INVESTOR PRESENTATION

Published on December 30, 2020

Exhibit 99.1

December 2020 FINDING VALUE THROUGH OUT OF FAVOR, OVERLOOKED OR MISUNDERSTOOD SECURITIES ENZO BIOCHEM, INC. Immediate Change is Warranted Shareholder Presentation

2 Disclaimers Important Information Concerning the Participants in a Proxy Solicitation : Roumell Asset Management, LLC, Matthew M . Loar, James C . Roumell and Edward Terino (collectively, "Roumell" or "we"), have filed with the Securities and Exchange Commission (the "SEC") a definitive proxy statement and accompanying GREEN proxy card to be used in connection with the solicitation of proxies from the shareholders of Enzo Biochem , Inc . (" ENZ ", "Enzo" or the "Company") . Roumell strongly advises all shareholders of the Company to read the definitive proxy statement, accompanying GREEN proxy card and other proxy materials filed by Roumell Asset Management, LLC, as they contain important information . Such proxy materials are available at no charge on the SEC's website at http : //www . sec . gov . In addition, the participants in this proxy solicitation will provide copies of the proxy statement without charge upon request . Requests for hard copies should be directed to Roumell Asset Management, LLC . As of the date hereof, Roumell Asset Management, LLC beneficially owns 2 , 769 , 479 shares of common stock, $ 0 . 01 par value per share (the “Common Stock”) of the Company . Mr . Roumell, as the President of Roumell Asset Management, LLC, may be deemed the beneficial owner of the 2 , 769 , 479 shares of Common Stock beneficially owned by Roumell Asset Management, LLC . As of the date hereof, none of Messrs . Loar or Terino own any shares of Common Stock . This presentation is for discussion and general informational purposes only . It does not have regard to the specific investment objective, financial situation, suitability, or the particular need of any specific person who may receive this presentation, and should not be taken as advice on the merits of any investment decision . This presentation is not an offer to sell or the solicitation of an offer to buy interests in a fund or investment vehicle managed by Roumell and is being provided to you for informational purposes only . The views expressed herein represent the opinions of Roumell and are based on publicly available information with respect to the Company . Certain financial information and data used herein have been derived or obtained from public filings, including filings made by the Issuer with the SEC, and other sources . Roumell has not sought or obtained consent from any third party to use any statements or information indicated herein as having been obtained or derived from statements made or published by third parties . Any such statements or information should not be viewed as indicating the support of such third party for the views expressed herein . No warranty is made that data or information, whether derived or obtained from filings made with the SEC or from any third party, are accurate . No agreement, arrangement, commitment or understanding exists or shall be deemed to exist between or among Roumell and any third party or parties by virtue of furnishing this presentation . Except for the historical information contained herein, the matters addressed in this presentation are forward - looking statements that involve certain risks and uncertainties . You should be aware that actual results may differ materially from those contained in the forward - looking statements . Roumell shall not be responsible or have any liability for any misinformation contained in any third party SEC filing or third party report relied upon in good faith by Roumell that is incorporated into this presentation . There is no assurance or guarantee with respect to the prices at which any securities of the Issuer will trade, and such securities may not trade at prices that may be implied herein . The estimates, projections and pro forma information set forth herein are based on assumptions which Roumell believes to be reasonable, but there can be no assurance or guarantee that actual results or performance of the Issuer will not differ, and such differences may be material . This presentation does not recommend the purchase or sale of any security . Roumell reserves the right to change any of its opinions expressed herein at any time as it deems appropriate . Roumell disclaims any obligation to update the information contained herein . Under no circumstances is this presentation to be used or considered as an offer to sell or a solicitation of an offer to buy any security .

3 Table of Contents Executive Summary Enzo Biochem , Inc. 4 Roumell Asset Management, LLC 5 Why Immediate Change is Warranted 6 Our History with Enzo 7 Enzo’s Board has Perpetual: Decades of Shareholder Destruction 9 Dismal Shareholder Returns 10 Failed Corporate Governance 11 Poor Returns on Assets, Equity and Capital 12 Outsized Executive Compensation 13 Unchecked Related Party Transactions 14 A History of Broken Promises 15 Enzo is Trying to Fool Shareholders by Selectively Quoting Roumell 16 Immediate Change is Warranted 17 A Perennial “Science Project” 18 Former Enzo Directors 20 Our Nominations for the Board 21 Highly - Qualified Candidates 22 Nominees’ Top Priorities if Chosen to Serve on the Board 24 Addendum A 25 Addendum B 26

4 Executive Summary Enzo Biochem , Inc. Enzo runs clinical labs in the Northeast region, develops platforms and reagents for use in its own labs and for resale, and operates a therapeutics division Wholly - owned operating companies : 1 . Enzo Clinical Labs, Inc . (“Enzo Labs”) • Segment includes a full - service clinical laboratory in Farmingdale, NY, over 30 patient service centers throughout New York and New Jersey, and a stand - alone rapid response laboratory in NYC • Routing/esoteric testing splits 60 / 40 2 . Enzo Life Sciences, Inc . • Develops, manufactures and markets diagnostic products and tools for use in its labs as well as for sale to other labs • Products are sold through a direct sales effort and a global network of distributors and axxora . com, Enzo’s online marketplace • Several platforms in development that are expected to reduce the cost of running diagnostic tests for its clinical labs as well as for sale to other labs 3 . Enzo Therapeutics, Inc . • Development venture targeting treatments for bone - related diseases, immune - related diseases and gastrointestinal diseases Patent Portfolio • Owns 475 patents • History of successful litigation Ticker: ENZ (NYSE) Founding Year: 1976 Market Cap: $110 million Headquarters: Farmingdale, New York Founders: Elazar Rabbani, Ph.D., Barry Weiner, Shahram K. Rabbani

5 Executive Summary Roumell Asset Management, LLC Roumell Asset Management, LLC (“RAM”) pursues long - term capital growth through opportunistic value investing . We seek to own a non - diversified portfolio of deeply researched, conservatively financed securities that are out of favor, overlooked or misunderstood by Wall Street and thus able to be bought at a significant discount to our calculation of intrinsic value Firm Characteristics • Founded by James C . Roumell in 1998 • Based in Chevy Chase, Maryland • 100 % employee - owned • Three highly - seasoned investment professionals • ≈ $ 100 million in assets under management • Roumell Opportunistic Value Fund ( RAMSX ) • Focused on a single strategy

6 Executive Summary Why Immediate Change is Warranted Obvious wrongs should be righted with obvious solutions • RAM is one of Enzo’s largest shareholders, owning 5 . 8 % of the Company’s outstanding Common Stock • We are seeking to elect two highly qualified independent directors to represent shareholders’ interests, and we need your help • Years of entrenchment by Enzo’s board of directors (the “Board”) and business mismanagement has resulted in the destruction of shareholder value

