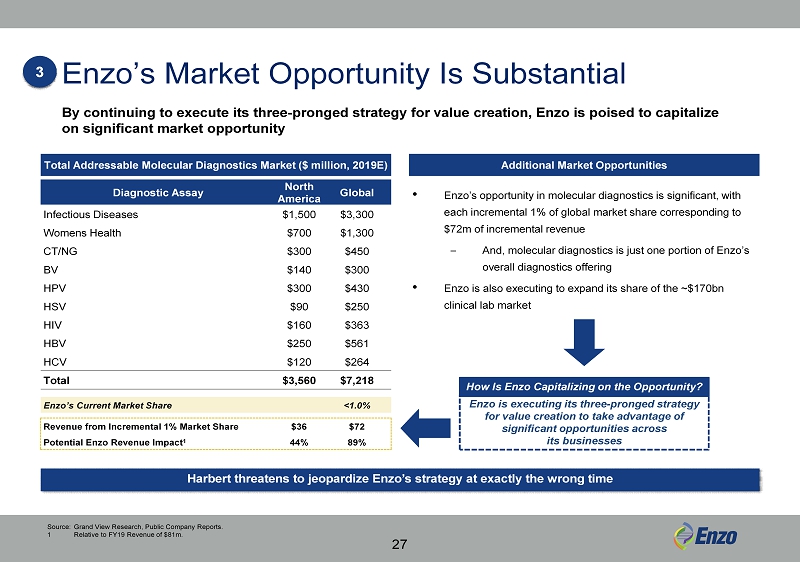

Enzo’s Market Opportunity Is Substantial 6 By continuing to execute its three - pronged strategy for value creation, Enzo is poised to capitalize on significant market opportunity Harbert threatens to jeopardize Enzo’s strategy at exactly the wrong time Diagnostic Assay North America Global Infectious Diseases $1,500 $3,300 Womens Health $700 $1,300 CT/NG $300 $450 BV $140 $300 HPV $300 $430 HSV $90 $250 HIV $160 $363 HBV $250 $561 HCV $120 $264 Total $3,560 $7,218 Enzo’s Current Market Share <1.0% Revenue from Incremental 1% Market Share $36 $72 Potential Enzo Revenue Impact 1 44% 89% • Enzo’s opportunity in molecular diagnostics is significant, with each incremental 1% of global market share corresponding to $72m of incremental revenue – And , molecular diagnostics is just one portion of Enzo’s overall diagnostics offering • Enzo is also executing to expand its share of the ~$170bn clinical lab market Total Addressable Molecular Diagnostics Market ($ million, 2019E) Additional Market Opportunities Source: Grand View Research, Public Company Reports. 1 Relative to FY19 Revenue of $81m. Enzo is executing its three - pronged strategy for value creation to take advantage of significant opportunities across its businesses How Is Enzo Capitalizing on the Opportunity?

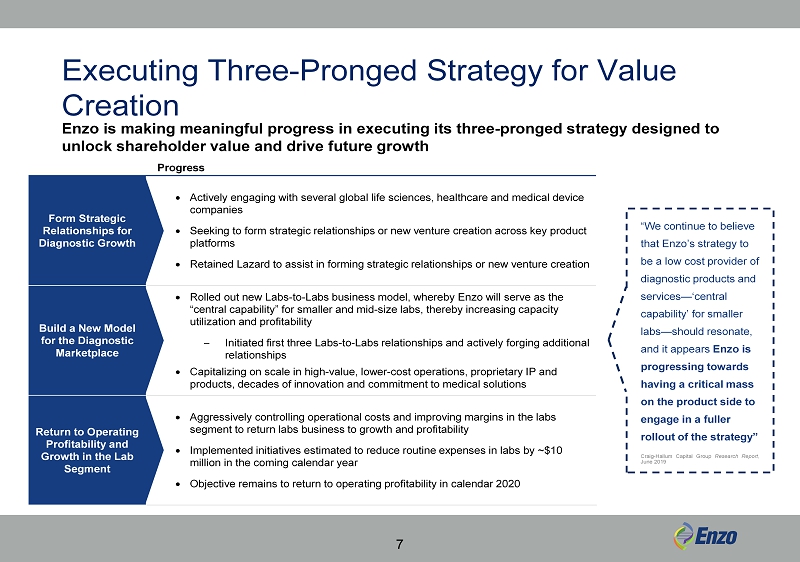

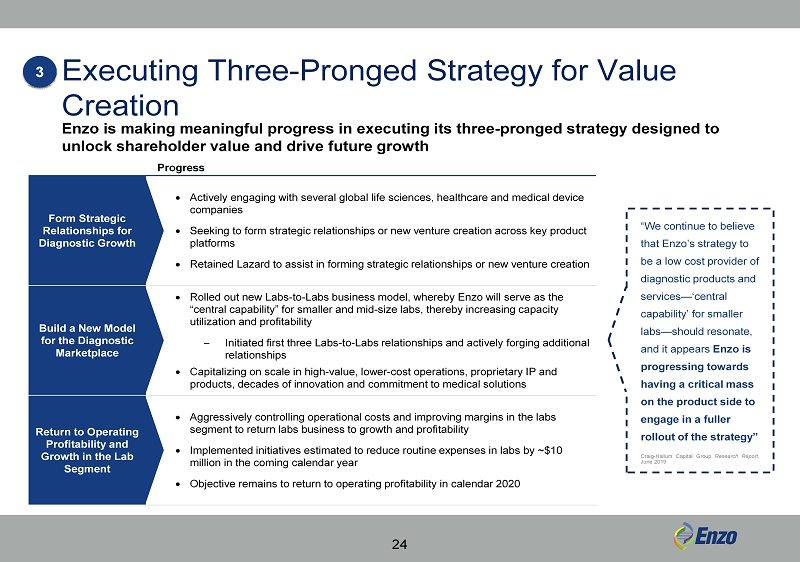

“We continue to believe that Enzo’s strategy to be a low cost provider of diagnostic products and services — ’ central capability’ for smaller labs — should resonate, and it appears Enzo is progressing towards having a critical mass on the product side to engage in a fuller rollout of the strategy” Craig - Hallum Capital Group Research Report , June 2019 Executing Three - Pronged Strategy for Value Creation Progress Form Strategic Relationships for Diagnostic Growth Actively engaging with several global life sciences, healthcare and medical device companies Seeking to form strategic relationships or new venture creation across key product platforms Retained Lazard to assist in forming strategic relationships or new venture creation Build a New Model for the Diagnostic Marketplace Rolled out new Labs - to - Labs business model, whereby Enzo will serve as the “central capability” for smaller and mid - size labs, thereby increasing capacity utilization and profitability – Initiated first three Labs - to - Labs relationships and actively forging additional relationships Capitalizing on scale in high - value, lower - cost operations, proprietary IP and products, decades of innovation and commitment to medical solutions Return to Operating Profitability and Growth in the Lab Segment Aggressively controlling operational costs and improving margins in the labs segment to return labs business to growth and profitability Implemented initiatives estimated to reduce routine expenses in labs by ~$10 million in the coming calendar year Objective remains to return to operating profitability in calendar 2020 Enzo is making meaningful progress in executing its three - pronged strategy designed to unlock shareholder value and drive future growth 7

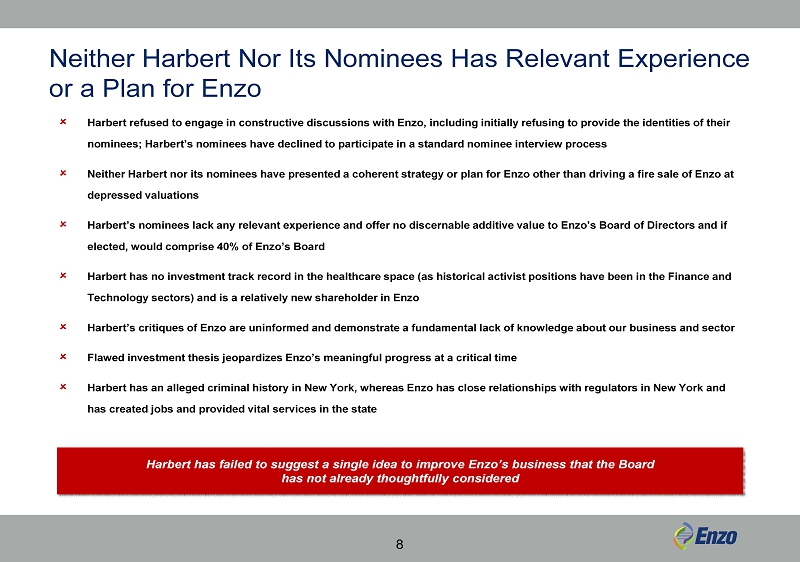

Neither Harbert Nor Its Nominees Has Relevant Experience or a Plan for Enzo Harbert refused to engage in constructive discussions with Enzo, including initially refusing to provide the identities of their nominees; Harbert’s nominees have declined to participate in a standard nominee interview process Neither Harbert nor its nominees have presented a coherent strategy or plan for Enzo other than driving a fire sale of Enzo at depressed valuations Harbert’s nominees lack any relevant experience and offer no discernable additive value to Enzo’s Board of Directors and if elected, would comprise 40% of Enzo’s Board Harbert has no investment track record in the healthcare space (as historical activist positions have been in the Finance and Technology sectors) and is a relatively new shareholder in Enzo Harbert’s critiques of Enzo are uninformed and demonstrate a fundamental lack of knowledge about our business and sector Flawed investment thesis jeopardizes Enzo’s meaningful progress at a critical time Harbert has an alleged criminal history in New York, whereas Enzo has close relationships with regulators in New York and has created jobs and provided vital services in the state 8 Harbert has failed to suggest a single idea to improve Enzo’s business that the Board has not already thoughtfully considered

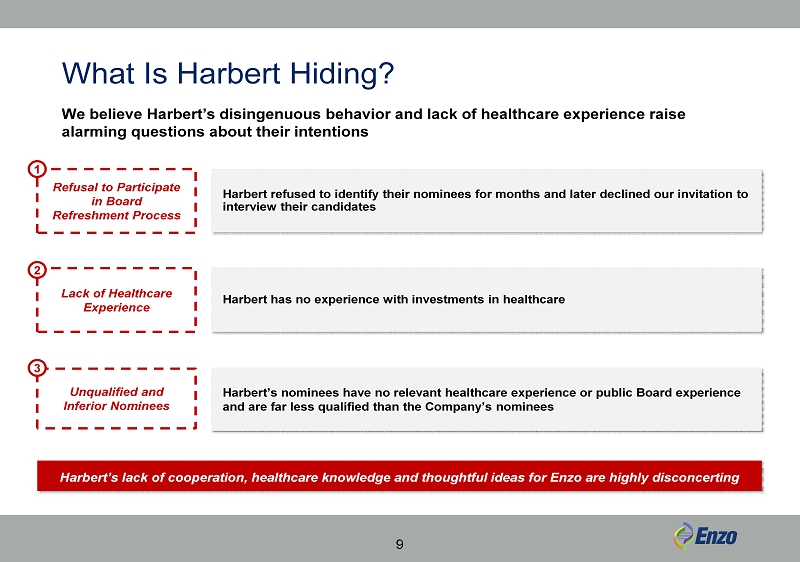

Unqualified and Inferior Nominees Lack of Healthcare Experience What Is Harbert Hiding? We believe Harbert’s disingenuous behavior and lack of healthcare experience raise alarming questions about their intentions Refusal to Participate in Board Refreshment Process 1 2 3 9 Harbert’s lack of cooperation, healthcare knowledge and thoughtful ideas for Enzo are highly disconcerting Harbert refused to identify their nominees for months and later declined our invitation to interview their candidates Harbert has no experience with investments in healthcare Harbert’s nominees have no relevant healthcare experience or public Board experience and are far less qualified than the Company’s nominees

The Choice for Shareholders Is Clear: Vote for Enzo’s Nominees on the WHITE Card 10

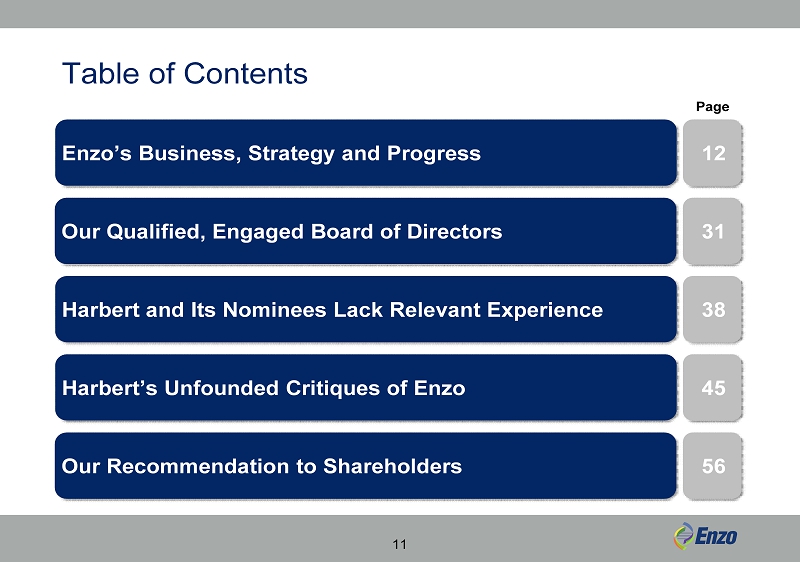

Table of Contents Enzo’s Business, Strategy and Progress Our Qualified, Engaged Board of Directors Harbert and Its Nominees Lack Relevant Experience Harbert’s Unfounded Critiques of Enzo Our Recommendation to Shareholders 11 12 31 38 45 56 Page