7 Our History with Enzo • In 2018 , RAM began purchasing shares of ENZ based on the following : • Enviable Clinical Lab footprint in the New York tri - state area • Life Sciences unit creating proprietary products • Promising Therapeutics division • Patent - enforcement litigation optionality • In April 2019 , after a lengthy sit - down meeting with Dr . Elazar Rabbani (Chairman of the Board and CEO and Secretary of Enzo) and Barry Weiner (co - founder of Enzo and Dr . Rabbani’s brother - in - law), Mr . Roumell concluded that Dr . Rabbani lacked the emotional temperament and clear - sighted judgment that was necessary to lead the company • In May 2019 , Mr . Roumell sent an email to Dr . Rabbani and Mr . Weiner sharing the resume of Matthew M . Loar for the Company’s consideration as an addition to the Board (see “Addendum A” for details) • In July 2019 , RAM decided to exit its ENZ position • In February 2020 , Harbert Discovery Fund, L . P . and Harbert Discovery Co - Investment Fund I, LP (collectively, “Harbert”), ENZ’s largest shareholders, successfully placed two independent directors on the Board

8 Our History with Enzo (continued) • Our belief that Harbert would likely run an additional proxy campaign to dislodge Dr . Rabbani (which turned out to be incorrect) and the Company’s success in receiving Emergency Use Authorization (EUA) for its Proprietary Test System for Detection of Coronavirus SARS - CoV - 2 (“Covid - 19 ”) persuaded us to reinvest in ENZ shares • In early November 2020 , the two independent directors elected to the Board in February 2020 , pursuant to nominations by Harbert, resigned and were quickly replaced by directors appointed by Enzo • On November 27 , 2020 , RAM delivered a letter (the "Notice") to Dr . Rabbani, nominating Messrs . Terino and Loar for election to the Board at the Company's 2020 annual meeting of shareholders (the " 2020 Annual Meeting") and submitting two business proposals • On November 27 , 2020 , the Company retroactively set the nomination deadline as October 6 , 2020 and summarily rejected the Notice • On December 1 , 2020 , Dr . Rabbani informed RAM that the Notice failed to "comport" with the Amended and Restated Bylaws of the Company • On December 23 , 2020 , RAM filed a definitive proxy statement in connection with its solicitation for the 2020 Annual Meeting

9 • Dismal stock performance • Severe underperformance compared to Enzo’s peers and relevant indices • Failed corporate governance • Complex web of related parties and self - dealings • No substantial improvements over the years despite being the subject of prior proxy fights • Poor capital allocation • ENZ has had operating losses every year since 2004 • Weak return on assets, return on investments and return on invested capital • Growing patent portfolio with questionable returns • Outsized compensation • Unchecked related party transactions • Overpromising and not delivering • Years of broken promises regarding value creation (see “Addendum B” for list of promises) Enzo’s Board has Perpetual Decades of Shareholder Destruction

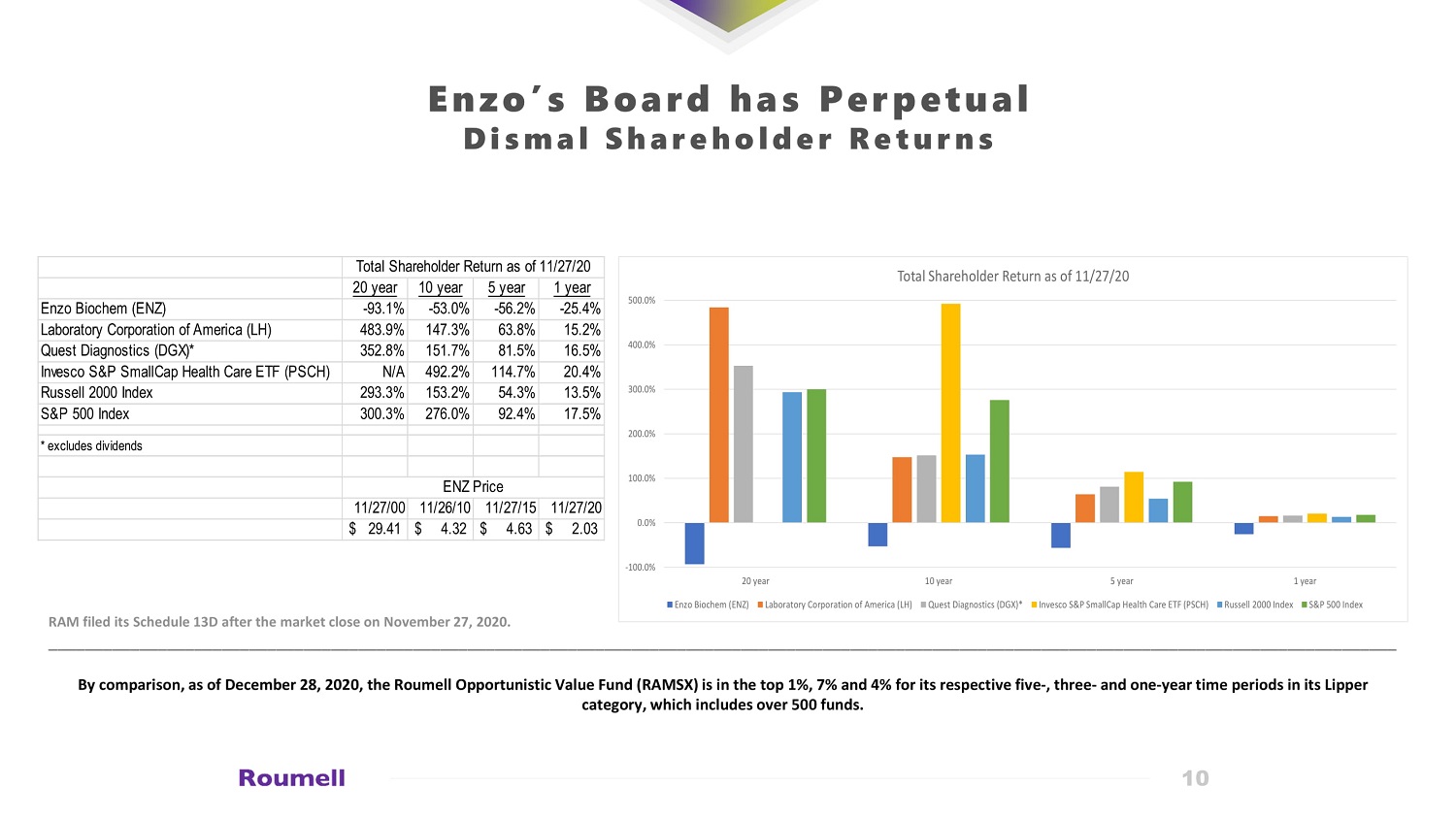

10 Enzo’s Board has Perpetual Dismal Shareholder Returns 20 year 10 year 5 year 1 year Enzo Biochem (ENZ) -93.1% -53.0% -56.2% -25.4% Laboratory Corporation of America (LH) 483.9% 147.3% 63.8% 15.2% Quest Diagnostics (DGX)* 352.8% 151.7% 81.5% 16.5% Invesco S&P SmallCap Health Care ETF (PSCH) N/A 492.2% 114.7% 20.4% Russell 2000 Index 293.3% 153.2% 54.3% 13.5% S&P 500 Index 300.3% 276.0% 92.4% 17.5% * excludes dividends 11/27/00 11/26/10 11/27/15 11/27/20 29.41$ 4.32$ 4.63$ 2.03$ Total Shareholder Return as of 11/27/20 ENZ Price -100.0% 0.0% 100.0% 200.0% 300.0% 400.0% 500.0% 20 year 10 year 5 year 1 year Total Shareholder Return as of 11/27/20 Enzo Biochem (ENZ) Laboratory Corporation of America (LH) Quest Diagnostics (DGX)* Invesco S&P SmallCap Health Care ETF (PSCH) Russell 2000 Index S&P 500 Index RAM filed its Schedule 13 D after the market close on November 27 , 2020 . _____________________________________________________________________________________________________________________________ ___ ____________________ By comparison, as of December 28 , 2020, the Roumell Opportunistic Value Fund (RAMSX) is in the top 1%, 7% and 4% for its respective five - , three - and one - year t ime periods in its Lipper category, which includes over 500 funds.

11 • Outdated governance structure • Combined CEO and Chairman role • Classified Board • Conflicts of interest • CEO/Chairman tenured for 44 years • No shareholder right to call a special meeting _________________________________________________________________________________________________________ • Two independent directors elected in February 2020 suddenly resigned in November 2020 • Manipulated nomination deadline in 2020 to prevent shareholders from presenting a competing slate • In November 2020 , Enzo filed a lawsuit against its largest shareholders, Harbert, which won a proxy fight earlier this year by as much as a nearly 4 to 1 margin, alleging, among other things, that Harbert violated Section 14 (a) of the Securities Exchange Act of 1934 , as amended, and Rule 14 a - 9 thereunder • Enzo held out Bruce A . Hanna, Ph . D . , as a key opinion leader in a December 2020 presentation with no disclosure that he was a director of the Company and a shareholder as recently as January 2020 Enzo’s Board has Perpetual Failed Corporate Governance

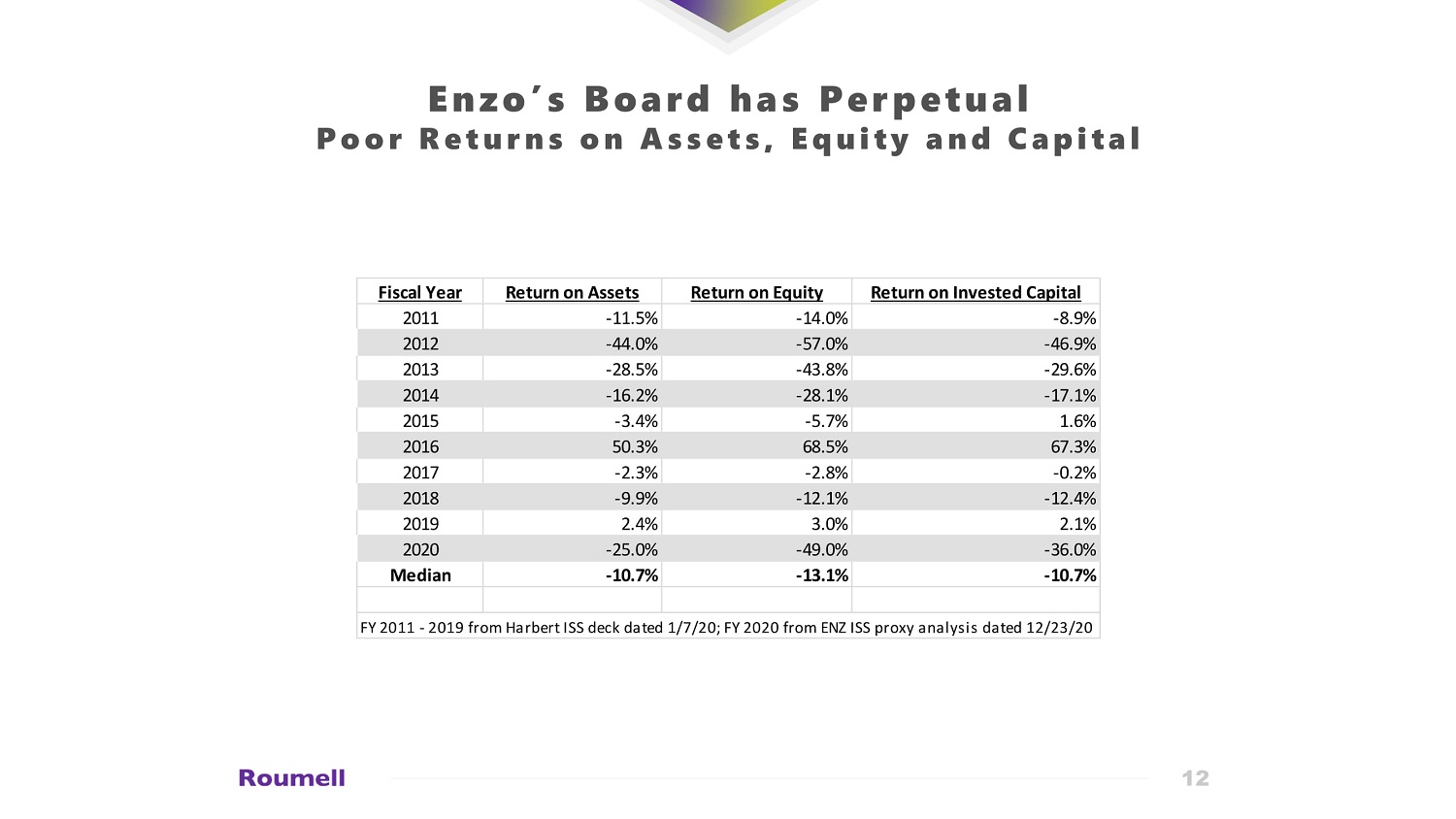

12 Fiscal Year Return on Assets Return on Equity Return on Invested Capital 2011 -11.5% -14.0% -8.9% 2012 -44.0% -57.0% -46.9% 2013 -28.5% -43.8% -29.6% 2014 -16.2% -28.1% -17.1% 2015 -3.4% -5.7% 1.6% 2016 50.3% 68.5% 67.3% 2017 -2.3% -2.8% -0.2% 2018 -9.9% -12.1% -12.4% 2019 2.4% 3.0% 2.1% 2020 -25.0% -49.0% -36.0% Median -10.7% -13.1% -10.7% FY 2011 - 2019 from Harbert ISS deck dated 1/7/20; FY 2020 from ENZ ISS proxy analysis dated 12/23/20 Enzo’s Board has Perpetual Poor Returns on Assets, Equity and Capital