Our Recommendation to Shareholders Enzo’s Business, Strategy and Progress Our Qualified, Engaged Board of Directors Harbert and Its Nominees Lack Relevant Experience Harbert’s Unfounded Critiques of Enzo 12

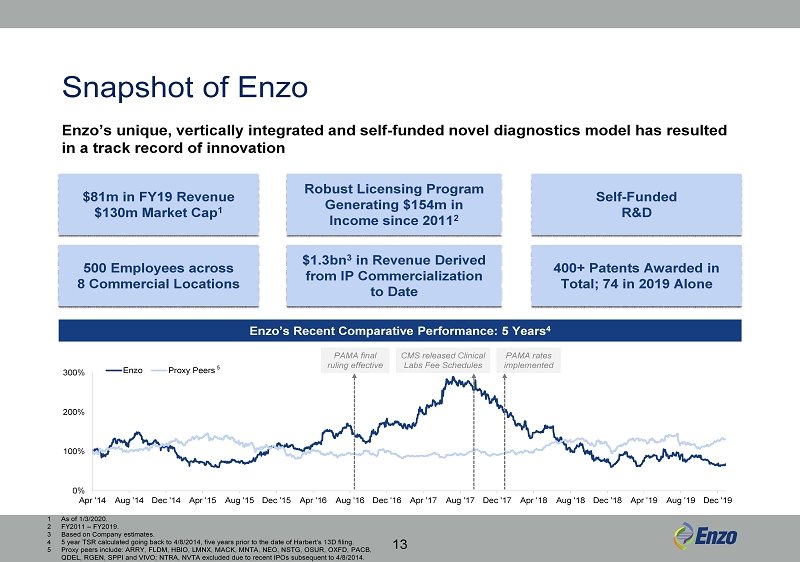

Snapshot of Enzo 13 Enzo’s unique, vertically integrated and self - funded novel diagnostics model has resulted in a track record of innovation Self - Funded R&D Robust Licensing Program Generating $154m in Income since 2011 2 $1.3bn 3 in Revenue Derived from IP Commercialization to Date $ 81m in FY19 Revenue $130m Market Cap 1 500 Employees across 8 Commercial Locations 400+ Patents Awarded in Total; 74 in 2019 Alone Enzo’s Recent Comparative Performance: 5 Years 4 0% 100% 200% 300% Apr ’14 Aug ’14 Dec ’14 Apr ’15 Aug ’15 Dec ’15 Apr ’16 Aug ’16 Dec ’16 Apr ’17 Aug ’17 Dec ’17 Apr ’18 Aug ’18 Dec ’18 Apr ’19 Aug ’19 Dec ’19 Enzo Proxy Peers 5 1 As of 1/3/2020. 2 FY2011 – FY2019. 3 Based on Company estimates. 4 5 year TSR calculated going back to 4/8/2014, five years prior to the date of Harbert’s 13D filing . 5 Proxy peers include: ARRY, FLDM, HBIO, LMNX, MACK, MNTA, NEO, NSTG, OSUR, OXFD, PACB, QDEL, RGEN, SPPI and VIVO; NTRA, NVTA excluded due to recent IPOs subsequent to 4/8/2014. PAMA final ruling effective CMS released Clinical Labs Fee Schedules PAMA rates implemented

• Enzo is the new model for a modern diagnostics company, with a unique and synergistic vertical integration model that fuels Enzo’s value creation - Enzo’s diagnostics, clinical services and innovation and IP technology platforms are interdependent and allow Enzo to deliver 30 – 50% 1 cost savings to customers based on current market prices • Enzo is well - positioned to succeed in spite of recent industry headwinds - Declining reimbursement and increasing costs are sector - wide headwinds but create opportunities for Enzo’s unique cost savings proposition • Enzo is actively executing its three - pronged strategy for value creation and making progress • Enzo’s track record of innovation and disruption continues today and enables a highly profitable IP strategy • Enzo’s robust and experienced management team provides thoughtful , experienced and engaged leadership 1 2 3 4 Overview of Enzo’s Business Enzo has evolved into a new model for a modern diagnostics company, with a unique and strategic vertical integration that positions Enzo to capitalize upon ongoing pressures in the diagnostics market place 14 1 Based on Company estimates. 5

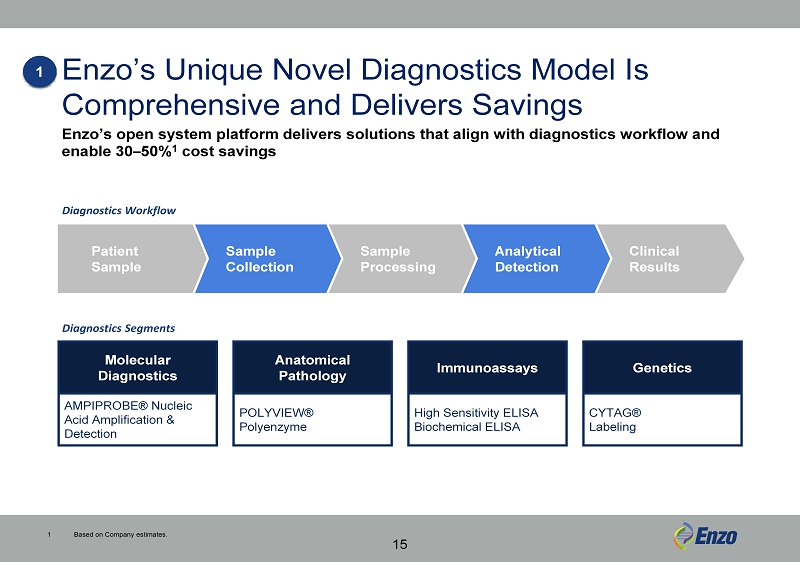

Enzo’s Unique Novel Diagnostics Model Is Comprehensive and Delivers Savings 15 Clinical Results Analytical Detection Sample Processing Sample Collection Patient Sample Diagnostics Workflow Diagnostics Segments Enzo’s open system platform delivers solutions that align with diagnostics workflow and enable 30 – 50% 1 cost savings 1 Molecular Diagnostics AMPIPROBE® Nucleic Acid Amplification & Detection Anatomical Pathology POLYVIEW® Polyenzyme Immunoassays High Sensitivity ELISA Biochemical ELISA Genetics CYTAG® Labeling 1 Based on Company estimates.

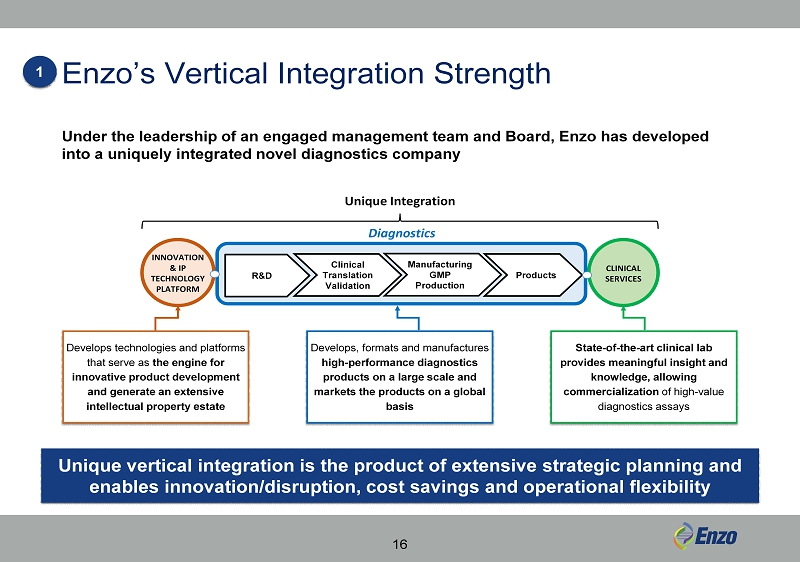

Enzo’s Vertical Integration Strength Under the leadership of an engaged management team and Board, Enzo has developed into a uniquely integrated novel diagnostics company Unique vertical integration is the product of extensive strategic planning and enables innovation/disruption, cost savings and operational flexibility INNOVATION & IP TECHNOLOGY PLATFORM CLINICAL SERVICES Clinical Translation Validation Manufacturing GMP Production Products R&D Diagnostics Unique Integration Develops technologies and platforms that serve as the engine for innovative product development and generate an extensive intellectual property estate State - of - the - art clinical lab provides meaningful insight and knowledge, allowing commercialization of high - value diagnostics assays Develops, formats and manufactures high - performance diagnostics products on a large scale and markets the products on a global basis 16 1

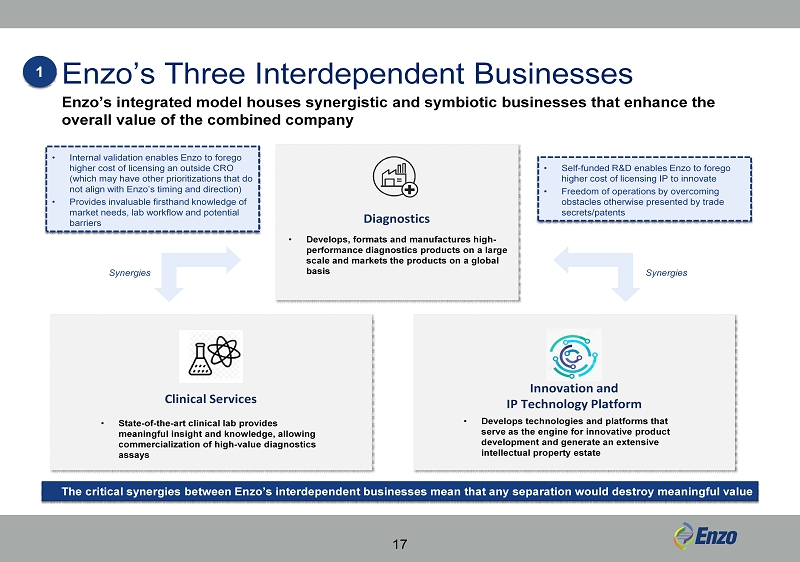

Enzo’s Three Interdependent Businesses 17 • Develops, formats and manufactures high - performance diagnostics products on a large scale and markets the products on a global basis Diagnostics • Internal validation enables Enzo to forego higher cost of licensing an outside CRO (which may have other prioritizations that do not align with Enzo’s timing and direction) • Provides invaluable firsthand knowledge of market needs, lab workflow and potential barriers • Self - funded R&D enables Enzo to forego higher cost of licensing IP to innovate • Freedom of operations by overcoming obstacles otherwise presented by trade secrets/patents Enzo’s integrated model houses synergistic and symbiotic businesses that enhance the overall value of the combined company • Develops technologies and platforms that serve as the engine for innovative product development and generate an extensive intellectual property estate Innovation and IP Technology Platform Clinical Services • State - of - the - art clinical lab provides meaningful insight and knowledge, allowing commercialization of high - value diagnostics assays The critical synergies between Enzo’s interdependent businesses mean that any separation would destroy meaningful value Synergies Synergies 1

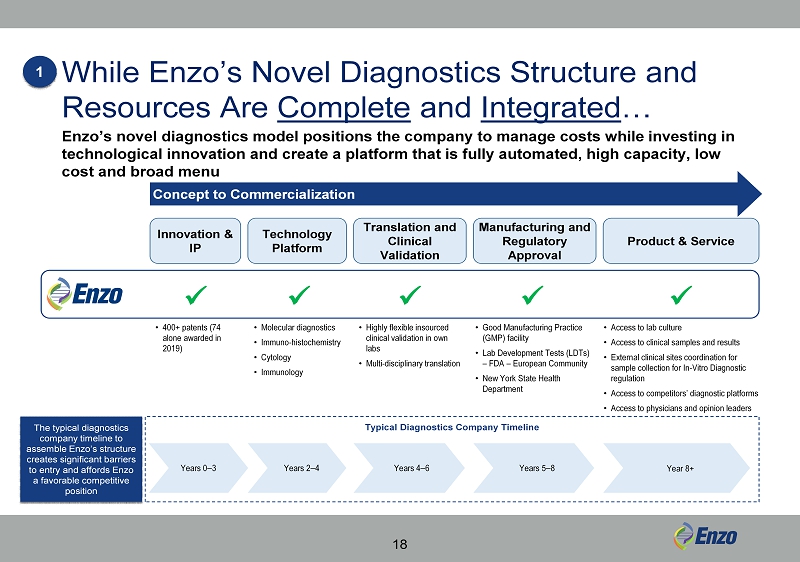

Typical Diagnostics Company Timeline While Enzo’s Novel Diagnostics Structure and Resources Are Complete and Integrated … Enzo’s novel diagnostics model positions the company to manage costs while investing in technological innovation and create a platform that is fully automated, high capacity, low cost and broad menu Technology Platform Manufacturing and Regulatory Approval Translation and Clinical Validation Product & Service Innovation & IP • Good Manufacturing Practice (GMP) facility • Lab Development Tests (LDTs) – FDA – European Community • New York State Health Department • Access to lab culture • Access to clinical samples and results • External clinical sites coordination for sample collection for In - Vitro Diagnostic regulation • Access to competitors’ diagnostic platforms • Access to physicians and opinion leaders x x x x x • Highly flexible insourced clinical validation in own labs • Multi - disciplinary translation • Molecular diagnostics • Immuno - histochemistry • Cytology • Immunology • 400 + patents (74 alone awarded in 2019) 18 Years 0 – 3 Years 2 – 4 Years 4 – 6 Years 5 – 8 Year 8+ Concept to Commercialization The typical diagnostics company timeline to assemble Enzo’s structure creates significant barriers to entry and affords Enzo a favorable competitive position 1