13 As noted in Institutional Shareholder Services, Inc . ’s (“ISS”) Proxy Analysis for the 2020 Annual Meeting, “[t]he compensation committee demonstrated poor responsiveness following significant shareholder opposition to last year's say - on - pay proposal . Given that no compensation committee members are standing for election at this year's annual meeting as a result of the company's classified board, withhold votes are warranted for incumbent director nominee Elazar Rabbani” • Enzo’s leadership is being rewarded for overseeing an unprofitable and value destructive business • Enzo executives continue to see significant compensation year after year, even as the Company generates consistent losses • This year Enzo decided to exclude peer companies in its proxy for compensation comparison • In fiscal year 2020 , Dr . Rabbani and Mr . Weiner’s compensation totaled 4 % of Company revenue ; a 100 % premium as compared to the top two executives at Harvard Bioscience, Inc . ( HBIO ) for the fiscal year ended December 31 , 2019 • No performance - based metrics for potential bonus payments • Dr . Rabbani and Mr . Weiner received bonus payments this year while simultaneously going cup - in hand to taxpayers by taking money from our federal government under the Payment Protection Program • Dr . Rabbani and Mr . Weiner have received over $ 35 million cumulatively since 2004 , including a significant cash bonus every year . • On December 28 , 2020 , Enzo issued a press release announcing that, in response to an issue raised by ISS in its latest report, both Dr . Rabbani and Mr . Weiner would receive their previously announced bonuses as Common Stock instead of as cash Company continues to be tone deaf to broad shareholder and proxy advisory firm feedback Enzo’s Board has Perpetual Outsized Executive Compensation

14 • Enzo Labs has leased a facility in Farmingdale, New York from Pari Management Corporation (“Pari”) since 1989 • Pari is owned equally by Dr . Rabbani, Mr . Weiner (and his wife), and former officer and director Shahram Rabbani (co - founder and Dr . Rabbani’s brother) • In fiscal year 2019 , Enzo paid $ 1 , 833 , 000 in rent expense to Pari Enzo’s Board has Perpetual Unchecked Related Party Transactions

15 A History of Broken Promises • Beginning on the March 12 th, 2018 investor call, Mr . Weiner suggested that monetizing the Company’s therapeutic assets is imminent . On the March 12 th, 2018 call, Mr . Weiner teasingly said, “I can’t say too much,” signaling that the Company was close to monetizing these assets • In subsequent calls, Mr . Weiner regularly referred to a potential spin - out, sale, joint venture, or licensing of the Company’s therapeutic assets • It’s been over two years since this idea was fed to shareholders as a means of soon - to - be value creation, yet there is nothing to show for this alleged event (See “Addendum B” for further examples of comments made by Mr . Weiner on this topic) • In connection with the Company’s 2019 annual meeting of shareholders, Glass Lewis & Co . (“Glass Lewis”) summed up the Company’s argument to stay the course as “ … rehashed promises of value generation,” implying it is aware of Enzo’s reputation for over - promising and under - delivering

16 Enzo is Trying to Fool Shareholders by Selectively Quoting Roumell Enzo wrote : In fact, Roumell complimented Dr . Rabbani and new CFO David Bench - On October 28 , 2020 , he expressed his “satisfaction with the Company’s recent initiatives” and noted the Company’s hiring of a new Chief Financial Officer was a “positive step” - In an October 30 , 2020 email to the lead independent board member, Roumell wrote “I applaud the company’s initiatives this year . To the extend (sic) these initiatives were Elazar’s doing, I applaud him as well . ” Actual full text of email sent to Dov Perlysky on October 30 , 2020 Dov - Thanks for your time the other day; I appreciate you making the time to hear my thoughts. As I mentioned, Roumell Asset now owns roughly 3 million shares. To reiterate my comments – Elazar is not trusted by the investment community. Full stop. Simply too many years of shareholder destruction. Full stop. Potential investors will not consider investing in the company’s shares with Elazar as CEO. The company’s hiring a new CFO was very positive, but it’s not enough. As I mentioned, I applaud the company’s initiatives this year. To the extend (sic) these initiatives were Elazar’s doing, I applaud him as well. However, the company needs a new face, and new energy at the CEO level. Please insure all directors are aware of my views. ENZ selectively quotes from p. 26 of its investor presentation filed with the SEC on December 23, 2020.

17 Immediate Change is Warranted • Enzo spent $ 4 . 1 million of shareholder resources in its campaign against Harbert, 7 % of the Company’s cash balance as of October 31 , 2019 , in a failed bid to disallow shareholder directed board representation • In its report published in connection with the 2019 annual meeting of shareholders, Glass Lewis wrote, “ … we are inclined to argue the current Enzo directors have manipulated Enzo’s corporate machinery in the extreme, given rise to a brazen 11 th hour effort to supersede a shareholder vote in order to further the entrenchment of incumbent members” • In the same report, Glass Lewis referred to the Company’s efforts in fighting Harbert’s efforts for change as an “ … unequivocally dubious governance shell game … ” • In its report published in connection with the 2019 annual meeting of shareholders, ISS stated the following regarding Enzo’s “shell game,” : “However, given the timing of the announcement (three days before the scheduled AGM and after apparently strong showing of support for dissident nominees), the board’s assertion that it is somehow shareholder friendly is not only misleading, but arguably deceptive” • Shareholders‘ interests are not being served by Enzo’s recent lawsuit against Harbert • Shareholders’ interests are not being served when Enzo rejects valid nominations for independent Board directors

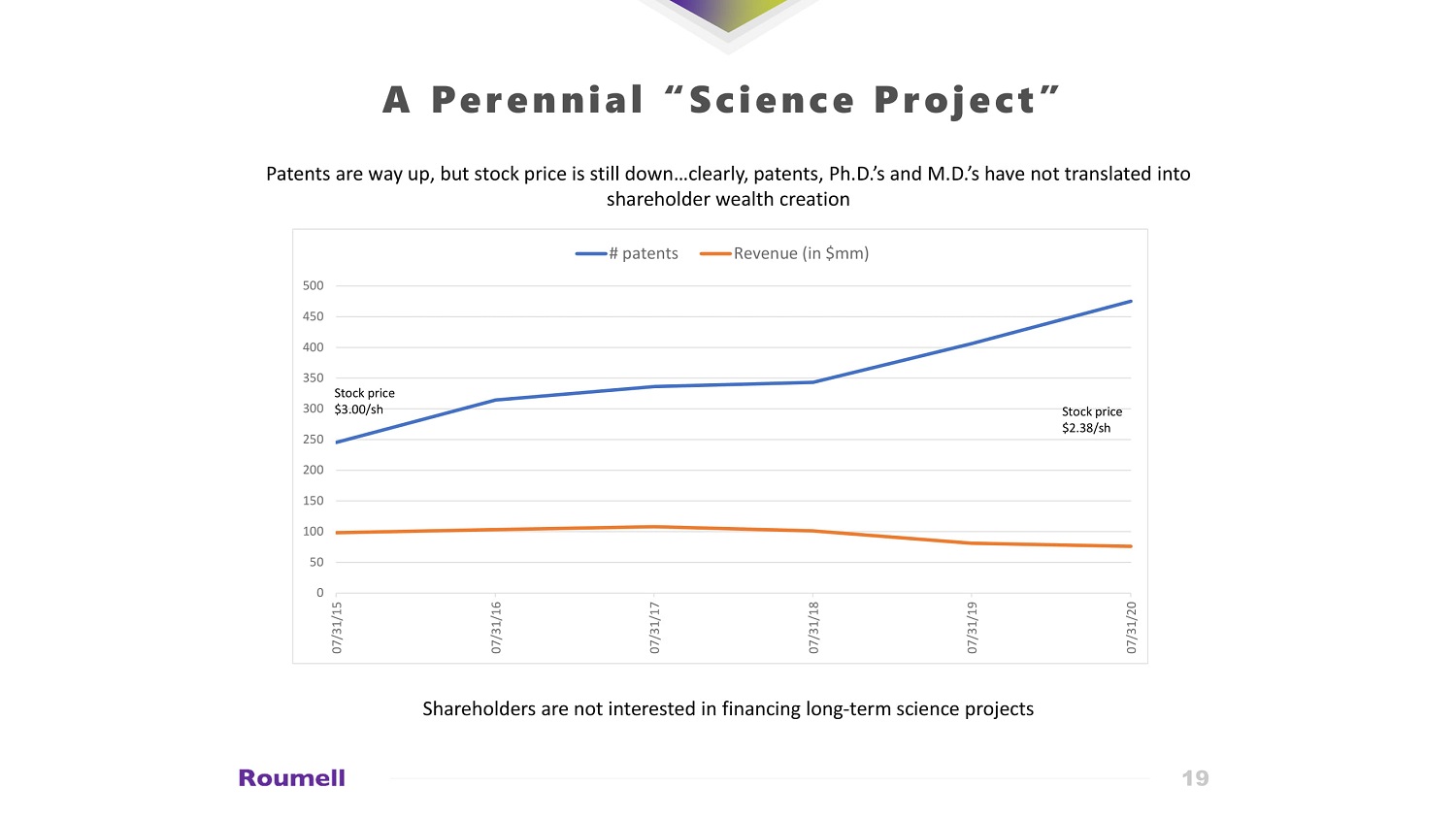

18 A Perennial “Science Project” • Number of patents has nearly doubled from 245 in 2015 to 475 in 2020 • Over the past several years, Enzo has won over $ 125 million in legal settlements for patent infringement • Future awards appear to be highly unlikely as the Supreme Court denied Enzo’s petition on claims for patents ‘ 180 and ‘ 405 on March 30 , 2020 • Enzo can no longer use litigation awards as a primary means to finance its significant operational losses Enzo’s patents are way up, but its stock price is way down…clearly, patents and the involvement of Ph.D.s and M.D.s on the Board have not translated into shareholder wealth creation

19 A Perennial “Science Project” Patents are way up, but stock price is still down…clearly, patents, Ph.D.’s and M.D.’s have not translated into shareholder wealth creation Shareholders are not interested in financing long - term science projects 0 50 100 150 200 250 300 350 400 450 500 07/31/15 07/31/16 07/31/17 07/31/18 07/31/19 07/31/20 # patents Revenue (in $mm) Stock price $3.00/ sh Stock price $2.38/ sh

20 Former Enzo Directors Enzo has never suffered from a lack of Ph . D . and/or M . D . Directors • Drs . Tagliaferri and Walters are highly trained professionals in their respective fields, but such respective talent has never resulted in value creation for ENZ shareholders • On December 28 , 2020 , Enzo announced in a press release that Drs . Tagliaferri and Walters were both willing to serve as Chair of the Compensation Committee of the Board . However, neither has any previous experience serving as chair of a compensation committee and may be ill - equipped to serve as chair of a compensation committee with as many concerns as the Board’s • What is needed are seasoned public - company board members with experience holding management accountable and demanding operational results or pursuing strategic alternatives • Messrs . Terino and Loar possess such requisite experience Some former directors and total shareholder return over respective Board tenure : • Bruce A . Hanna, Ph . D .: January 2017 – January 2020 ; TSR = ( 62 % ) • Carl W . Balezentis , Ph . D .: June 2006 – July 2010 ; TSR = ( 69 % ) End of month prices of Common Stock were used to calculate TSR .

21 Our Nominations for the Board • We have nominated Matthew M . Loar and Edward Terino to the Board at the 2020 Annual Meeting • Each is a seasoned public company executive with significant public board experience • Mr . Terino has been placed on a number of public company boards as a result of shareholder led campaigns . His reputation for constructively contributing to micro - cap companies’ board rooms is exceptional . Mr . Terino, while decidedly not an expert in the healthcare field, in our view is exactly what ENZ needs – a non - industry person with broad experience judging a multitude of business models capable of helping the Company determine its best path forward given its strengths and weaknesses … as a business • Mr . Loar possesses deep and broad healthcare industry experience as an executive, both as CEO and CFO of various companies, combined with public company board roles • Messrs . Terino and Loar will find a way to ( 1 ) create shareholder value as a going - concern or ( 2 ) place the Company in the hands of an entity that can leverage the enviable pool of assets __________________________________________________________________________________________ • Dr . Rabbani should not be re - elected . He has been the chief architect of all strategy and governance that has resulted in abysmal returns and even worse shareholder relations • Dr . Tagliaferri should not be elected as she appears to only bring duplicative scientific insights, not business acumen . Dr . Tagliaferri co - founded Bionova, Inc . (formerly a NASDAQ listed company), which filed a Chapter 7 petition in the U . S . Bankruptcy Court for the Northern District of California on October 26 , 2012 • Shareholders should be weary of any director handpicked by Dr . Rabbani, who has presided over value destruction and shareholder abuse . We doubt if any of those candidates have the ability to stand up to Dr . Rabbani