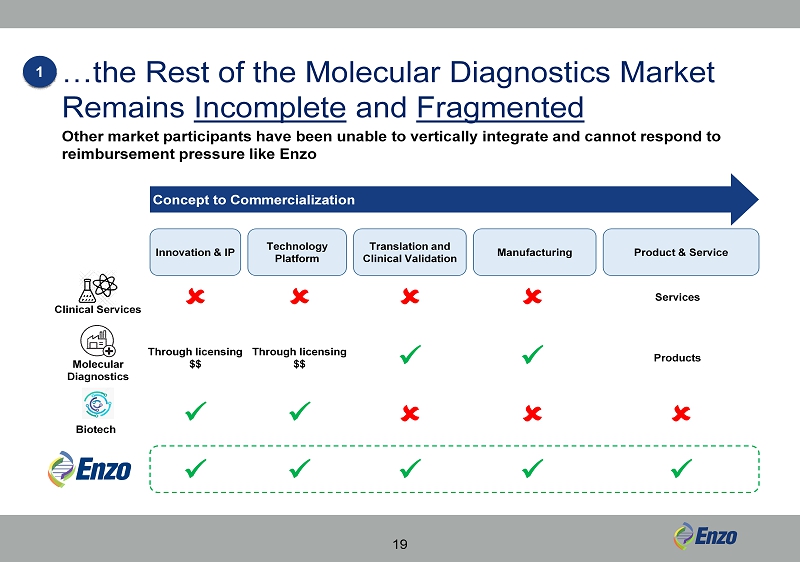

…the Rest of the Molecular Diagnostics Market Remains Incomplete and Fragmented Biotech x Molecular Diagnostics Products Through licensing $$ Clinical Services Services Through licensing $$ x x x x x x x x Concept to Commercialization Other market participants have been unable to vertically integrate and cannot respond to reimbursement pressure like Enzo 19 Technology Platform Manufacturing Translation and Clinical Validation Product & Service Innovation & IP 1

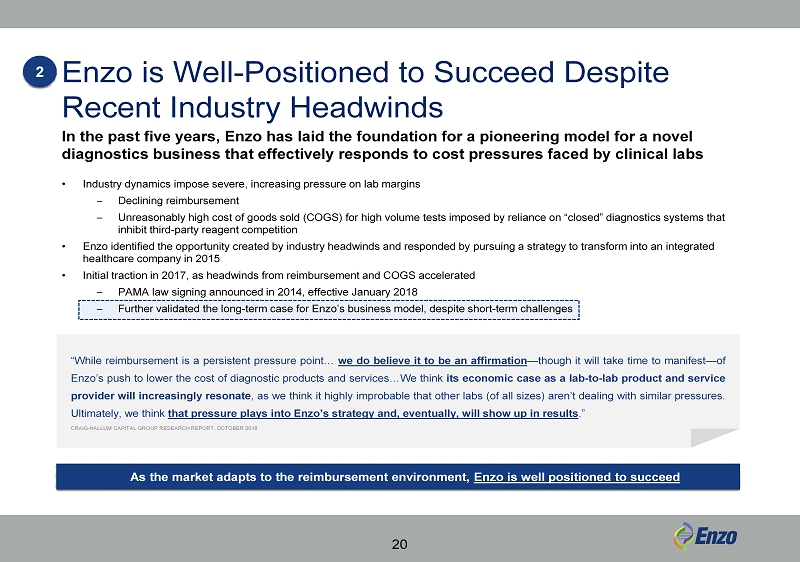

Enzo is Well - Positioned to Succeed Despite Recent Industry Headwinds In the past five years, Enzo has laid the foundation for a pioneering model for a novel diagnostics business that effectively responds to cost pressures faced by clinical labs 20 • Industry dynamics impose severe, increasing pressure on lab margins – Declining reimbursement – Unreasonably high cost of goods sold (COGS) for high volume tests imposed by reliance on “closed” diagnostics systems that inhibit third - party reagent competition • Enzo identified the opportunity created by industry headwinds and responded by pursuing a strategy to transform into an integrated healthcare company in 2015 • Initial traction in 2017, as headwinds from reimbursement and COGS accelerated – PAMA law signing announced in 2014, effective January 2018 – Further validated the long - term case for Enzo’s business model, despite short - term challenges As the market adapts to the reimbursement environment, Enzo is well positioned to succeed “While reimbursement is a persistent pressure point … we do believe it to be an affirmation — though it will take time to manifest — of Enzo’s push to lower the cost of diagnostic products and services … We think its economic case as a lab - to - lab product and service provider will increasingly resonate , as we think it highly improbable that other labs (of all sizes) aren’t dealing with similar pressures . Ultimately, we think that pressure plays into Enzo’s strategy and, eventually, will show up in results . ” CRAIG - HALLUM CAPITAL GROUP RESEARCH REPORT, OCTOBER 2018 2

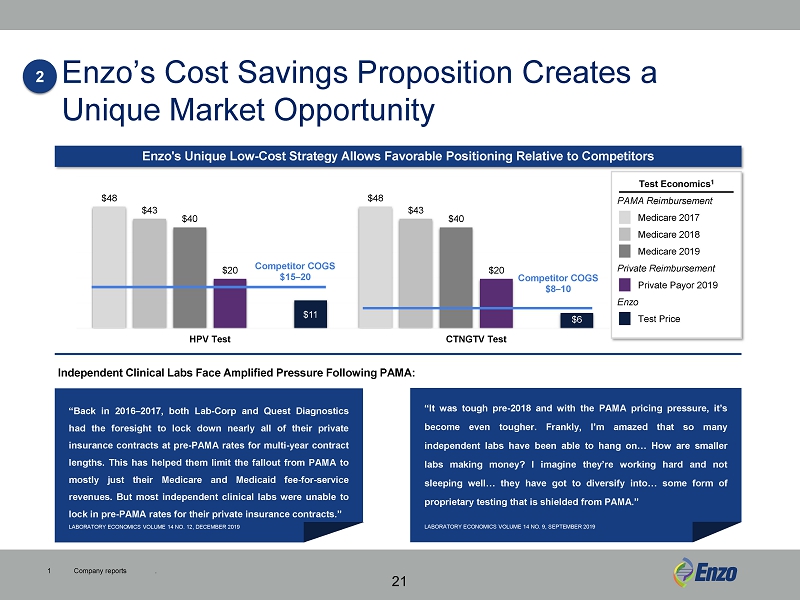

Enzo’s Cost Savings Proposition Creates a Unique Market Opportunity 21 Enzo’s Unique Low - Cost Strategy Allows Favorable Positioning Relative to Competitors 1 Company reports . “It was tough pre - 2018 and with the PAMA pricing pressure, it’s become even tougher . Frankly, I’m amazed that so many independent labs have been able to hang on … How are smaller labs making money? I imagine they’re working hard and not sleeping well … they have got to diversify into … some form of proprietary testing that is shielded from PAMA . ” LABORATORY ECONOMICS VOLUME 14 NO . 9 , SEPTEMBER 2019 “Back in 2016 – 2017 , both Lab - Corp and Quest Diagnostics had the foresight to lock down nearly all of their private insurance contracts at pre - PAMA rates for multi - year contract lengths . This has helped them limit the fallout from PAMA to mostly just their Medicare and Medicaid fee - for - service revenues . But most independent clinical labs were unable to lock in pre - PAMA rates for their private insurance contracts . ” LABORATORY ECONOMICS VOLUME 14 NO. 12, DECEMBER 2019 Independent Clinical Labs Face Amplified Pressure Following PAMA: 2 $48 $48 [VALUE] $43 $40 $40 $20 $20 $11 $6 HPV Test CTNGTV Test Competitor COGS $8 – 10 Competitor COGS $ 15 – 20 Test Economics 1 PAMA Reimbursement Medicare 2017 Medicare 2018 Medicare 2019 Private Reimbursement Private Payor 2019 Enzo Test Price

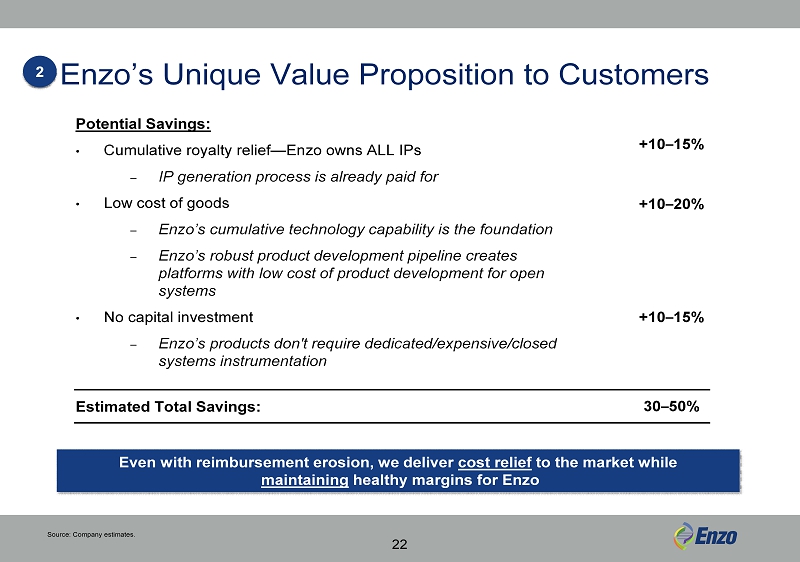

Enzo’s Unique Value Proposition to Customers Potential Savings: • Cumulative royalty relief — Enzo owns ALL IPs – IP generation process is already paid for • Low cost of goods – Enzo’s cumulative technology capability is the foundation – Enzo’s robust product development pipeline creates platforms with low cost of product development for open systems • No capital investment – Enzo’s products don’t require dedicated/expensive/closed systems instrumentation Even with reimbursement erosion, we deliver cost relief to the market while maintaining healthy margins for Enzo +10 – 15% +10 – 20% +10 – 15% Source: Company estimates. 22 Estimated Total Savings: 30 – 50% 2

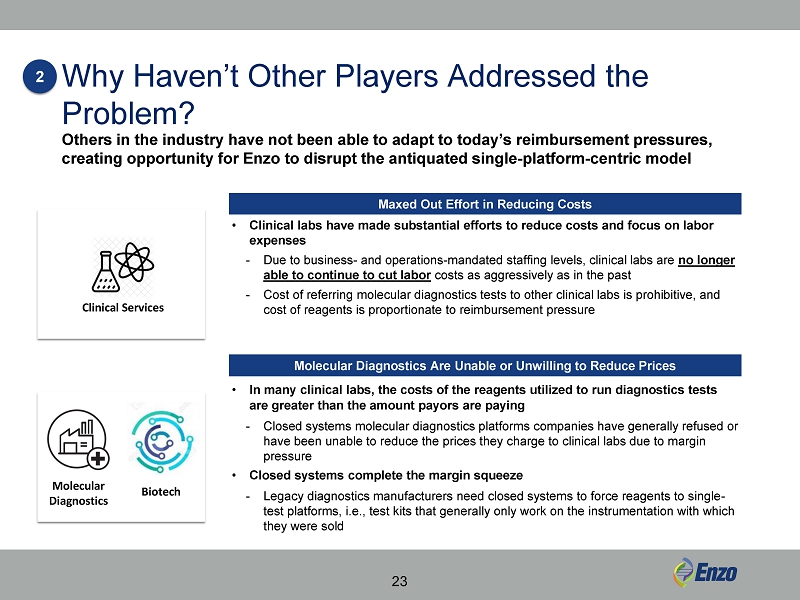

Why Haven’t Other Players Addressed the Problem? Others in the industry have not been able to adapt to today’s reimbursement pressures, creating opportunity for Enzo to disrupt the antiquated single - platform - centric model • Clinical labs have made substantial efforts to reduce costs and focus on labor expenses - Due to business - and operations - mandated staffing levels, clinical labs are no longer able to continue to cut labor costs as aggressively as in the past - Cost of referring molecular diagnostics tests to other clinical labs is prohibitive, and cost of reagents is proportionate to reimbursement pressure • In many clinical labs, the costs of the reagents utilized to run diagnostics tests are greater than the amount payors are paying - Closed systems molecular diagnostics platforms companies have generally refused or have been unable to reduce the prices they charge to clinical labs due to margin pressure • Closed systems complete the margin squeeze - Legacy diagnostics manufacturers need closed systems to force reagents to single - test platforms, i.e., test kits that generally only work on the instrumentation with which they were sold Maxed Out Effort in Reducing Costs Molecular Diagnostics Are Unable or Unwilling to Reduce Prices Biotech Molecular Diagnostics Clinical Services 23 2