22 Highly - Qualified Candidates EDWARD TERINO High energy, results - oriented leader with over 40 years of international Board and C - level experience in many different industries, including educational publishing, enterprise software, healthcare, financial services, maritime transportation, and technology, media and telecom ; significant public company Board experience ; significant merger and acquisition experience ; successful turnaround experience to return companies to profitability and increase shareholder value . Edward Terino , age 67 , currently serves as the President of GET Advisory Services, a New Hampshire - based consulting business providing strategy planning and financial management consulting services focused on the Media, Technology, Education and Maritime Transportation industries that he started in 2009 . From April 2016 to February 2019 , he served as the Chief Executive Officer of SeaChange International Inc . (“ SeaChange ”), a global leader in video technology solutions to content owners, telecommunications providers and cable operators . He also served as Chief Operational Officer of SeaChange from June 2015 to April 2016 . Mr . Terino was previously the Chief Executive Officer and President of Arlington Tankers Ltd . from July 2005 until its merger with General Maritime in December 2008 . He previously served as Senior Vice President and Chief Financial Officer of Art Technology Group, Inc . from September 2001 to June 2005 ; Senior Vice President, Chief Financial Officer and Treasurer of Applix , Inc . from April 1999 to September 2001 ; and Chief Financial Officer, Treasurer and Secretary of Celerity Solutions, Inc . from 1996 to 1999 . Mr . Terino served in various positions at Houghton Mifflin, including Vice President of Finance, Planning and Operations, from 1985 to 1996 . He began his career in 1976 at Deloitte and spent nine years in its consulting services organization, where, among other roles, Mr . Terino served as lead consultant on a number of engagements within the healthcare industry, including the evaluation of internal controls for several healthcare organizations and of information systems for several hospitals, all in the greater Boston area . Mr . Terino currently serves on the board of Zagg Inc . , a global mobile lifestyle company . Mr . Terino previously served on the boards of SeaChange from July 2010 to February 2019 ; Baltic Trading Limited from March 2010 until its merger with Genco Shipping and Trading Ltd . in July 2015 ; Extreme Networks from October 2012 to November 2013 ; S 1 Corporation from April 2007 until its sale to ACI Worldwide, Inc . in February 2012 ; and Phoenix Technologies Ltd . from November 2009 until its sale to Marlin Equity Partners in November 2010 . Mr . Terino has served as Chairman of the Audit Committee and a member of the Compensation Committee on most of these boards . Mr . Terino earned a M . B . A . from Suffolk University – Sawyer School of Management and a B . S . in Management from Northeastern University . RAM believes Mr . Terino’s executive management and strategy - planning experience and background in consulting in the technology and healthcare industries qualify him to serve on the Board .

23 Highly - Qualified Candidates MATTHEW M . LOAR CPA with over ten years of experience as CFO for both public and private companies in the biopharmaceutical industry . Matthew M . Loar, age 57 , is an independent financial consultant to public and private companies in the health care industry, and has been performing services in this capacity since July 2019 . He previously served as the Chief Financial Officer of Mateon Therapeutics, Inc . , a public biopharmaceutical company, from July 2015 until his resignation in June 2019 . Earlier in his career, Mr . Loar served as Chief Financial Officer of KineMed, Inc . , a privately held biotechnology company, from January 2014 to July 2015 . Mr . Loar has also previously served as acting Chief Executive Officer and Chief Financial Officer of Neurobiological Technologies, Inc . (“NTI”), a publicly traded pharmaceutical company, from 2010 through 2019 and as Chief Financial Officer of Virolab, Inc . , a biotechnology company, from 2011 to 2012 . Previously, he was Chief Financial Officer of NTI from 2008 to 2009 . Earlier in his career, Mr . Loar was Chief Financial Officer of Osteologix, Inc . , a publicly traded pharmaceutical company, from 2006 to 2008 , and of Genelabs Technologies, Inc . , a publicly traded biopharmaceutical and diagnostics company, from 1995 to 2006 . Prior to moving the biopharmaceutical industry in 1995 , he served as Manager, Corporate Accounting at the North American Corporate Headquarters of CBR Cement Corporation from 1991 to 1995 , and as an Audit Manager from Coopers & Lybrand from 1986 to 1991 . Mr . Loar has served on the board of NTI from 2010 to 2019 . Mr . Loar also has previously served on the board of Transcept Pharmaceuticals, Inc . from 2013 to 2014 and Silicon Valley Chapter of Financial Executives International (“SVFEI”) from 1999 to 2004 . He also served as Treasurer of SVFEI from 2001 to 2003 . Mr . Loar received a B . A . in Legal Studies from the University of California, Berkeley and is a Certified Public Accountant (inactive) in California . RAM believes Mr . Loar’s extensive background in the biotechnology and pharmaceutical industries and specific knowledge of financial, accounting and legal issues within the industries qualify him to serve as a director of the Company .

24 Nominees’ Top Priorities if Chosen to Serve on the Board • Increase shareholder value through understanding the Company's business strategy and corresponding intermediate (three - year) financial plan • Identify and evaluate strategic alliance and partnership opportunities • Improve corporate governance to ensure that the Company has a best practices Board structure and corporate governance practices to improve its corporate governance ratings • Improve the Company's financial management to increase profitability, strengthen cash flow and liquidity, ensure optimal capital allocation to the Company's businesses and potential investments, and better align compensation programs with financial performance • Identify more effective and efficient ways for the Company to leverage its intellectual property portfolio • Identify and implement improvements to the Company's investor relations efforts to improve analyst and shareholder communications