Executing Three - Pronged Strategy for Value Creation Progress Form Strategic Relationships for Diagnostic Growth Actively engaging with several global life sciences, healthcare and medical device companies Seeking to form strategic relationships or new venture creation across key product platforms Retained Lazard to assist in forming strategic relationships or new venture creation Build a New Model for the Diagnostic Marketplace Rolled out new Labs - to - Labs business model, whereby Enzo will serve as the “central capability” for smaller and mid - size labs, thereby increasing capacity utilization and profitability – Initiated first three Labs - to - Labs relationships and actively forging additional relationships Capitalizing on scale in high - value, lower - cost operations, proprietary IP and products, decades of innovation and commitment to medical solutions Return to Operating Profitability and Growth in the Lab Segment Aggressively controlling operational costs and improving margins in the labs segment to return labs business to growth and profitability Implemented initiatives estimated to reduce routine expenses in labs by ~$10 million in the coming calendar year Objective remains to return to operating profitability in calendar 2020 Enzo is making meaningful progress in executing its three - pronged strategy designed to unlock shareholder value and drive future growth 24 3 “We continue to believe that Enzo’s strategy to be a low cost provider of diagnostic products and services — ’ central capability’ for smaller labs — should resonate, and it appears Enzo is progressing towards having a critical mass on the product side to engage in a fuller rollout of the strategy” Craig - Hallum Capital Group Research Report , June 2019

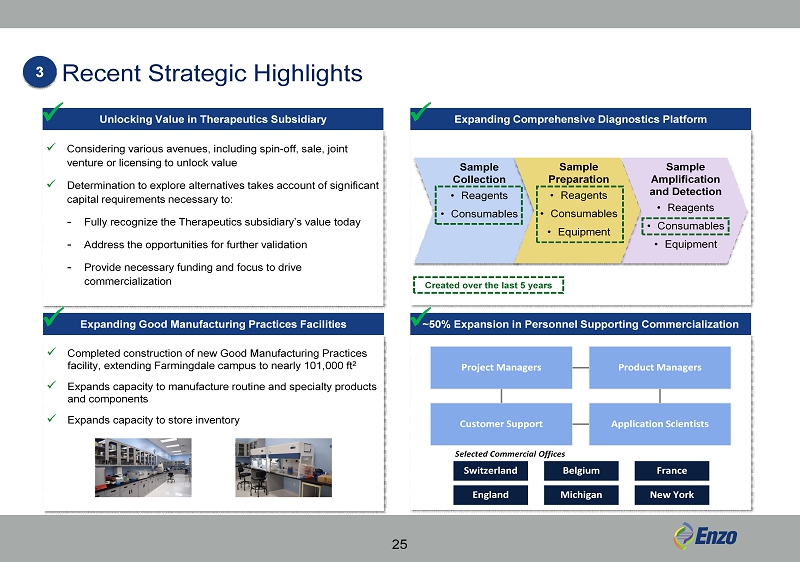

Recent Strategic Highlights 25 3 ~50% Expansion in Personnel Supporting Commercialization x Project Managers Product Managers Customer Support Application Scientists Switzerland Belgium France England Michigan New York Selected Commercial Offices Expanding Good Manufacturing Practices Facilities x x Completed construction of new Good Manufacturing Practices facility, extending Farmingdale campus to nearly 101,000 ft 2 x Expands capacity to manufacture routine and specialty products and components x Expands capacity to store inventory Expanding Comprehensive Diagnostics Platform x Sample Amplification and Detection • Reagents • Consumables • Equipment Sample Collection • Reagents • Consumables Created over the last 5 years Sample Preparation • Reagents • Consumables • Equipment Unlocking Value in Therapeutics Subsidiary x x Considering various avenues, including spin - off, sale, joint venture or licensing to unlock value x Determination to explore alternatives takes account of significant capital requirements necessary to: - Fully recognize the T herapeutics subsidiary’s value today - Address the opportunities for further validation - Provide necessary funding and focus to drive commercialization

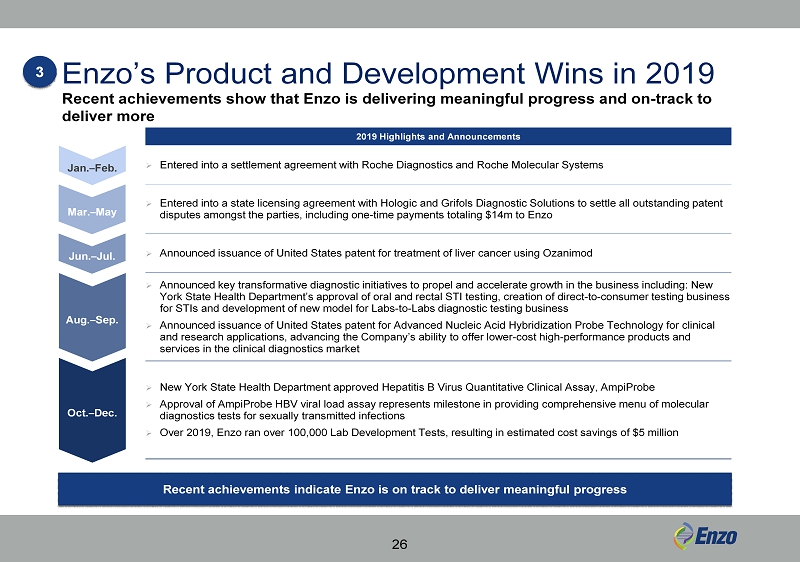

Enzo’s Product and Development Wins in 2019 26 2019 Highlights and Announcements » Entered into a settlement agreement with Roche Diagnostics and Roche Molecular Systems » Entered into a state licensing agreement with Hologic and Grifols Diagnostic Solutions to settle all outstanding patent disputes amongst the parties, including one - time payments totaling $14m to Enzo » Announced issuance of United States patent for treatment of liver cancer using Ozanimod » Announced key transformative diagnostic initiatives to propel and accelerate growth in the business including: New York State Health Department’s approval of oral and rectal STI testing, creation of direct - to - consumer testing business for STIs and development of new model for Labs - to - Labs diagnostic testing business » Announced issuance of United States patent for Advanced Nucleic Acid Hybridization Probe Technology for clinical and research applications, advancing the Company’s ability to offer lower - cost high - performance products and services in the clinical diagnostics market » New York State Health Department approved Hepatitis B Virus Quantitative Clinical Assay, AmpiProbe » Approval of AmpiProbe HBV viral load assay represents milestone in providing comprehensive menu of molecular diagnostics tests for sexually transmitted infections » Over 2019, Enzo ran over 100,000 Lab Development Tests, resulting in estimated cost savings of $5 million Recent achievements indicate Enzo is on track to deliver meaningful progress Recent achievements show that Enzo is delivering meaningful progress and on - track to deliver more Oct. – Dec. Aug. – Sep. Jun. – Jul. Mar. – May Jan. – Feb. 3

Enzo’s Market Opportunity Is Substantial 27 By continuing to execute its three - pronged strategy for value creation, Enzo is poised to capitalize on significant market opportunity Harbert threatens to jeopardize Enzo’s strategy at exactly the wrong time Diagnostic Assay North America Global Infectious Diseases $1,500 $3,300 Womens Health $700 $1,300 CT/NG $300 $450 BV $140 $300 HPV $300 $430 HSV $90 $250 HIV $160 $363 HBV $250 $561 HCV $120 $264 Total $3,560 $7,218 Enzo’s Current Market Share <1.0% Revenue from Incremental 1% Market Share $36 $72 Potential Enzo Revenue Impact 1 44% 89% • Enzo’s opportunity in molecular diagnostics is significant, with each incremental 1% of global market share corresponding to $72m of incremental revenue – And , molecular diagnostics is just one portion of Enzo’s overall diagnostics offering • Enzo is also executing to expand its share of the ~$170bn clinical lab market Total Addressable Molecular Diagnostics Market ($ million, 2019E) Additional Market Opportunities Source: Grand View Research, Public Company Reports. 1 Relative to FY19 Revenue of $81m. Enzo is executing its three - pronged strategy for value creation to take advantage of significant opportunities across its businesses How Is Enzo Capitalizing on the Opportunity? 3

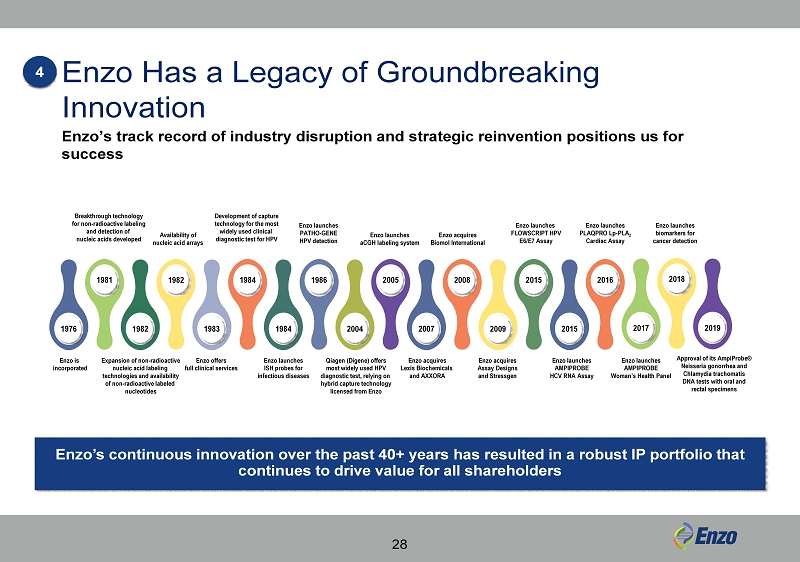

Enzo Has a Legacy of Groundbreaking Innovation Enzo’s track record of industry disruption and strategic reinvention positions us for success 28 1976 1981 1982 1982 1983 1984 1984 1986 2004 2005 2007 2008 2009 2015 2015 2016 2017 2018 2019 Enzo is incorporated Breakthrough technology for non - radioactive labeling and detection of nucleic acids developed Expansion of non - radioactive nucleic acid labeling technologies and availability of non - radioactive labeled nucleotides Availability of nucleic acid arrays Enzo offers full clinical services Development of capture technology for the most widely used clinical diagnostic test for HPV Enzo launches ISH probes for infectious diseases Enzo launches PATHO - GENE HPV detection Qiagen (Digene) offers most widely used HPV diagnostic test, relying on hybrid capture technology licensed from Enzo Enzo launches aCGH labeling system Enzo acquires Lexis Biochemicals and AXXORA Enzo acquires Biomol International Enzo acquires Assay Designs and Stressgen Enzo launches FLOWSCRIPT HPV E6/E7 Assay Enzo launches AMPIPROBE HCV RNA Assay Enzo launches PLAQPRO Lp - PLA 2 Cardiac Assay Enzo launches AMPIPROBE Woman’s Health Panel Enzo launches biomarkers for cancer detection Approval of its AmpiProbe® Neisseria gonorrhea and Chlamydia trachomatis DNA tests with oral and rectal specimens Enzo’s continuous innovation over the past 40+ years has resulted in a robust IP portfolio that continues to drive value for all shareholders 4

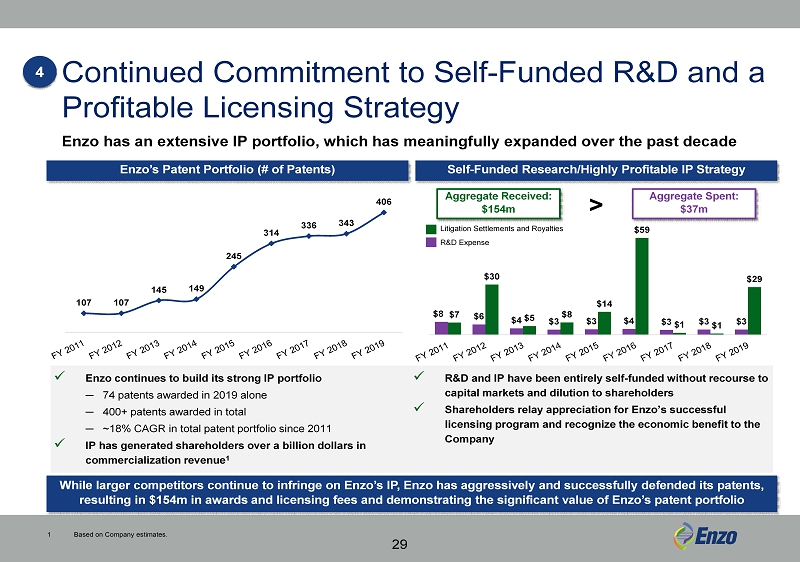

Continued Commitment to Self - Funded R&D and a Profitable Licensing Strategy Enzo has an extensive IP portfolio, which has meaningfully expanded over the past decade 107 107 145 149 245 314 336 343 406 Enzo’s Patent Portfolio (# of Patents) While larger competitors continue to infringe on Enzo’s IP, Enzo has aggressively and successfully defended its patents, resulting in $154m in awards and licensing fees and demonstrating the significant value of Enzo’s patent portfolio 29 $8 $6 $4 $3 $3 $4 $3 $3 $3 $7 $30 $5 $8 $14 $59 $1 $1 $29 Self - Funded Research/Highly Profitable IP Strategy Aggregate Spent : $37m Aggregate Received: $154m > Litigation Settlements and Royalties R&D Expense 1 Based on Company estimates. x Enzo continues to build its strong IP portfolio ─ 74 patents awarded in 2019 alone ─ 400+ patents awarded in total ─ ~ 18% CAGR in total patent portfolio since 2011 x IP has generated shareholders over a billion dollars in commercialization revenue 1 x R&D and IP have been entirely self - funded without recourse to capital markets and dilution to shareholders x Shareholders relay appreciation for Enzo’s successful licensing program and recognize the economic benefit to the Company 4