25 Addendum A In May 2019, RAM sought to constructively engage with ENZ and allay any concerns ENZ might have about RAM’s investment strategy and yet was still rebuffed by ENZ , which was one of the reasons RAM sold its shares of Common Stock later that year Elazar and Barry - Thank you for taking the time to meet with Tom and me on April 25 th . We found it helpful . As we discussed, we are still trying to determine our best course of action going forward . As I tried to convey in our meeting, I enjoy working constructively with companies and people . I try to avoid adversarial engagements . We are reasonable . However, we also work very hard, and relentlessly, on behalf our clients to maximize the capital they’ve entrusted to us . As I indicated, Rosetta Stone, RST, is a situation that we got involved in a few years ago in a very constructive manner . After filing our initial letter, we heard from many activist investors seeking our support for a “campaign” against the company . Ultimately, we believed management had a credible plan going forward and decided to support those efforts with the addition to the board of someone put up by shareholders . David Nierenberg (a large shareholder) remains on RST’s board to this day . The stock was roughly $ 7 /share at our filing and is $ 25 /share today . David provided us comfort that a shareholder representative would be present on the board as the company deployed capital to new initiatives . http : //www . finalternatives . com/node/ 31154 In 2013 , we got involved with Transcept Pharmaceuticals, TSPT . As in the case of RST, we decided to support management after they agreed to accept Matt Loar onto TSPT’s board . Matt worked constructively with TSPT . After instituting a large cash dividend, the company did a reverse merger with Paratek , PRTK, and in the subsequent 24 months the stock increased over 200 % . https : //www . marketwatch . com/press - release/transcept - pharmaceuticals - announces - that - largest - stockholder - roumell - asset - management - declares - support - of - comp any - strategies - 2013 - 12 - 16 Lastly, we got involved in Tecumseh Products (formerly TECUA) several years ago . We tried to work constructively with the company, but its Chairman, Kent Herrick, was unwilling to meet us halfway . Kent was the grandson of the company’s founder and as a direct result of our involvement, stepped down as Chairman (because he knew shareholders ultimately supported our view) . At the time Kent stepped down, TECUA’s stock was $ 3 /share ; several months later it was $ 9 /share . Ultimately, the company was sold as it was burning cash and there was no end in sight . https : //www . crainsdetroit . com/article/ 20130127 /NEWS/ 301279980 /tecumseh - products - founding - family - out - stock - price - soars I’ve attached Matt Loar’s resume for your consideration as an addition to ENZ’s board . We believe the company should add two directors introduced by shareholders . We look forward to working together . As I mentioned when we met, I would welcome any and all opportunities to deepen my understanding of ENZ’s business, particularly talking with clients and/or individuals who can provide insight into the company’s emerging initiatives . Please forward this email to all of the company’s directors . Regards, Jim

26 Addendum B Comments by Barry Weiner on Conference Calls and in Press Releases Press Release dated December 7 , 2015 – Results for the First Fiscal Quarter ended October 31 , 2015 1 Comments by Barry Weiner : “ … .. we believe we can address the challenges facing the molecular diagnostics industry today — namely an increased demand for tests that is coupled with high costs of goods and declining reimbursement from payors . The value inherent in Enzo emanates from internally developed content, ranging from innovation to product, as well as our vertically integrated structure, all of which should allow us to provide products and services at significant savings to the market . ” Press Release “Overview” section : “Enzo’s corporate strategy has come increasingly to the fore, based on the Company being an integrated diagnostics entity, one uniquely structured to capitalize upon ongoing reimbursement pressures being experienced in the molecular diagnostics market . The recent approval of the AmpiProbe - HCV assay Ρ represents just the first of a number of molecular tests that Enzo plans to introduce based on that nucleic acid amplification and detection platform . Currently in the AmpiProbe Ρ development pipeline are products for the identification of women’s health infectious diseases as well as additional assays for quantification of viral loads for other diseases . ” Press Release dated March 9 , 2016 – Results for the Second Fiscal Quarter and Fiscal First Half ended January 31 , 2016 2 Comments by Barry Weiner : “In addition to those products already approved, we are actively developing, and expect to soon file for approval, major new assays that will further enhance the flexibility and application of our AmpiProbe Ρ and Flowscript Ρ technologies … With its use, savings could amount to 30 % to 50 % on certain diagnostic tests, offsetting steadily declining reimbursements and rising product costs that are sharply cutting into profitability at Clinical Labs . The Company expects over the coming year to introduce various analytes in its developing women’s health panel, in addition to a fertility assay and a cardiac marker . The Company has completed and submitted a validation package to the New York State Department of Health for its latest AmpiProbe Ρ based assay to identify the presence of the most common species of Candida … ” 1 https : //www . enzo . com/corporate/press - releases/enzo - biochem - reports - strong - first - quarter - results - execution - on - corporate - strategy - seen - in - companys - results 2 https : //www . enzo . com/corporate/press - releases/enzo - biochem - reports - increased - fiscal - second - quarter - results

27 Addendum B (continued) Press Release dated September 27 , 2017 – Results for the Fourth Quarter and Fiscal Year ended July 31 , 2017 3 Comments by Barry Weiner : “Our position as an innovative provider of low cost but highly versatile women’s health diagnostics has likewise resulted in expanding opportunities that soon will allow for diagnosis from a single blood sample for a variety of female infections, making life easier for physician and patient alike . We are completing final steps to launch our AmpiProbe® PCR platform specialized 14 - analyte panel, that will further establish Enzo’s strong MDx position in women’s health . Enzo’s technical know - how and abilities are rapidly coming together to drive growth . Our Polyview product, an enhanced detection system used by pathologists in reading tissue biopsies, was the subject of a favorable article in the prestigious peer reviewed Annals of Diagnostic Pathology because it resulted in no false - positives in tests as compared to others, including some of the leaders in the field, whose tests indicated a large percentage of false positives . ” Earnings Release Call held on March 13 , 2018 – Results for the Second Fiscal Quarter and First Half ended January 31 , 2018 4 Comments by Barry Weiner : “In terms of the therapeutic areas, we have not commented much on our therapeutic activity, because we did not want to divert the focus on our diagnostic strategy . As you well know, because you asked the question, we do have a number of therapeutic compounds under development, most of these are being developed in the form of funded partnerships with different entities . One was with NIH, others are under other grant processes . I can't say too much, but I hope you will begin to hear more about these into the future, as they are beginning to emerge from the testing protocols that they have been undergoing . I believe, that there is asset value here, and it is something that we as a company are absolutely focused on, and we hope to create shareholder value from that . I think it's probably wise to just not say too much more about it, and the wait -- the evolution of this, but it is definitely in the vision of where we are moving right now . ” 3 https : //www . enzo . com/corporate/press - releases/enzo - biochem - reports - increase - in - revenues - and 4 https : //seekingalpha . com/article/ 4155911 - enzo - biochem - enz - q 2 - 2018 - results - earnings - call - transcript?part=single