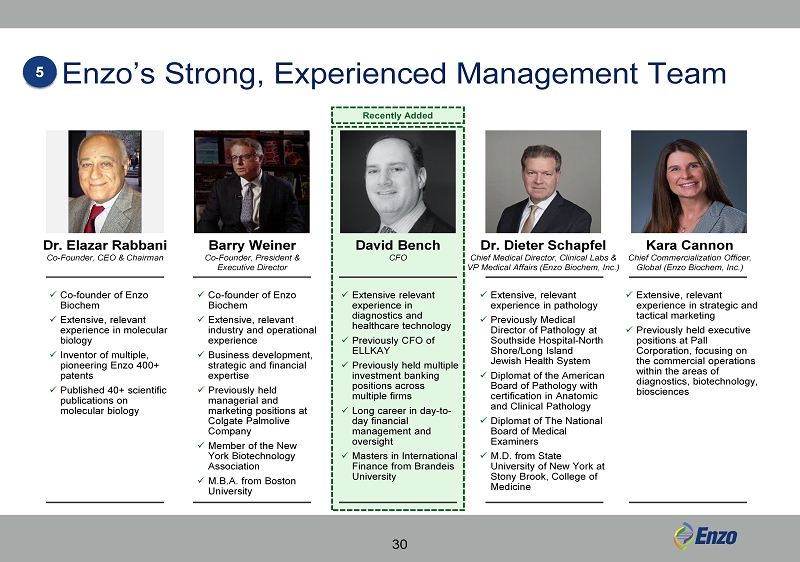

Enzo’s Strong, Experienced Management Team Dr. Elazar Rabbani Co - Founder, CEO & Chairman Barry Weiner Co - Founder, President & Executive Director x Co - founder of Enzo Biochem x Extensive, relevant experience in molecular biology x Inventor of multiple, pioneering Enzo 400+ patents x Published 40+ scientific publications on molecular biology Dr. Dieter Schapfel Chief Medical Director, Clinical Labs & VP Medical Affairs (Enzo Biochem, Inc.) Kara Cannon Chief Commercialization Officer, Global (Enzo Biochem, I nc.) 30 x Co - founder of Enzo Biochem x Extensive , relevant industry and operational experience x Business development, strategic and financial expertise x Previously held managerial and marketing positions at Colgate Palmolive Company x Member of the New York Biotechnology Association x M.B.A. from Boston University David Bench CFO x Extensive relevant experience in diagnostics and healthcare technology x Previously CFO of ELLKAY x Previously held multiple investment banking positions across multiple firms x Long career in day - to - day financial management and oversight x Masters in International Finance from Brandeis University x Extensive, relevant experience in pathology x Previously Medical Director of Pathology at Southside Hospital - North Shore/Long Island Jewish Health System x Diplomat of the American Board of Pathology with certification in Anatomic and Clinical Pathology x Diplomat of The National Board of Medical Examiners x M.D. from State University of New York at Stony Brook, College of Medicine x Extensive, relevant experience in strategic and tactical marketing x Previously held executive positions at Pall Corporation, focusing on the commercial operations within the areas of diagnostics, biotechnology, biosciences Recently Added 5

Our Recommendation to Shareholders Enzo’s Business, Strategy and Progress Our Qualified, Engaged Board of Directors Harbert and Its Nominees Lack Relevant Experience Harbert’s Unfounded Critiques of Enzo 31

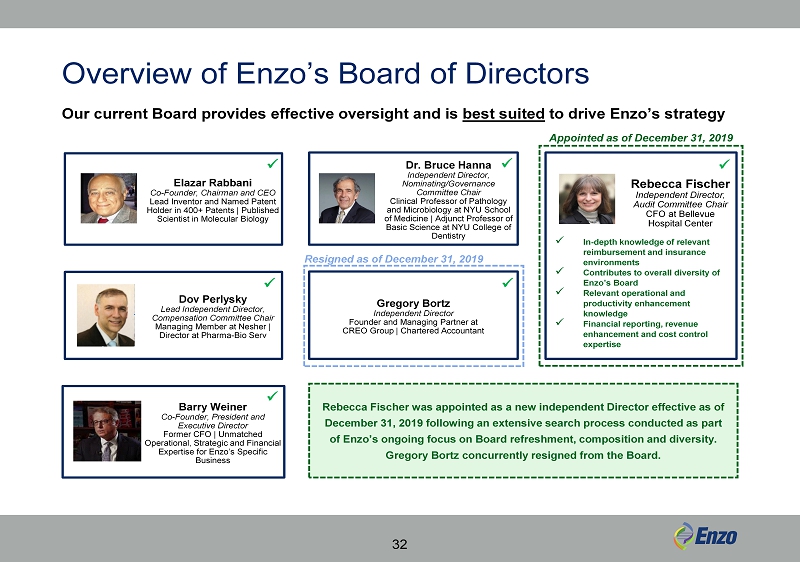

Appointed as of December 31, 2019 Resigned as of December 31, 2019 Our current Board provides effective oversight and is best suited to drive Enzo’s strategy Overview of Enzo’s Board of Directors 32 Elazar Rabbani Co - Founder, Chairman and CEO Lead Inventor and Named Patent Holder in 400+ Patents | Published Scientist in Molecular Biology x Dov Perlysky Lead Independent Director, Compensation Committee Chair Managing Member at Nesher | Director at Pharma - Bio Serv x Barry Weiner Co - Founder, President and Executive Director Former CFO | Unmatched Operational, Strategic and Financial Expertise for Enzo’s Specific Business x Dr. Bruce Hanna Independent Director, Nominating/Governance Committee Chair Clinical Professor of Pathology and Microbiology at NYU School of Medicine | Adjunct Professor of Basic Science at NYU College of Dentistry x Rebecca Fischer Independent Director, Audit Committee Chair CFO at Bellevue Hospital Center x Gregory Bortz Independent Director Founder and Managing Partner at CREO Group | Chartered Accountant x x In - depth knowledge of relevant reimbursement and insurance environments x Contributes to overall diversity of Enzo’s Board x Relevant operational and productivity enhancement knowledge x Financial reporting, revenue enhancement and cost control expertise Rebecca Fischer was appointed as a new independent Director effective as of December 31, 2019 following an extensive search process conducted as part of Enzo’s ongoing focus on Board refreshment, composition and diversity . Gregory Bortz concurrently resigned from the Board.

Barry Weiner Barry Weiner Co - Founder & President x President and Director and a co - founder of Enzo Biochem x Committed to Enzo: has served as the Company’s President since 1996 and previously held the position of Chief Financial Officer and Executive Vice President x Operational, strategic and financial expertise from serving at Enzo x Meaningful investment in Enzo: owns 2.4% of the Company’s shares outstanding x Managerial and marketing experience at the Colgate Palmolive Company x M ember of the New York Biotechnology Association x Bachelor of Arts degree in Economics from New York University x Masters of Business Administration in Finance from Boston University x Unmatched knowledge of Enzo’s operating businesses, Innovation and IP Technology Platform, Diagnostics and Clinical Services, each of which present unique focuses and goals x Demonstrated ability to execute Enzo’s strategy , develop unparalleled innovation and fund the Company’s growth without dilution of shareholders x Manages a transparent and open investor relations program, feedback from which has resulted in enhancements to compensation program and corporate governance practices x Effectively institutes governance reforms Contributions to Enzo Up for Reelection at 2019 Annual Meeting 33

Dr. Bruce Hanna, Ph.D. Dr. Bruce Hanna Director x Director since January 2017 (3 - year tenure; most recently added Director until Rebecca Fischer’s appointment) x Clinical Professor of Pathology and Clinical Professor of Microbiology at the New York University School of Medicine, Adjunct Professor of Basic Science at New York University College of Dentistry x Former Adjunct Professor of Biology at Long Island University, served on the ASM International Committee and WHO Global Committee ( 2006 – 2015 ), Editor of Clinical Microbiology Reviews (2000 - 2012), Director of Clinical Microbiology, Immunology ( 1982 – 2008 ) at Bellevue Hospital Center, was Interim Director of Pathology ( 2008 – 2010 ) at Bellevue Hospital Center, Owner and Director at The Village Diagnostic Laboratory (1987 – 1999) x Bachelor of Science in Biology from Saint Bonaventure University x Masters of Science in Microbiology from Northeastern University x Ph.D. in Microbiology from Saint John’s University; Dr. Hanna’s post - doctorate work in Clinical Microbiology was at Mt. Sinai Hospital x Appointed following a thoughtful and robust search process that specifically sought experience in diagnostics and clinical innovation x Serves on the Audit, Nominating and Corporate Governance (Chairman ) and the Compensation Committees x Contributes extensive, relevant medical experience x Integrally involved in the development of Enzo’s strategy, operational progress, governance reform and shareholder engagement Contributions to Enzo Up for Reelection at 2019 Annual Meeting 34

Recently Announced Board Refreshment On December 31, 2019, following a robust, proactive search process, Enzo added Rebecca Fischer to the Board 35 Rebecca Fischer Director x Chief Financial Officer at New York Health & Hospitals/Bellevue Hospital Center in New York City x Addition followed a deliberate and thoughtful refreshment process that sought out particular skills x Operational, revenue enhancement, reimbursement and insurance/payor experience from serving as CFO and other executive roles at Bellevue Hospital x Senior Planning Associate at New York Presbyterian Hospital prior to joining Bellevue Hospital x Previous experience includes progressively responsible positions at Columbia University Medical Center, the Center for State Health Policy at Rutgers University and the New York City Office of Management and Budget x Bachelor of Arts in History and Government from Cornell University x Masters of Public Administration in Health Policy and Management from New York University x In - depth knowledge of policy making and relevant reimbursement and insurance environments x Highly experienced in enacting policy and dealing with regulations in the healthcare industry x Contributes to overall diversity of Enzo’s Board x Relevant operational and productivity enhancement knowledge x Financial reporting, revenue enhancement and cost control expertise Contributions to Enzo Up for Election at 2019 Annual Meeting

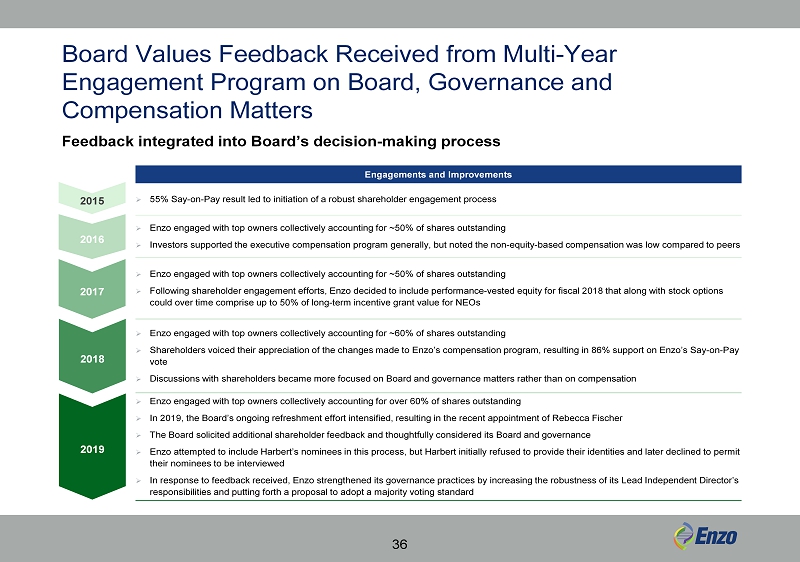

Board Values Feedback Received from Multi - Year Engagement Program on Board, Governance and Compensation Matters Feedback integrated into Board’s decision - making process 36 Engagements and Improvements » 55% Say - on - Pay result led to initiation of a robust shareholder engagement process » Enzo engaged with top owners collectively accounting for ~50% of shares outstanding » Investors supported the executive compensation program generally, but noted the non - equity - based compensation was low compared t o peers » Enzo engaged with top owners collectively accounting for ~50% of shares outstanding » Following shareholder engagement efforts, Enzo decided to include performance - vested equity for fiscal 2018 that along with stoc k options could over time comprise up to 50% of long - term incentive grant value for NEOs » Enzo engaged with top owners collectively accounting for ~60% of shares outstanding » Shareholders voiced their appreciation of the changes made to Enzo’s compensation program, resulting in 86% support on Enzo’s Sa y - on - Pay vote » Discussions with shareholders became more focused on Board and governance matters rather than on compensation » Enzo engaged with top owners collectively accounting for over 60% of shares outstanding » In 2019, the Board’s ongoing refreshment effort intensified, resulting in the recent appointment of Rebecca Fischer » The Board solicited additional shareholder feedback and thoughtfully considered its Board and governance » Enzo attempted to include Harbert’s nominees in this process, but Harbert initially refused to provide their identities and l ate r declined to permit their nominees to be interviewed » In response to feedback received, Enzo strengthened its governance practices by increasing the robustness of its Lead Indepen den t Director’s responsibilities and putting forth a proposal to adopt a majority voting standard 2019 2018 2017 2016 2015

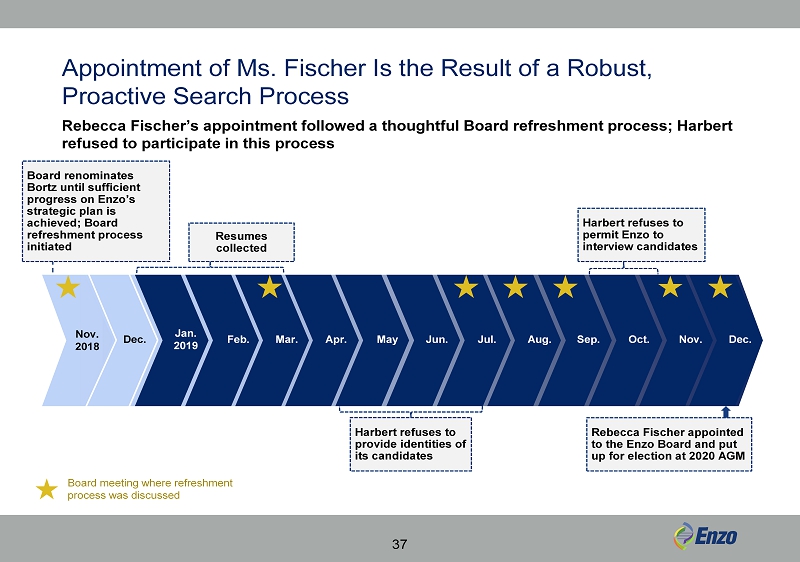

37 Board meeting where refreshment process was discussed Appointment of Ms. Fischer Is the Result of a Robust, Proactive Search Process Jan. 2019 Feb. Mar. Apr. May Jun. Jul. Aug. Sep. Oct. Nov. Dec. Rebecca Fischer appointed to the Enzo Board and put up for election at 2020 AGM Rebecca Fischer’s appointment followed a thoughtful Board refreshment process; Harbert refused to participate in this process Nov. 2018 Board renominates Bortz until sufficient progress on Enzo’s strategic plan is achieved; Board refreshment process initiated Dec. Harbert refuses to provide identities of its candidates Harbert refuses to permit Enzo to interview candidates Resumes collected

Our Recommendation to Shareholders Enzo’s Business, Strategy and Progress Our Qualified, Engaged Board of Directors Harbert and Its Nominees Lack Relevant Experience Harbert’s Unfounded Critiques of Enzo 38

Unqualified and Inferior Nominees Lack of Healthcare Experience What Is Harbert Hiding? We believe Harbert’s disingenuous behavior and lack of healthcare experience raise alarming questions about their intentions Refusal to Participate in Board Refreshment Process 1 2 3 39 Harbert’s lack of cooperation, healthcare knowledge and thoughtful ideas for Enzo are highly disconcerting Harbert refused to identify their nominees for months and later declined our invitation to interview their candidates Harbert has no experience with investments in healthcare Harbert’s nominees have no relevant healthcare experience or public Board experience and are far less qualified than the Company’s nominees

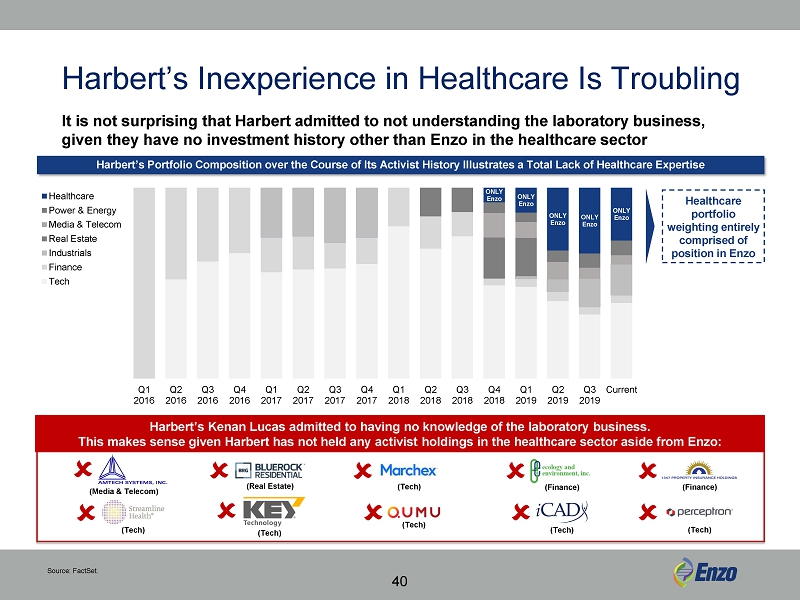

Harbert’s Inexperience in Healthcare Is Troubling [CELLRANGE] [CELLRANGE] [CELLRANGE] [CELLRANGE] [CELLRANGE] [CELLRANGE] [CELLRANGE] [CELLRANGE] [CELLRANGE] [CELLRANGE] [CELLRANGE] [CELLRANGE] [CELLRANGE] Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Current Healthcare Power & Energy Media & Telecom Real Estate Industrials Finance Tech Healthcare portfolio weighting entirely comprised of position in Enzo Harbert’s Portfolio Composition over the Course of Its Activist History Illustrates a Total Lack of Healthcare Expertise Source: FactSet. It is not surprising that Harbert admitted to not understanding the laboratory business, given they have no investment history other than Enzo in the healthcare sector 40 (Media & Telecom) (Real Estate) (Tech) (Finance) (Tech) (Tech) (Tech) (Tech) Harbert’s Kenan Lucas admitted to having no knowledge of the laboratory business. This makes sense given Harbert has not held any activist holdings in the healthcare sector aside from Enzo: (Finance) (Tech)

Harbert’s Problematic History in New York “The New York attorney general’s office on Tuesday said it reached a $ 40 million settlement with an Alabama investment firm over the failure of members of an investment management company it sponsored to pay millions in New York state taxes [ … ]” “Our investigation uncovered a brazen and deliberate decision to avoid paying millions in taxes owed to New York State,” Mr . Schneiderman said in a statement . ” Harbert Management made a clear choice to skirt the rules, and as a result, ordinary New York taxpayers were left footing the bill . ” THE WALL STREET JOURNAL 18 APRIL 2017 Maintaining close and good relationships with regulators and elected officials in New York is vital to Enzo’s business; by contrast, Harbert has an alleged history of deliberately skirting the rules in New York 41

Harbert’s Nominees Do N ot Offer V alue for Enzo Because Harbert’s nominees declined to participate in any interview process, we have no basis for evaluating them except based on their resumes Harbert’s nominees’ resumes show they are not the right Directors for Enzo Fabian Blank Peter Clemens, IV Uncooperative , Uninterested, Irrelevant 42

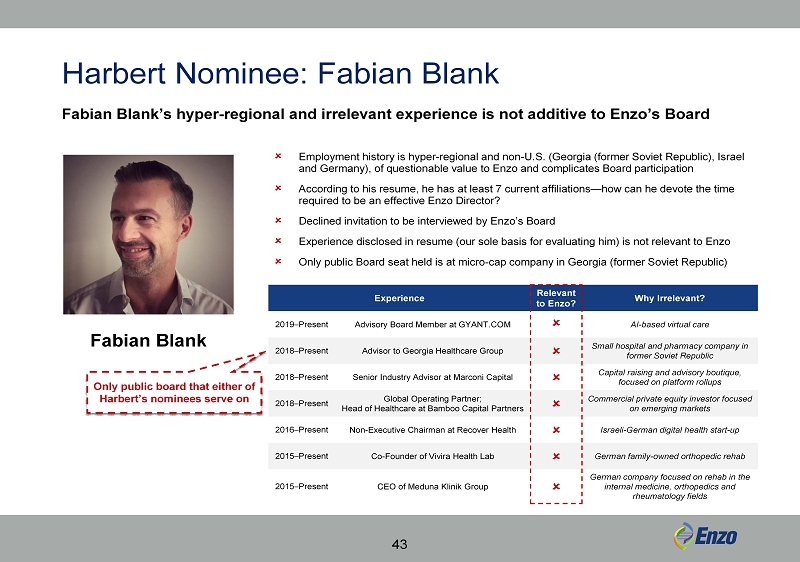

Harbert Nominee: Fabian Blank Employment history is hyper - regional and non - U.S. (Georgia (former Soviet Republic), Israel and Germany), of questionable value to Enzo and complicates Board participation According to his resume, he has at least 7 current affiliations — how can he devote the time required to be an effective Enzo Director? Declined invitation to be interviewed by Enzo’s Board Experience disclosed in resume (our sole basis for evaluating him) is not relevant to Enzo Only public Board seat held is at micro - cap company in Georgia (former Soviet Republic) Fabian Blank Experience Relevant to Enzo? Why Irrelevant? 2019 – Present Advisory Board Member at GYANT.COM AI - based virtual care 2018 – Present Advisor to Georgia Healthcare Group Small hospital and pharmacy company in former Soviet Republic 2018 – Present Senior Industry Advisor at Marconi Capital Capital raising and advisory boutique, focused on platform rollups 2018 – Present Global Operating Partner; Head of Healthcare at Bamboo Capital Partners Commercial private equity investor focused on emerging markets 2016 – Present Non - Executive Chairman at Recover Health Israeli - German digital health start - up 2015 – Present Co - Founder of Vivira Health Lab German family - owned orthopedic rehab 2015 – Present CEO of Meduna Klinik Group German company focused on rehab in the internal medicine, orthopedics and rheumatology fields Fabian Blank’s hyper - regional and irrelevant experience is not additive to Enzo’s Board 43 O nly public board that either of Harbert’s nominees serve on

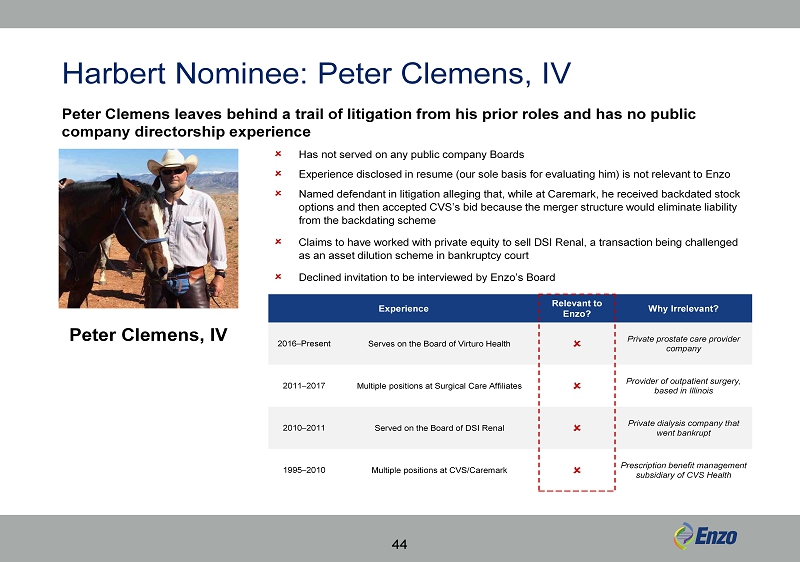

Harbert Nominee : Peter Clemens, IV Peter Clemens, IV Has not served on any public company Boards Experience disclosed in resume (our sole basis for evaluating him) is not relevant to Enzo Named defendant in litigation alleging that, while at Caremark, he received backdated stock options and then accepted CVS’s bid because the merger structure would eliminate liability from the backdating scheme Claims to have worked with private equity to sell DSI Renal, a transaction being challenged as an asset dilution scheme in bankruptcy court Declined invitation to be interviewed by Enzo’s Board Experience Relevant to Enzo? Why Irrelevant? 2016 – Present Serves on the Board of Virturo Health Private prostate care provider company 2011 – 2017 Multiple positions at Surgical Care Affiliates Provider of outpatient surgery, based in Illinois 2010 – 2011 Served on the Board of DSI Renal Private dialysis company that went bankrupt 1995 – 2010 Multiple positions at CVS/Caremark Prescription benefit management subsidiary of CVS Health Peter Clemens leaves behind a trail of litigation from his prior roles and has no public company directorship experience 44