28 Addendum B (continued) Earnings Release Call held on June 12 , 2018 – Results for the Third Fiscal Quarter ended April 30 , 2018 5 Comments by Barry Weiner : “We have had an area of activity in the therapeutic area for quite a while . It has been quietly pursued . We’ve kept some very interesting products in that area that are being looked at and explored to bring to commercialization … I think there will be more to be said about the therapeutic activity in the near future, but at this time it is active, it is viable and I believe it may have extremely positive consequences for us as a company . ” Earnings Release Call held on October 16 , 2018 – Results for the Fourth Quarter and Fiscal Year ended July 31 , 2018 6 Comments by Barry Weiner : “As we are all aware the market potential for cancer related compounds is quite high . We believe the efforts behind this and efforts behind some of our other therapeutic programs some of which as you are aware have already been through human studies are quite valuable and I believe not well understood by the marketplace partially that is our need to focus on the strategy that we've been focusing on in the diagnostics area, but I can envision at a point in time assuming these assets maintain their viability, the value of them being offered to our shareholders in various possible formats either in partnerships, joint ventures or in acquisition of or sale of these compounds to third parties . We are exploring different modes of value and opportunity and we hope to pursue this and obtain more clarity over the next year . ” Press Release dated March 11 , 2019 – Results for the Second Fiscal Quarter and First Half ended January 31 , 2019 7 The Company is rapidly implementing its strategic plan to build a comprehensive menu of reagents, automated systems, and related consumables on several independent platforms and systems . This effort started with research and development activity, which was initiated several years ago, adaptation and validation of products to automated systems and has extended into GMP manufacturing . These automated systems are in the process of clinical trial for submission to obtain LDT, CE Mark and FDA approvals where appropriate . Enzo’s business development efforts are ongoing with potential partners that would accelerate market access and penetration to provide much need margin relief to small and midsize clinical and hospital laboratories . 5 https : //seekingalpha . com/article/ 4181039 - enzo - biochem - inc - enz - q 3 - 2018 - results - earnings - call - transcript?part=single 6 https : //seekingalpha . com/article/ 4211931 - enzo - biochem - inc - enz - q 4 - 2018 - results - earnings - call - transcript?part=single 7 https : //www . enzo . com/corporate/press - releases/enzo - biochem - reports - fiscal - 2019 - second - quarter - results

29 Addendum B (continued) Earnings Release Call held on March 12 , 2019 – Results for the Second Fiscal Quarter and First Half ended January 31 , 2019 8 Comments by Barry Weiner : “Enzo has expanded on marketing and sales activities to address the market opportunities which include a broad range of diagnostic testing including FISH [ ], immunohistochemistry, and molecular diagnostics … In the past quarter alone, we have held numerous discussions of many strategic partners, many of whom we’ve met with over the last year . Defining the scope of new relationships and building collaborations and partnerships takes time . However, Enzo’s disruptive strategic plan is gaining market awareness and acceptance and we are confident new relationships will materialize … We have been actively working quietly in the therapeutic area . It is a program that has not required a lot of capital investment at this point in time . We are actually looking to outside sources to support that activity . But there is an interesting active approach which is being explored at this point in time . It’s too early to comment on that . We believe our therapeutic assets are meaningful . We don’t believe we are getting much credit for that within the company at this point in time . I am optimistic that you will see activity there that will create value generation for us as a company … … I did say that we are in the process of exploring approaches to create value around the therapeutics business, yes . ” Earnings Release Call held on June 11 , 2019 – Results for the Third Fiscal Quarter ended April 30 , 2019 9 Comments by Barry Weiner : “We know that growth is how we will be measured and valued . And we are focused on the growth initiatives underway . First of which is our strategic relationship program . Enzo is in active discussions with several leading global life sciences and medical device companies, as well as manufacturers of automated systems to develop strategic relationships in three key platforms : molecular diagnostics, immunohistochemistry, and our Elisa platform . The discussions involve developing long - term relationships and automation and manufacturing, distribution, marketing and product sales . We are pleased by the awareness and acceptance we are receiving . And our goal is to announce at least one of these relationships by the end of calendar 2019 . ” 8 https : //seekingalpha . com/article/ 4248098 - enzo - biochem - inc - enz - q 2 - 2019 - results - earnings - call - transcript 9 https : //seekingalpha . com/article/ 4269676 - enzo - biochem - inc - enz - q 3 - 2019 - results - earnings - call - transcript

30 Addendum B (continued) Earnings Release Call held on October 15 , 2019 – Results for the Fourth Quarter and Fiscal Year ended July 31 , 2019 10 Comments by Barry Weiner : “One important note related to our strategic activities . As we noted in a release and so has retained Lazard to Assist in Strategic Relationships and New Venture Creation across the company's four core platforms : molecular, immunohistochemistry, cytology and immunology . We expect to update the market by the end of the calendar year on these discussions . ” Earnings Release Call held on December 11 , 2019 – Results for the First Fiscal Quarter ended October 31 , 2019 11 Comments by Barry Weiner : “While the company remains committed to the strategic path of Enzo Therapeutics, the Board of Directors made the determination that given the significant capital requirements necessary at this point to fully recognize the therapeutic subsidiary’s value, and address the opportunities for further validation to drive commercialization, it would consider various alternatives . The alternatives under consideration, include a spin - off, sale, joint venture, or licensing of its intellectual property . Our legal and finance teams along with our investment bankers are working diligently on this initiative, and we will look forward to updating our shareholders on the next steps as they emerge . ” Press Release dated March 5 , 2020 – Results for the Second Fiscal Quarter and First Half ended January 31 , 2020 12 Highlights for the Quarter : “Enzo continues to explore various avenues to unlock value in Enzo Therapeutics, a biopharmaceutical subsidiary of Enzo [ ] . Alternatives under consideration include a possible spin - off, sale, joint venture or licensing of its intellectual property . ” Earnings Release Call held on June 8 , 2020 – Results for the Third Fiscal Quarter ended April 30 , 2020 13 Comments by Barry Weiner : “We are in dialog with a number of different parties concerning many of the different aspects of our business, whether it's on the diagnostics front . We have historically commented . We have been exploring opportunities on the therapeutic front as well . The COVID issue certainly forced all companies to take a look inward in terms of their survival, their strategic plans moving forward . So I think during the last few months that has been the general nature of the industry . ” 10 https : //seekingalpha . com/article/ 4296673 - enzo - biochem - inc - enz - q 4 - 2019 - results - earnings - call - transcript 11 https : //seekingalpha . com/article/ 4311744 - enzo - biochem - inc - enz - q 1 - 2020 - results - earnings - call - transcript?utm_medium=referral&utm_source=partner_conferencecalltranscripts % 3 Fpart % 3 Dsingle 12 https : //www . enzo . com/corporate/press - releases/enzo - biochem - reports - fiscal - second - quarter - results - 2020 13 https : //seekingalpha . com/article/ 4352677 - enzo - biochem - inc - enz - q 3 - 2020 - results - earnings - call - transcript?utm_source=conferencecalltranscripts . org?part=single&utm_medium=referral