Our Recommendation to Shareholders Enzo’s Business, Strategy and Progress Our Qualified, Engaged Board of Directors Harbert and Its Nominees Lack Relevant Experience Harbert’s Unfounded Critiques of Enzo 45

“Harbert doesn’t know anything about the laboratory business” – Kenan Lucas, Harbert Portfolio Manager, 5/7/2019 46

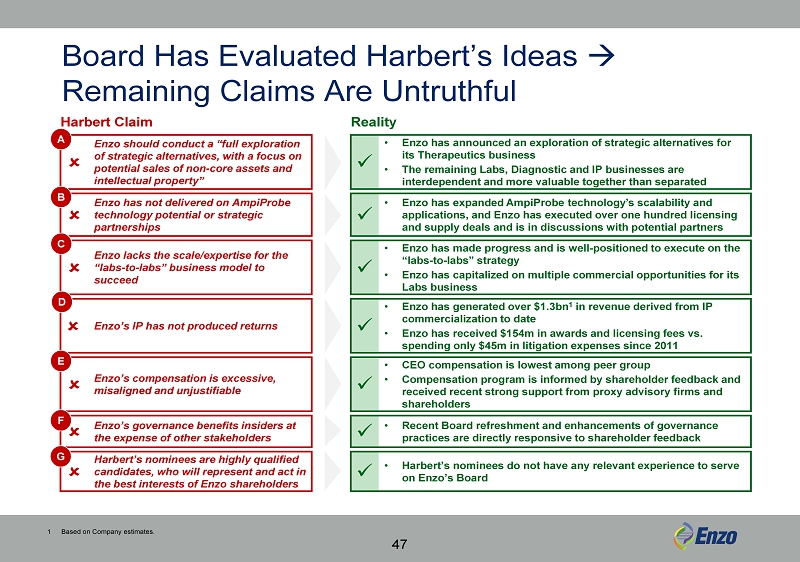

Harbert Claim Reality Enzo should conduct a “full exploration of strategic alternatives, with a focus on potential sales of non - core assets and intellectual property” x • Enzo has announced an exploration of strategic alternatives for its Therapeutics business • The remaining Labs, Diagnostic and IP businesses are interdependent and more valuable together than separated Enzo has not delivered on AmpiProbe technology potential or strategic partnerships x • Enzo has expanded AmpiProbe technology’s scalability and applications, and Enzo has executed over one hundred licensing and supply deals and is in discussions with potential partners Enzo lacks the scale/expertise for the “labs - to - labs” business model to succeed x • Enzo has made progress and is well - positioned to execute on the “labs - to - labs” strategy • Enzo has capitalized on multiple commercial opportunities for its Labs business Enzo’s IP has not produced returns x • Enzo has generated over $1.3bn 1 in revenue derived from IP commercialization to date • Enzo has received $154m in awards and licensing fees vs. spending only $45m in litigation expenses since 2011 Enzo’s compensation is excessive, misaligned and unjustifiable x • CEO compensation is lowest among peer group • Compensation program is informed by shareholder feedback and received recent strong support from proxy advisory firms and shareholders Enzo’s governance benefits insiders at the expense of other stakeholders x • Recent Board refreshment and enhancements of governance practices are directly responsive to shareholder feedback Harbert’s nominees are highly qualified candidates, who will represent and act in the best interests of Enzo shareholders x • Harbert’s nominees do not have any relevant experience to serve on Enzo’s Board Board Has Evaluated Harbert’s Ideas Remaining Claims Are Untruthful 1 Based on Company estimates. 47 A B C D E F G

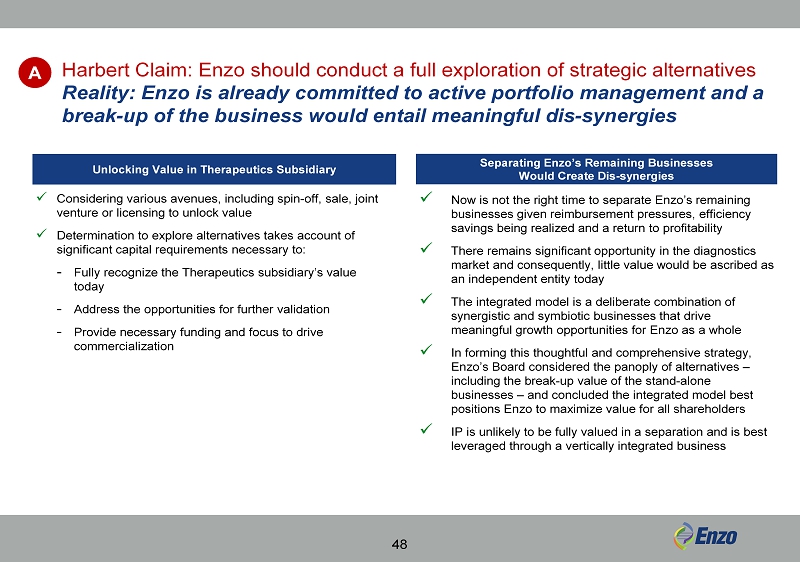

Harbert Claim: Enzo should c onduct a full e xploration of strategic a lternatives Reality: Enzo is already committed to active portfolio management and a break - up of the business would entail meaningful dis - synergies A x Now is not the right time to separate Enzo’s remaining businesses given reimbursement pressures, efficiency savings being realized and a return to profitability x There remains significant opportunity in the diagnostics market and consequently, little value would be ascribed as an independent entity today x The integrated model is a deliberate combination of synergistic and symbiotic businesses that drive meaningful growth opportunities for Enzo as a whole x In forming this thoughtful and comprehensive strategy, Enzo’s Board considered the panoply of alternatives – including the break - up value of the stand - alone businesses – and concluded the integrated model best positions Enzo to maximize value for all shareholders x IP is unlikely to be fully valued in a separation and is best leveraged through a vertically integrated business 48 Unlocking Value in Therapeutics Subsidiary x Considering various avenues, including spin - off, sale, joint venture or licensing to unlock value x Determination to explore alternatives takes account of significant capital requirements necessary to: - Fully recognize the Therapeutics subsidiary’s value today - Address the opportunities for further validation - Provide necessary funding and focus to drive commercialization Separating Enzo’s Remaining Businesses Would Create Dis - synergies

Harbert Claim: Enzo has n ot delivered on AmpiProbe technology potential or strategic partnerships Reality: Enzo is actively engaged in discussions with potential partners and has meaningfully expanded AmpiProbe technology’s scalability and applications x Developed AmpiProbe technology to increase scalability and broaden dimensions and applications x Meaningful revenue of AmpiProbe - related systems expected within 12 months post - national rollout x Attained New York State Regulatory Approval on 8 different analytes already being delivered from our lab and working on rolling out high throughput, fully automated system x Enzo has signed over one hundred licensing deals with leading global companies x Retained Lazard to assist with forming strategic relationships 49 B

Harbert Claim: Enzo lacks the scale/expertise for the ” labs - to - labs ” business model to succeed Reality : Enzo has made progress and is well - positioned to execute on the ” labs - to - labs ” strategy, recently capitalizing on multiple commercial opportunities for its Labs business C x Formalized three Labs - to - Labs relationships and actively negotiating terms with other small - to medium - sized clinical labs x ~50% expansion in personnel supporting commercialization x Ran over 100,000 Enzo laboratory developed tests resulting in more than $5 million in year - over - year cost savings compared to third - party vendor tests 50

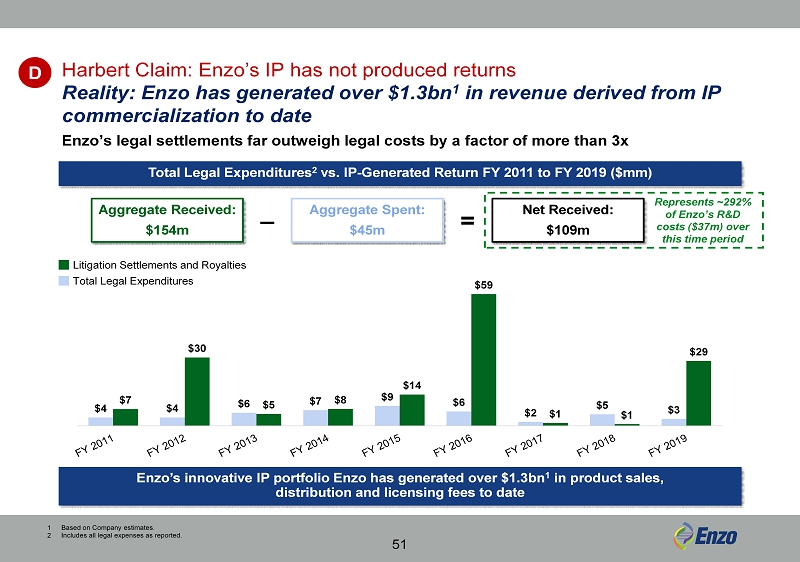

Harbert Claim: Enzo’s IP has not produced returns Reality : Enzo has generated over $1.3bn 1 in revenue derived from IP commercialization to date Enzo’s legal settlements far outweigh legal costs by a factor of more than 3x $4 $4 $6 $7 $9 $6 $2 $5 $3 $7 $30 $5 $8 $14 $59 $1 $1 $29 Total Legal Expenditures 2 vs. IP - Generated Return FY 2011 to FY 2019 ($mm) Enzo’s innovative IP portfolio Enzo has generated over $1.3bn 1 in product sales , distribution and licensing fees to date 51 1 Based on Company estimates. 2 Includes all legal expenses as reported. D Net Received: $109m – = Aggregate Spent: $45m Aggregate Received: $154m Represents ~292% of Enzo’s R&D costs ($37m) over this time period Litigation Settlements and Royalties Total Legal Expenditures

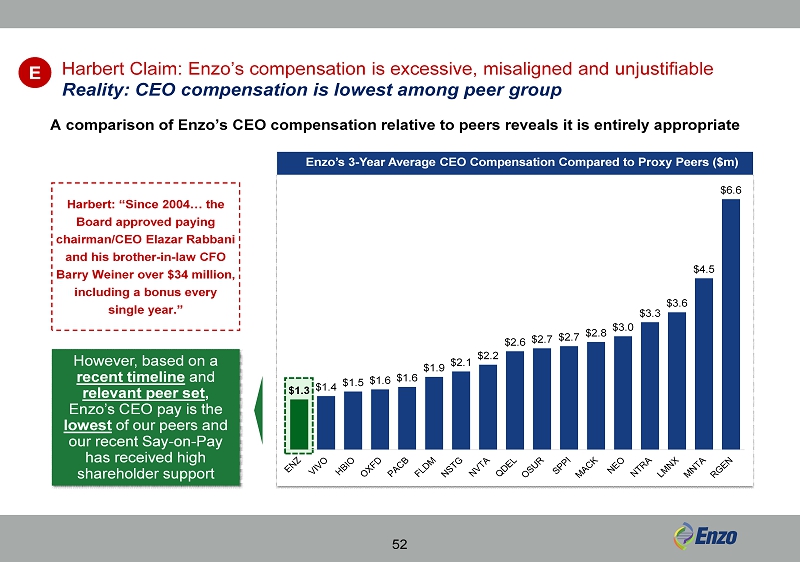

Harbert Claim: Enzo’s compensation is excessive, misaligned and unjustifiable Reality: CEO compensation is lowest among peer group Enzo’s 3 - Year Average CEO Compensation Compared to Proxy Peers ($m) A comparison of Enzo’s CEO compensation relative to peers reveals it is entirely appropriate 52 E Harbert: “Since 2004… the Board approved paying chairman/CEO Elazar Rabbani and his brother - in - law CFO Barry Weiner over $34 million, including a bonus every single year.” However, based on a recent timeline and relevant peer set , Enzo’s CEO pay is the lowest of our peers and our recent Say - on - Pay has received high shareholder support $1.3 $1.4 $1.5 $1.6 $1.6 $1.9 $2.1 $2.2 $2.6 $2.7 $2.7 $2.8 $3.0 $3.3 $3.6 $4.5 $6.6

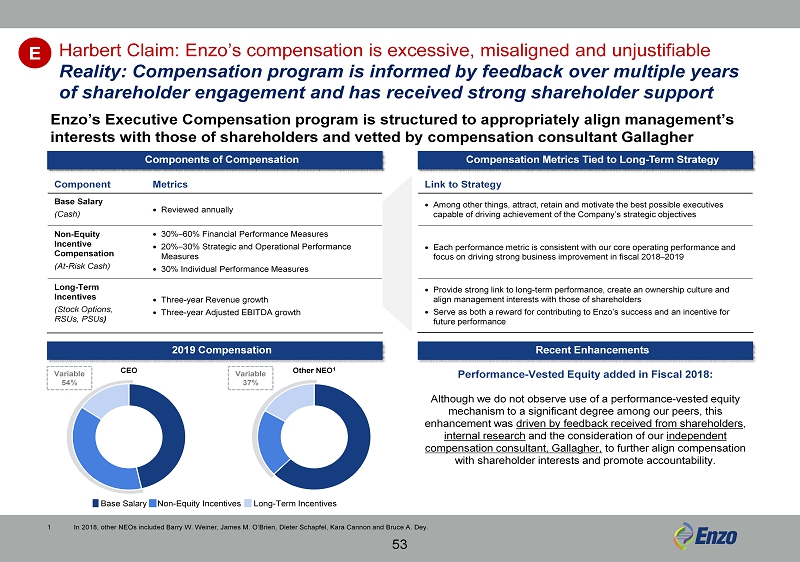

1 In 2018, other NEOs included Barry W. Weiner, James M. O’Brien, Dieter Schapfel, Kara Cannon and Bruce A. Dey. Components of Compensation 2019 Compensation Recent Enhancements Component Metrics Base Salary (Cash) Reviewed annually Non - Equity Incentive Compensation (At - Risk Cash) 30% – 60% Financial Performance Measures 20% – 30% Strategic and Operational Performance Measures 30% Individual Performance Measures Long - Term Incentives (Stock Options, RSUs, PSUs ) Three - year Revenue growth Three - year Adjusted EBITDA growth Link to Strategy Among other things, attract, retain and motivate the best possible executives capable of driving achievement of the Company’s strategic objectives Each performance metric is consistent with our core operating performance and focus on driving strong business improvement in fiscal 2018 – 2019 Provide strong link to long - term performance, create an ownership culture and align management interests with those of shareholders Serve as both a reward for contributing to Enzo’s success and an incentive for future performance Compensation Metrics Tied to Long - Term Strategy Other NEO 1 Variable 54% Variable 37% CEO Enzo’s Executive Compensation program is structured to appropriately align management’s interests with those of shareholders and vetted by compensation consultant Gallagher Base Salary Non - Equity Incentives Long - Term Incentives Performance - Vested Equity added in Fiscal 2018: Although we do not observe use of a performance - vested equity mechanism to a significant degree among our peers, this enhancement was driven by feedback received from shareholders , internal research and the consideration of our independent compensation consultant, Gallagher, to further align compensation with shareholder interests and promote accountability. 53 E Harbert Claim: Enzo’s compensation is excessive, misaligned and unjustifiable Reality: Compensation program is informed by feedback over multiple years of shareholder engagement and has received strong shareholder support

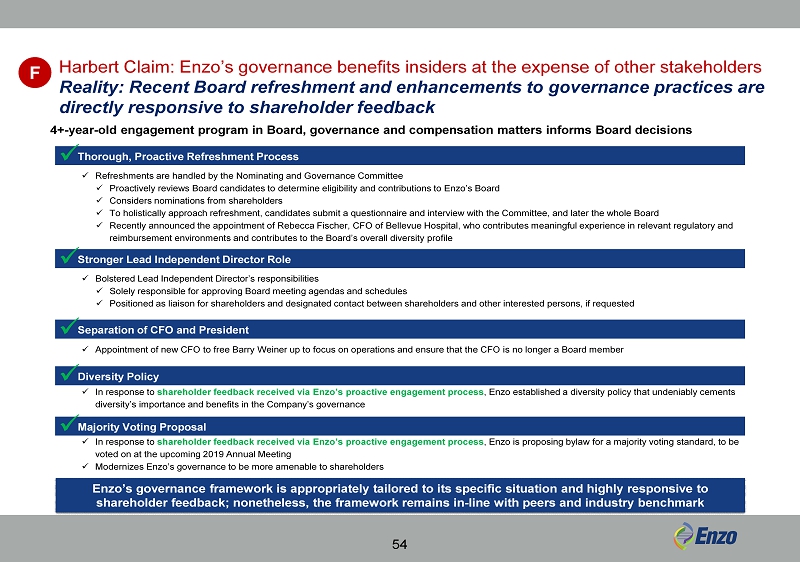

Enzo’s governance framework is appropriately tailored to its specific situation and highly responsive to shareholder feedback; nonetheless, the framework remains in - line with peers and industry benchmark Majority Voting Proposal x In response to shareholder feedback received via Enzo’s proactive engagement process , Enzo is proposing bylaw for a majority voting standard, to be voted on at the upcoming 2019 Annual Meeting x Modernizes Enzo’s governance to be more amenable to shareholders x Diversity Policy x In response to shareholder feedback received via Enzo’s proactive engagement process , Enzo established a diversity policy that undeniably cements diversity’s importance and benefits in the Company’s governance x Thorough, Proactive Refreshment Process x Refreshments are handled by the Nominating and Governance Committee x Proactively reviews Board candidates to determine eligibility and contributions to Enzo’s Board x Considers nominations from shareholders x To holistically approach refreshment, candidates submit a questionnaire and interview with the Committee, and later the whole Bo ard x Recently announced the appointment of Rebecca Fischer, CFO of Bellevue Hospital, who contributes meaningful experience in rel eva nt regulatory and reimbursement environments and contributes to the Board’s overall diversity profile x Stronger Lead Independent Director Role x Bolstered Lead Independent Director’s responsibilities x Solely responsible for approving Board meeting agendas and schedules x Positioned as liaison for shareholders and designated contact between shareholders and other interested persons, if requested x F 4+ - year - old engagement program in Board, governance and compensation matters informs Board decisions Harbert Claim: Enzo’s governance benefits insiders at the expense of other stakeholders Reality: Recent Board refreshment and enhancements to governance practices are directly responsive to shareholder feedback 54 Separation of CFO and President x Appointment of new CFO to free Barry Weiner up to focus on operations and ensure that the CFO is no longer a Board member x

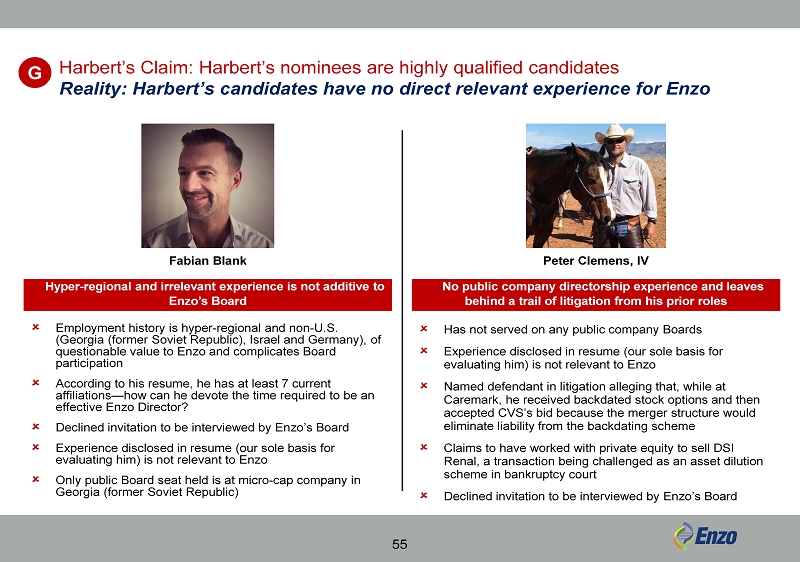

Harbert’s Claim: Harbert’s nominees are highly q ualified c andidates Reality: Harbert’s candidates h ave n o d irect r elevant e xperience for Enzo Fabian Blank Peter Clemens, IV Employment history is hyper - regional and non - U.S. (Georgia (former Soviet Republic), Israel and Germany), of questionable value to Enzo and complicates Board participation According to his resume, he has at least 7 current affiliations — how can he devote the time required to be an effective Enzo Director? Declined invitation to be interviewed by Enzo’s Board Experience disclosed in resume (our sole basis for evaluating him) is not relevant to Enzo Only public Board seat held is at micro - cap company in Georgia (former Soviet Republic) 55 G Has not served on any public company Boards Experience disclosed in resume (our sole basis for evaluating him) is not relevant to Enzo Named defendant in litigation alleging that, while at Caremark, he received backdated stock options and then accepted CVS’s bid because the merger structure would eliminate liability from the backdating scheme Claims to have worked with private equity to sell DSI Renal, a transaction being challenged as an asset dilution scheme in bankruptcy court Declined invitation to be interviewed by Enzo’s Board H yper - regional and irrelevant experience is not additive to Enzo’s Board N o public company directorship experience and leaves behind a trail of litigation from his prior roles

Our Recommendation to Shareholders Enzo’s Business, Strategy and Progress Our Qualified, Engaged Board of Directors Harbert and Its Nominees Lack Relevant Experience Harbert’s Unfounded Critiques of Enzo 56

x Innovator, disruptor and groundbreaking pioneer in modern biological research x Thoughtful and well - considered transition to a fully integrated healthcare company x Business model and operational structure thoughtfully designed to capitalize on industry headwinds and offer unique value proposition to reduce costs by 30 – 50% 1 x Execution of recently announced three - pronged strategy for value creation x Exploration of strategic alternatives for Therapeutics business x Implemented initiatives to reduce costs in light of industry environment 57 x Recent addition of new Director, Rebecca Fischer, following robust, proactive search process x Recent announcement of new CFO appointment and separation of President and CFO functions x Recent corporate governance enhancements, including proposed bylaw for adoption of majority voting standard for uncontested elections x Compensation program that is responsive to shareholder feedback and aligned with performance x Highly qualified nominees with valuable expertise and knowledge of Enzo’s business and our sector Evolution of Business and Strategy Evolution of Leadership and Governance 1 Based on Company estimates. Robust investor relations efforts (including 4+ - year - old governance engagement program) informs Board and management actions on business, strategy, leadership and governance The Board Has Made the Necessary Changes to Position Enzo for Success

Neither Harbert Nor Its Nominees Has Relevant Experience or a Plan for Enzo Harbert refused to engage in constructive discussions with Enzo, including initially refusing to provide the identities of their nominees; Harbert’s nominees have declined to participate in a standard nominee interview process Neither Harbert nor its nominees have presented a coherent strategy or plan for Enzo other than driving a fire sale of Enzo at depressed valuations Harbert’s nominees lack any relevant experience and offer no discernable additive value to Enzo’s Board of Directors and if elected, would comprise 40% of Enzo’s Board Harbert has no investment track record in the healthcare space (as historical activist positions have been in the Finance and Technology sectors) and is a relatively new shareholder in Enzo Harbert’s critiques of Enzo are uninformed and demonstrate a fundamental lack of knowledge about our business and sector Flawed investment thesis jeopardizes Enzo’s meaningful progress at a critical time Harbert has an alleged criminal history in New York, whereas Enzo has close relationships with regulators in New York and has created jobs and provided vital services in the state 58 Harbert has failed to suggest a single idea to improve Enzo’s business that the Board has not already thoughtfully considered

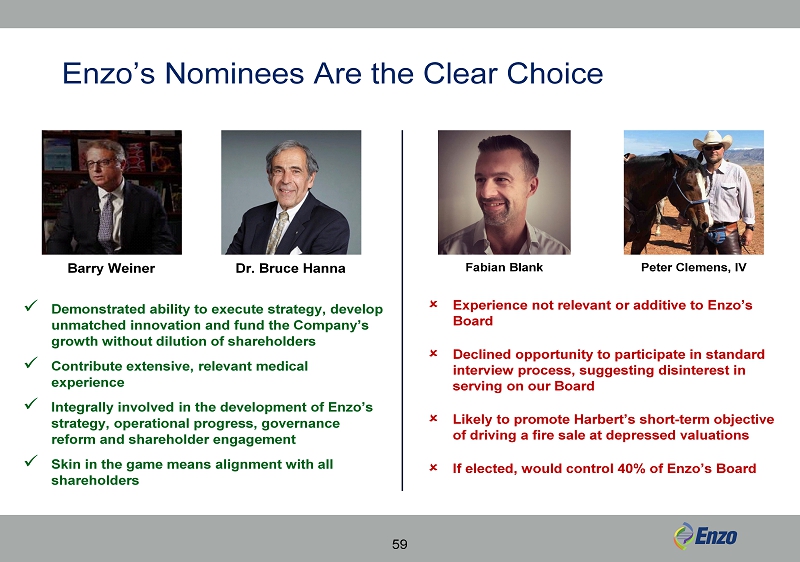

Enzo’s Nominees Are the Clear Choice Barry Weiner Dr. Bruce Hanna x Demonstrated ability to execute strategy, develop unmatched innovation and fund the Company’s growth without dilution of shareholders x Contribute extensive, relevant medical experience x Integrally involved in the development of Enzo’s strategy, operational progress, governance reform and shareholder engagement x Skin in the game means alignment with all shareholders Fabian Blank Peter Clemens, IV Experience not relevant or additive to Enzo’s Board Declined opportunity to participate in standard interview process, suggesting disinterest in serving on our Board Likely to promote Harbert’s short - te rm objective of driving a fire sale at depressed valuations If elected, would control 40% of Enzo’s Board 59

The Choice for Shareholders Is Clear: Vote for Enzo’s Nominees on the WHITE Card 60

Questions? Need Help Voting? Please contact our Strategic Shareholder Advisor and Proxy Solicitation Agent, Kingsdale Advisors CONTACT US: Kingsdale Advisors 1 - 888 - 518 - 1554 (toll - free in North America) 416 - 867 - 2272 (outside of North America) email: ENZ@kingsdaleadvisors.com This image cannot currently be displayed. 61